How do you find the right stocks to buy? It’s a simple question, but the answer can be challenging. Thankfully, there are numerous signs and signals to help guide your decisions.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

One of the clearest signs comes from the corporate insiders, the company officers who operate in the C-suites and the Boardrooms and are responsible not just for the day-to-day operations of their companies but also for ensuring profits and returns for the shareholders. The first point gives them an intimate knowledge of how their company runs and what it has in store; the second ensures that they keep their eyes on the golden ring. Taken together, both points ensure that the insiders will only buy their own stock when they are certain it will gain in value. And that makes the insiders’ trades a valuable signal for the retail investor.

Federal regulations require that corporate officers keep their trades in their own company stock public, which gives us a valuable resource in tracing the insider trades. Using the Insiders’ Hot Stocks tool, available at TipRanks, we’ve looked up the details on some of them – and found that the insiders are pouring millions into two stocks in particular. Let’s take a closer look.

Tectonic Therapeutic (TECX)

We’ll start in the world of biotech and pharmaceutical research, where Tectonic Therapeutics is a clinical-stage research firm working with G-Protein Coupled Receptors, or GPCRs, to develop a line of novel drug candidates. GPCRs are receptor molecules involved in the regulation of multiple features of human biology. They are found on cell surfaces, and their involvement in blood pressure regulation, glucose metabolism, immune function, and neuronal signalling makes them attractive targets for Tectonic’s therapeutic research.

Tectonic’s research program is based on the company’s proprietary tech platform, the GEODe, which it is using to discover and develop new biologic medicines for its clinical pipeline. The company’s drug candidates target conditions with, as the medical jargon puts it, “high unmet medical needs,” meaning that there are no effective treatments, or at best only a few treatments with limited benefits.

The leading candidate in Tectonic’s pipeline, and the only one currently undergoing human clinical trials, is TX45. This drug candidate is being developed and studied as a new treatment for pulmonary hypertension, or high blood pressure in the circulation to the lungs. The drug is described as a “Fc-relaxin fusion protein,” and is potentially the best in its class. Tectonic is studying the drug as an agent to improve patient outcomes for Group 2 pulmonary hypertension by leveraging the vasodilatory and anti-fibrotic properties of relaxin.

This past September, Tectonic released favorable data from the Phase 1a study of TX45. The study focused on safety, tolerability, and PK/PD results, and the data will be used to identify doses for the Phase 2 trial, which was initiated in August of this year. Results from the Phase 2 trial are expected for release in 2026.

Turning to the insiders, we find that Timothy Springer, of the company’s Board of Directors, purchased 300,000 shares of TECX last month – for which he paid an impressive sum, just over $10 million. Springer currently holds more than $197 million worth of Tectonic shares.

For Piper Sandler biotech expert Yasmeen Rahimi, the upbeat prospects of TX45 are the key point for investors to consider. She writes, “We were pleased to see TECX report positive TX45 Ph1a data showing favorable PK/PD with clean safety/tolerability. While the topline disclosure was bare-boned, mgmt will be presenting these results in a poster at AHA (November 16-18, where general abstracts are embargoed until Nov. 11). Accordingly, we believe this will provide a key stock-moving event to further de-risk TX45’s RXFP1 agonist MoA.”

Looking forward, Rahimi adds, “Ahead of TX45 Ph1a HV at AHA, mgmt detailed types of data to expect, which reinforced preclinical PK/PD modeling that guided Ph2 dosing. Moreover, hemodynamic Ph1b PoC is guided for 2Q25, so mgmt reiterated that 15-20% reduction in both PVR and PCWP would be a clear win, and strengthen PoS for Ph2 APEX… Altogether, we remain highly bullish on TECX and see substantial upside ahead of several direct and indirect catalysts in the next ~year.”

That substantial upside is encapsulated in an Overweight (Buy) rating and a $76 price target that suggests a robust one-year upside of 69.5%. (To watch Rahimi’s track record, click here)

