Costco’s stock (COST) has surged over 66% in the past year, driven by strong sales, membership loyalty, and consistent earnings growth. However, as the company approaches its Fiscal Q4 2024 earnings report, investors may be asking whether COST stock is still a buy. In this article, we will recap the company’s most recent results and examine expectations for Q4 based on management’s outlook and monthly sales. We will also assess the potential risks tied to Costco’s elevated valuation, which I believe make Costco stock a Hold at this point.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Recap of Costco’s Fiscal Q3 2024 Results

Before discussing what to expect from Costco’s Fiscal Q4 results, let’s first take a brief glance back at the company’s Fiscal Q3 performance. Costco’s latest Q3 2024 results again evidenced the company’s robust business model, steady consumer demand, and highly efficient operations.

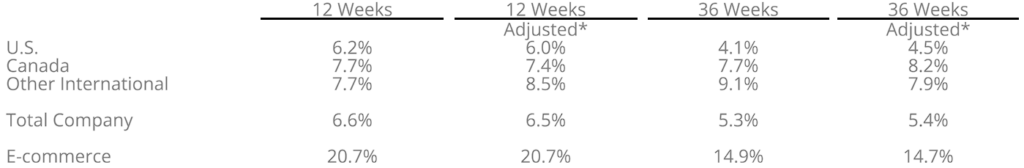

In particular, net sales for the quarter grew by 9.1% year-over-year to $57.39 billion. This growth was fueled by a 6.6% increase in comparable sales, with U.S. locations posting a 6.2% increase while Canada and international locations posted a gain of 7.7%. E-commerce was another standout, surging by 20.7%. Costco also opened two new stores in the quarter. For the period, membership fees rose 7.6% to $1.12 billion, reflecting strength in Costco’s renewal rates.

In addition, earnings growth also remained strong, with net income for Fiscal Q3 of $1.68 billion or $3.78 per diluted share rising from $1.30 billion or $2.93 per share in the same quarter of 2023. Earnings growth was backed by higher revenues and Costco’s ability to drive operational efficiencies and improve gross margins to 10.84% (+52 bps), partially offset by higher labor and logistics expenses.

What to Expect in Fiscal Q4 2024

Although I am neutral on the stock, Costco’s sales momentum suggests the company will report another strong quarter for Q4. The company is set to release those results after market close on September 26. Monthly sales reports for May, June and July were strong, coming in with year-over-year growth of 8.1%, 7.4% and 7.1% respectively. Comparable sales increased by between 5% and 6.5% for all three months. E-commerce revenues were key, reaching growth of more than 20% in recent months.

Costco announced a $5 rise in membership fees starting September 2024, which should further support the company’s top line.

Wall Street’s Q4 estimates may look a bit puzzling, as Costco is projected to report fiscal Q4 sales of about $80.0 billion, implying a year-over-year increase of just 1.4%. This is despite the much stronger monthly sales growth figures noted above. The surprisingly low quarterly revenue estimate can be primarily attributed to a short 16-week quarter this year (as compared 17 weeks for Q4 2023), as well as variables such as fluctuating gasoline prices and FX rates. Gasoline and FX considerations are excluded from monthly comparable sales metrics but still impact overall revenue, of course.

Valuation Concerns Amid Elevated Valuation

Costco’s momentum heading into Fiscal Q4 is impressive, but its extended share price rally has pushed its P/E ratio to unprecedented levels. Wall Street analysts project $5.08 in EPS for Fiscal Q4, which would bring the annual total to $16.09. If achieved, that would represent solid 13.6% year-over-year EPS growth. Yet, this figure still translates to a record-high P/E ratio of over 56x.

While COST stock remains a Wall Street favorite with excellent qualities, I believe that such a lofty valuation for a wholesaler leaves little margin for error. Costco shares could be vulnerable to even small negative developments, such as a slowdown in sales growth or increasing margin pressure.

Even if the company continues to meet or beat consensus earnings estimates over the medium term, it is difficult to justify such a high multiple, despite mid-teens EPS growth. Thus, while Costco is likely to deliver strong Q4 and Fiscal 2024 results along with solid guidance, investors should exercise caution when considering the stock at its current valuation.

Is COST Stock a Buy, According to Analysts?

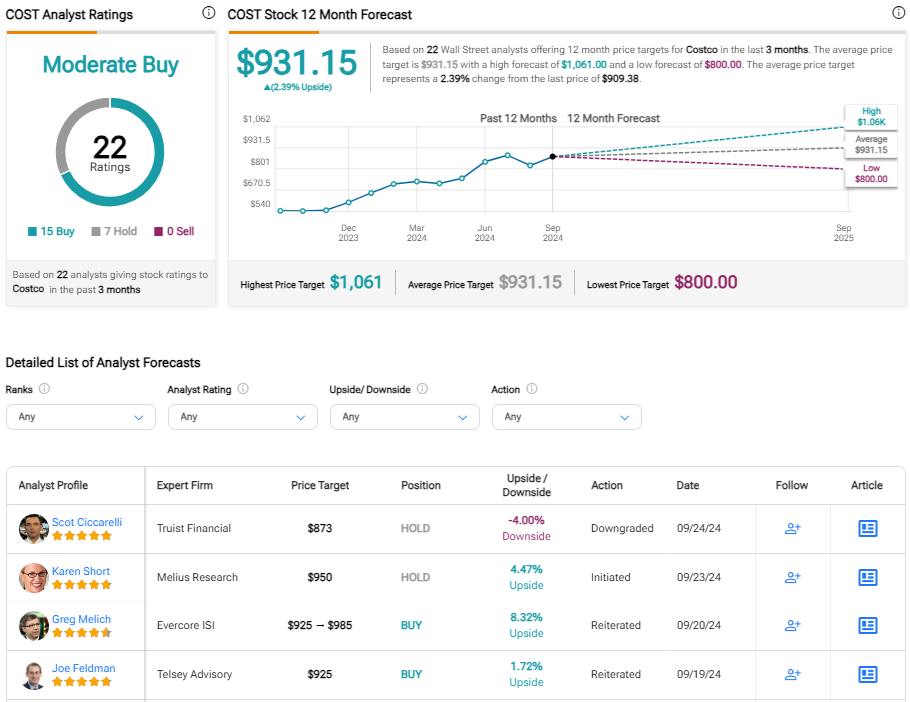

Wall Street’s analysts hold a Moderate Buy consensus rating based on 15 Buys and seven Hold recommendations assigned in the past three months. The street remains bullish despite the stock’s very high valuation. At $931.15, the average COST stock price target implies only about 3% of upside potential, however.

If you’re wondering which analyst you should follow on Costco, the most accurate analyst covering the stock (on a one-year timeframe) is Mark Astrachan from Stifel Nicolaus Markets, who has an average return of 26.26% per rating and a 96% success rate. Click on the image below to learn more.

Takeaway

In summary, while Costco’s strong sales and earnings growth momentum position it for another robust quarter and excellent full-year results, COST stock’s elevated valuation limits my optimism. With a P/E ratio at record highs, even minor setbacks could lead to a share price reversal. While the stock will probably remain a Wall Street darling that commands a premium, investors should weigh the potential risks of investing at today’s share price, in my view. Therefore, I’m adopting a neutral stance at this juncture.