The stock markets generate an immense flood of raw data, a glut of information that presents a barrier to the average investor. How to sort through it, to find the right stocks to buy?

What’s needed is some clear signal, something that can find some sensible patter in the results of millions of daily stock transactions. Fortunately, there are plenty of such signals out there. Purchases from the corporate insiders are generally seen as one of the clearest.

The reason is simple. Corporate insiders are company officers – high ranking personnel within their firms, residing in the C-suites or sitting on the company Boards. These positions give them an ‘inside’ view of what’s going on, and they can use that knowledge to better judge how their own company’s shares are going to move.

They key point to remember, when following the insiders, is this: they’ll sell for a multitude of reasons, but they’ll only buy for one – and that one reason to buy is that they believe the stock will appreciate. This makes large-scale insider buys – when insiders start pouring millions of their own money into their company stocks – the clear signal that retail investors should consider following.

We’ve gotten a start on this, using the TipRanks Insiders’ Hot Stocks tool to find two names that have seen multi-million-dollar insider purchases recently. And if that’s not convincing enough, Wall Street’s analysts see both of these shares as Buy-rated. Here’s a closer look at the details, and the analyst comments.

Iovance Biotherapeutics (IOVA)

The first stock we’ll look at is Iovance Biotherapeutics, a medical research firm based in California and focused on the development of new cancer treatments. The company is following a research approach based on the use of tumor-infiltrating lymphocytes (TIL) to harness the patient’s immune system to attack tumor cells. TILs occur naturally as part of the immune system, and have an anti-cancer function. These cells can be harvested from the patient and cultivated in the lab, resulting in a cache of anti-cancer TILs, personalized for that particular patient – and available for use as a one-dose treatment.

That’s the theory behind Iovance’s therapeutic research track. To date, data from pre-clinical and clinical studies has shown that the approach is both feasible and promising, and has application to a wide range of solid tumors. The company has put together a strong pipeline of drug candidates, on multiple tracks from early pre-clinical to late-stage clinical research, looking at potential treatments for cancers such as melanoma, cervical cancer, and non-small cell lung cancer.

The melanoma track is the most advanced, and earlier this month received a hefty boost from the US FDA. The regulatory agency tapped Iovance’s drug candidate lifileucel for accelerated approval in the treatment of advanced melanoma. The approval makes the drug, also known as Amtagvi, the first to receive FDA approval as a T-cell therapy in solid tumor cancer, and makes it the ‘first treatment option for advanced melanoma after anti-PD-1 and targeted therapy.’

A few days after this approval, Iovance announced an important offering of common stock. The offering, underwritten for $211 million, will see 23,014,000 shares put on the market at $9.15 each and the proceeds are intended to support the commercial launch of Amtagvi.

This gives background to the insider activity on IOVA stock. Two members of Iovance’s Board of Directors, Wayne Rothbaum and Merrill McPeak, each made substantial purchases recently. Last week, Rothbaum bought 5 million shares of the stock, valued at a huge $45,750,000, while McPeak picked up 250,000 shares for $2.287 million.

Turning to the analyst coverage, we find JMP’s Reni Benjamin taking a bullish view toward Iovance. He notes the FDA’s recent regulatory approval, and goes on to describe the drug’s profit potential, writing, “Recently, Iovance reported the FDA granted Amtagvi (lifileucel) accelerated approval… We view this announcement as great news for shareholders as a commercial launch gets underway. With 30 ATCs ready to roll, up to 50 ATCs to be onboarded within 90 days of launch, a >$1.5B peak sales opportunity, and a cash position of $334.7M (pro forma), we believe Iovance continues to represent a unique investment opportunity even with the recent rise in market capitalization.”

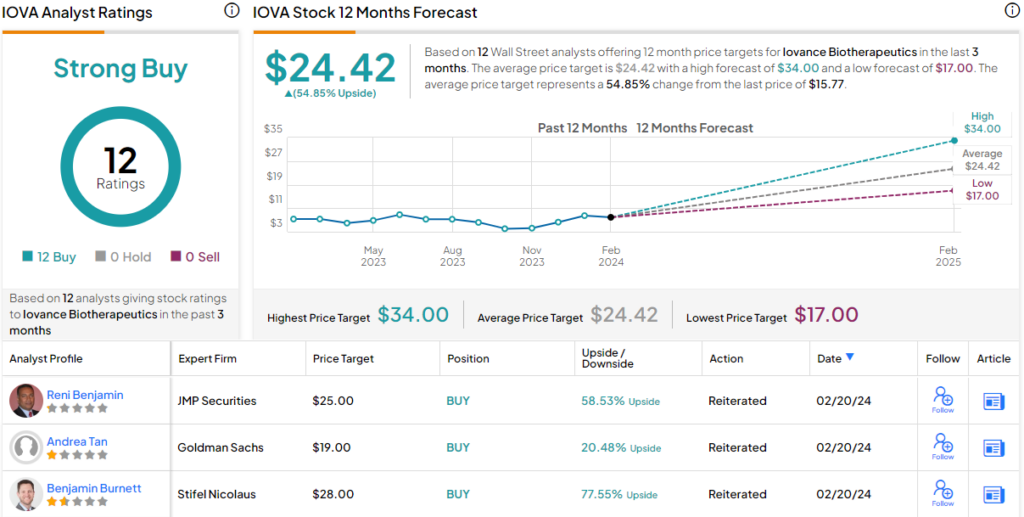

Summing up, Benjamin puts an Outperform (Buy) rating on these shares, along with a $25 price target that suggests a 58.5% upside for the coming year. (To watch Benjamin’s track record, click here)