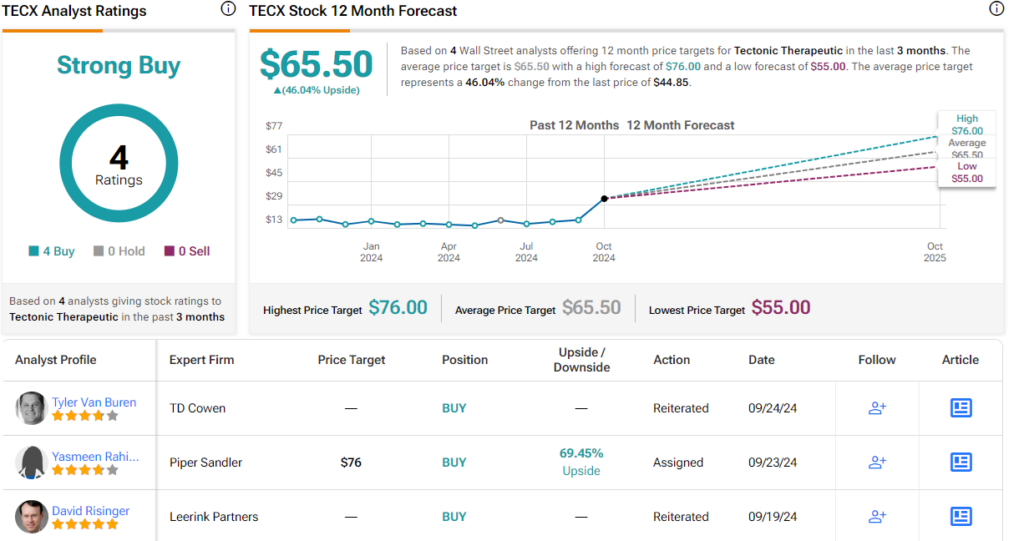

Overall, this stock boasts a unanimously positive Strong Buy consensus rating from the Street, based on 4 upbeat reviews on file. The shares are trading for $44.85 and the average target price of $65.50 points toward a gain of 46% in the next 12 months. (See TECX stock forecast)

CoStar Group (CSGP)

CoStar Group, the second stock we’ll look at here, is a tech company with a focus on data. CoStar provides data services, including information, analytics, and marketing, to the commercial and residential real estate sectors, making it easier for buyers to find properties, gain insights to the business, and make connections to improve their real estate business. The company has been operating for over 38 years, is based out of Washington, DC, and has 72 offices with locations in 14 countries.

CoStar’s goal is to digitize the world’s real estate market, making transactions smoother and putting more resources in the hands of buyers and owners alike. The company operates across the US and Canada, and has a strong presence in Europe. In addition, it has offices in East Asia, Australia, South America, and the Middle East. The key point – the specific locations in these areas all have reputations for desirable real estate markets.

The US property markets, however, have been having a rough time in recent years, due to high interest rates inflating mortgage costs, and CoStar’s shares are down almost 14% this year. The company’s residential product online brand, Homes.com, has seen a slowdown in net new sales, and that has put pressure on the stock. More recently, the company’s results and guidance for 3Q24 were mostly below expectations.

The Q3 results showed a top line of $693 million, up 11% year-over-year but some $3.11 million below the forecast. Earnings, at 22 cents per share in non-GAAP measures, beat expectations by 6 cents. However, the company guided toward Q4 y/y revenue growth of 9%, with the guidance top line of $703 million below the Q4 consensus estimate of $713.9 million.

The shares’ pullback must be appealing to one insider. Andrew Florance, the President and CEO of the company, recently purchased 14,731 shares, shelling out just under $1.1 million for the stock. He currently holds $95.16 million worth of CoStar shares.

CoStar has caught the attention of Baird analyst Jeffrey Meuler, who believes that the turndown in the stock price is overdone and represents a buying opportunity at current levels. He says of this firm, “We consider valuation attractive on ‘core’ earnings and believe the market is pricing in significant negative value for Homes.com. Meanwhile, bookings may be at/near a trough due to company-specific factors, while end market conditions may also be set to improve. Homes.com losses also likely at/near peak (with significant intermediate-term spend optionality) and Homes.com near-term bookings expectations low (aids achievability in coming quarters).”

These comments back up Meuler’s Outperform (Buy) rating here, while his price target of $100 implies that the stock will gain 33.5% heading out to the one-year horizon.(To watch Meuler’s track record, click here)

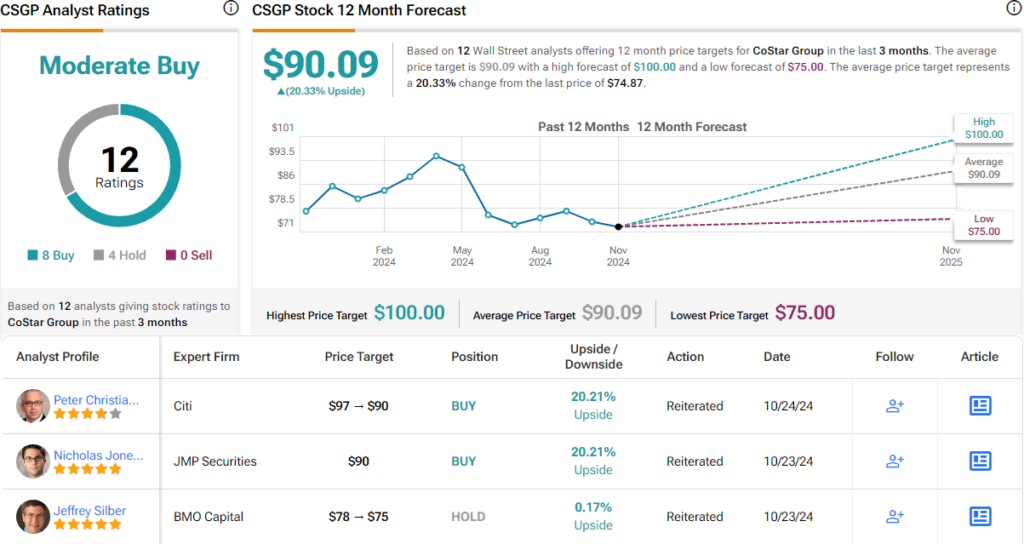

There are 12 recent reviews on file for this stock, and their 8 to 4 breakdown favoring Buy over Hold gives CSGP its Moderate Buy consensus rating. The stock is selling for $74.87, and its $90.09 average target price indicates potential for a 20% upside this coming year. (See CSGP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.