Vacation rental company Airbnb (NASDAQ:ABNB) has recently made it to the S&P 500 (SPX). This is, indeed, significant news, as it enhances the stock’s appeal to investors. Nevertheless, ABNB stock is trading below its IPO price of $146. The key question is, what lies ahead for Airbnb, and is the stock worth buying? Well, Airbnb has been in the spotlight lately for various reasons, both positive and negative. Taking all factors into account, I’m neutral on the stock and will continue to observe it from the sidelines.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Airbnb Stock is Weak Despite Recent Q2 Beat

On August 3, Airbnb reported impressive Q2 results, with adjusted earnings of $0.98 handily beating analysts’ estimates of $0.80 per share. Notably, the figure also came in much higher (75% year-over-year) than the Q2-2022 figure of $0.56 per share.

Further, total net revenue jumped 18% year-over-year to $2.5 billion and also outpaced the consensus estimate of $2.42 billion. In addition, active listings reached seven million, growing 19% year-over-year.

Despite an easy earnings beat, the stock is off over 11% from its 52-week high of ~$155, seen just days before the earnings report. What could be the cause of the negative post-earnings reaction? Let’s take a look at some of the potential concerns facing the stock.

NYC Regulation: An Overhang on Airbnb’s Short-Term Rental Market

After the COVID-19 pandemic, global travel came back with a vengeance. Similarly, Airbnb’s short-term rental market thrived, providing excellent value across various budgets. Airbnb rentals not only provide cost-effective choices but also deliver unique experiences to travelers, contributing to their popularity in recent years.

However, on September 5, NYC regulators passed a new law imposing restrictions on short-term rental platforms within the city to better manage housing stock issues. The new law mandates Airbnb owners to register their homes if they rent them for less than 30 days.

Other regulations include the requirement for hosts to be present for stays shorter than 30 days, as well as a cap of two people. Plus, hosts may face additional fines, potentially making it challenging for them to list their properties. This implies that the hosts will have difficulties with listings, while some illegal listings may be completely banned on Airbnb. As a result of this, short-term rentals in NYC have gone down by more than 75% in September, resulting in the elimination of an estimated 35,000 to 40,000 previous listings.

The company’s management holds a different perspective, as the ban on short-term rentals is limited to NYC alone. They emphasize that NYC, like any other city, contributes less than 1.5% to Airbnb’s total revenues. Therefore, its impact on overall revenue is expected to be minimal.

However, there is always the possibility that other states may follow suit and implement similar regulations to address the growing uncertainty regarding housing inventory.

Airbnb’s Insider Selling Doesn’t Instill Confidence

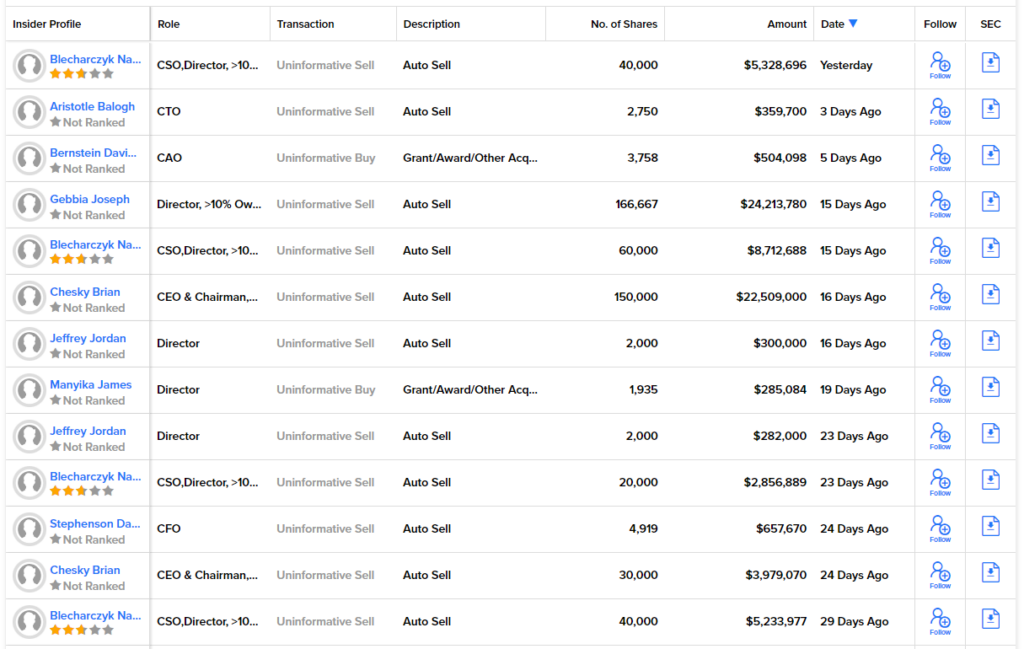

Separately, let’s look at ABNB insiders’ transactions. To my surprise, there has not been much insider buying for ABNB stock over the past year despite the stock price dips. On the contrary, several executives have sold shares over the past few months.

On September 14, CEO Brian Chesky sold 150,000 shares of ABNB stock worth $22.5 million. This follows another Sell transaction of 30K shares by the CEO worth $3.98 million in early September.

When insiders purchase shares, it indicates their confidence in the company’s growth prospects. The opposite holds true when the insiders are offloading the company’s shares. In the case of ABNB, insider selling actions do not indicate a positive outlook for the stock.

Is ABNB Stock a Buy, According to Analysts?

As per TipRanks, analysts overall are cautiously optimistic about ABNB stock and give it a Moderate Buy consensus rating, which is based on 13 Buys, 15 Holds, and three Sells. Airbnb’s average price forecast of $150.16 implies 9.4% upside potential.

In terms of its valuation, Airbnb is expensive. Currently, it’s trading at a P/E ratio of 40x compared to much lower multiples of its peers and large hotel chains worldwide. The online platform for making travel and restaurant reservations, Booking Holdings (NASDAQ:BKNG), is currently trading at only 26.8x earnings. US-based hotel Marriott International (NASDAQ:MAR) is trading at a P/E of 22.2x, while Hilton Worldwide Holdings (NYSE:HLT) is trading at over 31x.

Importantly, using TipRanks’ comparison tool, we can see that the above-mentioned hotels have given much higher returns to investors over the past three years compared to ABNB. Hence, the higher valuation does not look justified.

Key Takeaway: Remain Cautious on the Stock

On one end, booming travel demand showcases a promising outlook for the travel accommodation behemoth Airbnb. However, concerns over an impending recession, growing competition, and persistent inflation have tempered investor’s bullish stance on this space.

To add to that, newly-implemented regulations aimed at addressing the housing market shortage contribute to these concerns. Further, ABNB’s expensive valuation and insider selling give me more reasons to remain cautious about the stock.