The Strong Buy consensus rating on this stock is unanimous, based on 12 recent analyst reviews – all positive. The stock is selling for $15.77, and its $24.42 average price target implies the stock will gain 55% in the next 12 months. (See Iovance’s stock forecast)

WisdomTree (WT)

Next on our list is Wisdom Tree, an innovator on the global financial scene. The company specializes in exchange-traded products, as well as models, products, and solutions that leverage the advantages of blockchain technology. WisdomTree aims to help its customers shape their own financial future, and to support the professional financial sector as it serves its own clients and their businesses. The company likes to boast that it is working on the ‘next generation’ of digital financial products and services, including blockchain-enabled mutual funds and tokenized assets, and the company’s own blockchain-native digital wallet.

Looking at a thumbnail sketch of WisdomTree, we see a financial operator with a global reach, more than 200 employees, and over $102 billion in assets under management as of this month. The company has offices in financial hubs, including New York City, London, Dublin, and Milan, as well as in Latin America and the Middle East. In its January monthly metrics, the company reported that its AUM had hit a record high for the third consecutive month.

Turning to the overall financial results, the last set released covered 4Q23. In the quarter, WisdomTree generated $90.84 million in top-line revenue, a total that was up almost 24% year-over-year and beat the forecast by a modest half-million dollars. The firm’s non-GAAP earnings were reported as an EPS of 11 cents; this was a penny better than the estimates.

So WisdomTree is an asset manager with a solid position – and CEO Jonathan Steinberg recently bought 303,781 shares. This insider purchase was valued at over $2.18 million, and has now pushed Steinberg’s stake in the company to more than $70 million.

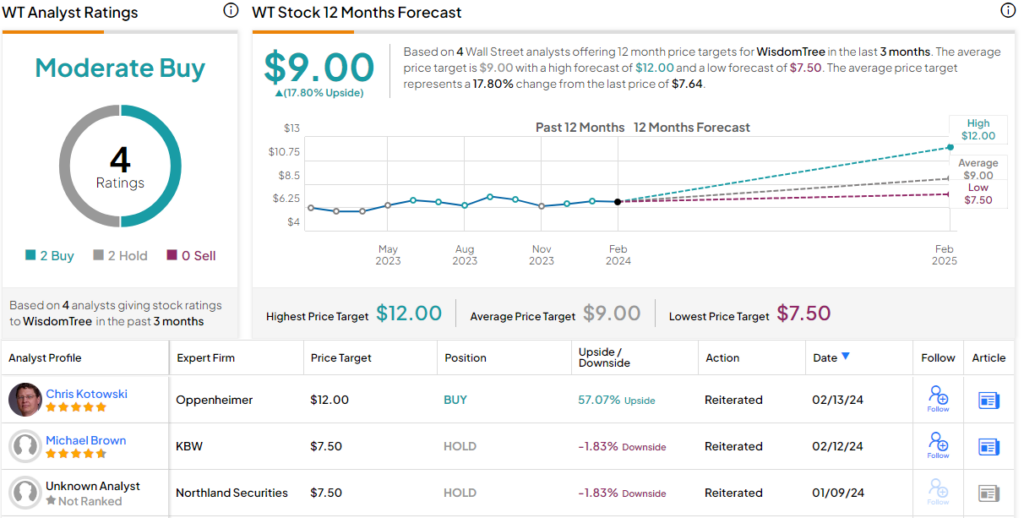

WisdomTree has also caught the attention of Oppenheimer analyst Chris Kotowski. The 5-star analyst, rated in the top 1% by TipRanks out of more than 8,700 peers, notes that WisdomTree’s policies of transparency makes the company’s financial calls somewhat dry, as there are few surprises – but that the results are exciting. He says, “On some level, earnings days for WT are rather boring and anticlimactic because the company posts its flows and AUM every day and gives pretty clear guidance on expenses. Thus, the reported EPS of $0.11 was in line with our expectations and a penny above consensus… However, while ‘in line,’ we thought that the results nicely show the operating leverage inherent in the business model, as the operating margin improved from 16.0% in 4Q22 to 28.7% in 4Q23.”

“While the earnings report may be boring the earnings calls aren’t because for a small company, WisdomTree has a lot going on,” Kotowski went on to add. “In an effort to make their AUM stickier, they have been expanding their model portfolios with more and more advisors. They disclosed on this call that the number of advisors using WisdomTree Portfolio Solutions doubled last year to 2,000, encompassing $3.2B in AUM.”

These comments back up the analyst’s Outperform (Buy) rating on the stock, while his $12 price target indicates potential for a solid 57% gain on the one-year horizon. (To watch Kotowski’s track record, click here)

There are 4 recent analyst reviews on this stock, and they show an even split – 2 Buys and 2 Holds – for a Moderate Buy consensus rating. WT shares are trading for $7.64 and their $9 average target price suggests an 18% increase over the course of the year. (See WisdomTree’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.