Early this week, beleaguered electric vehicle (EV) manufacturer Lordstown Motors (NASDAQ:RIDE) got a piece of news that it absolutely did not need: a key corporate investor threatened to pull out of a funding agreement. However, some bullish speculators responded with optimistic trades, leading to a spike in unusual options volume. Nevertheless, conservative investors should ignore the noise. I am bearish on RIDE stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Bulls Recklessly Pile Into RIDE Stock

Following the close of the May 1 session, RIDE stock became the subject of unusual stock options volume. Specifically, the total volume of RIDE options was 10,496 contracts. This figure represented a 615.47% gap up from RIDE’s trailing one-month average volume.

Moreover, call volume (where calls generally have bullish implications) hit 8,380 contracts, while the countervailing put volume (puts represent bearish bets) reached only 2,116 contracts. This pairing yielded a put/call volume ratio of 0.25, which on paper, favors the optimists.

Sure enough, on the following May 2 session, RIDE stock popped up over 16%. Further bolstering sentiment may have been short-squeeze speculation or the deliberate attempt to panic bears out of their positions for fear of incurring unlimited liability (since stocks have no upside price limit). RIDE stock’s short interest as a percentage of its float hit 21.8%, an elevated metric.

Even with the surprisingly positive backdrop, conservative or risk-averse investors should steer clear of RIDE stock. Fundamentally, the investment community will likely rotate away from risk-on assets toward risk-off securities or even safe havens like gold. With the market again suffering the implosion of a major financial institution – the third such bank failure this year – an aspirational enterprise like Lordstown may lose what little credibility it had prior to this week.

To quickly sum up, Foxconn Technology threatened to back out of making any further investments in the EV maker. Central to the dispute is the possibility of the Nasdaq exchange delisting RIDE stock for falling below the $1 minimum price point.

Though Lordstown intends to take all actions necessary to protect its business interests, with neither time nor money on its hands, RIDE stock seems doomed.

It’s Not the First Setback, but It Could be the Last

While investors just hearing about the Lordstown drama may be tempted to point the finger at Foxconn, the reality is that Lordstown has traversed a difficult journey almost from the get-go. At the peak of its power, RIDE stock climbed toward the $30 level, but at one point on Monday, it sat below 30 cents. So no, this latest headwind doesn’t represent Lordstown’s first setback. However, it may be the last (or close to it).

As TipRanks contributor Steve Anderson pointed out in February this year, Lordstown suffered a complete shutdown of production. Management filed notice with the National Highway Traffic Safety Administration to start a voluntary recall on the Endurance vehicle line. While Anderson notes that Lordstown didn’t produce many Endurance models, that’s also part of the problem.

Seeking to make an impact in the competitive EV ecosystem, storming out of the gate with “performance and quality issues” is not the way to make a proper debut. Not surprisingly, investors penalized RIDE stock for the matter, sending shares down 65% on a year-to-date basis.

And don’t be misled into thinking that the above issues represent anomalies against an otherwise sterling organization. In May 2021, The New York Times stated that many investors had second thoughts about RIDE stock and its ilk. From prototypes that caught fire to outright performance failures to a U.S. Securities and Exchange Commission (SEC) investigation, Lordstown has pretty much seen it all – except for lasting success.

Risky Financial Profile

Before anyone dives into RIDE stock, they must realize, first and foremost, that Lordstown remains a pre-revenue enterprise. Unfortunately, as stated earlier, Wall Street probably lacks the patience and the temerity for such undertakings.

To be fair, RIDE stock “benefits” from a zero-debt balance sheet. As well, the company holds $221.66 million in cash and cash equivalents as of the end of 2022. However, Lordstown risks being nothing more than a money pit, incurring net loss after net loss as it stumbles on one obstacle after another.

Is RIDE Stock a Buy, According to Analysts?

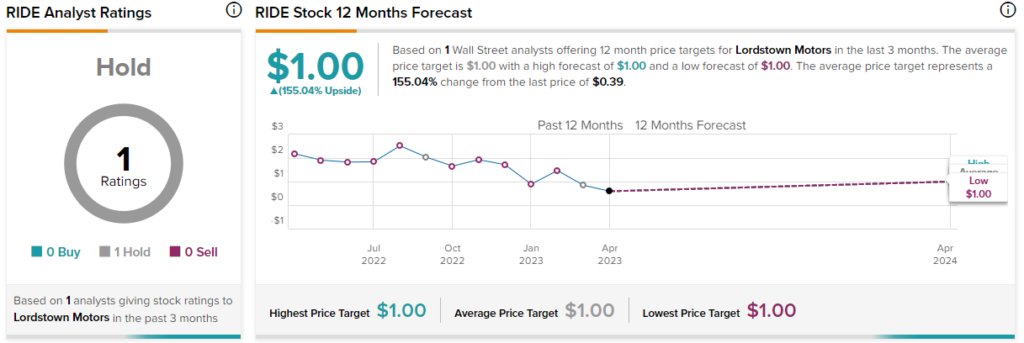

Turning to Wall Street, RIDE stock has a Hold consensus rating based on just one Hold rating. The average RIDE stock price target is $1.00, implying 155% upside potential.

The Takeaway: RIDE Stock Lacks an Incentive for Belief

Fundamentally, the problem with RIDE stock is that outside of blind speculation, the EV manufacturer offers no viable selling point. Bumbling through production setbacks, Lordstown finds itself on the cusp of losing a funding agreement. However, even with the agreement, the company hasn’t shown much progress. Therefore, investors should consider staying on the sidelines.