Tesla (TSLA) has seen its stock surge over 140% from its January low. The world’s biggest pure play Electric Vehicle (EV) maker has thrown its weight into a price war, sacrificing short-term profit for a larger market share; the markets seem to believe that Tesla is winning. While TSLA dominates the EV market and the headlines, other companies in the industry seem to benefit from the renewed investor attention, as the EV whale’s prohibitively rich valuation doesn’t leave them much choice but to look around. Besides, Tesla’s record deliveries underline the fast-growing global demand for electric cars – the thesis that drove the EV stock bubble in 2020/21 and has been all but forgotten after its burst. Will TSLA’s success reflate it again?

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Electrifying Journey

The fact that EV stocks are in a bubble became apparent in early 2021. Fueled by easy monetary policies that gave way to an influx of a myriad of passionate individual investors into the stock markets, several niches have demonstrated bubble-like behavior.

Specifically, the electric-vehicle industry behaved like a classic bubble, with stocks of companies that lacked even positive revenue, let alone profits, soaring hundreds of percent on a belief that the paradigm shift in the automobile market will make their investors rich. Companies that expected income sometime in the future, or, worse, haven’t yet built a single car, reached valuations rivaling those of respected veteran producers with large market shares, like Ford (F) or General Motors (GM), as speculative investors wagered on an emission-free future.

While the future is indeed expected to be fully electric, the bubble in EV stocks has burst spectacularly, as is the nature of bubbles. The companies that entered the stock market with a bang – many of them through a SPAC – lost from 50% to 100% of their market cap as the easy money era ended and the market participants became increasingly less reckless. However, those of them that remained alive after the bust, are showing signs of a comeback as of late, apparently reinvigorated by the buzz around Tesla.

A Long Ride Down

One of the classic examples of the craziness of bubble behavior was Lordstown Motors (RIDE). The company became public through a SPAC in 2020, when it didn’t have much more than an old GM plant and a design of an EV truck it purchased from its shareholder. At its peak, RIDE’s market cap reached more than $13 billion. After several failed prototypes, a suspected fraud, and a botched investment, the company’s shares fell below $1; at the end of June, Lordstown Motors filed for bankruptcy protection.

What’s interesting is that just two weeks prior to the bankruptcy filing, when it was known to all that the company has zero funds available to continue its activities, its stock soared almost 40% in a few days on an EV rally sparked by Tesla. I.e., investors injected funds into a failing company about to go belly up, just because Tesla’s stock rallied when its charging systems were adopted by Ford and GM. There is no logic to it whatsoever, just typical bubble psychology.

Another interesting case is Nikola (NKLA), which entered the market with a claim to become an electric heavy truck segment leader. As opposed to RIDE, Nikola delivered some trucks and even generated some positive revenues in 2022 but had to halt production this year on low demand for its trucks and higher-than-expected net losses. With dwindling cash and no investors in sight, as well as infighting between the founder and the management, NKLA might follow suit with RIDE.

The company was investigated by the SEC and the Department of Justice for fraud allegations; its founder was indicted for business and securities fraud. Nikola’s potential partners and investors, such as BP Plc (BP) and General Motors, backed off. The company that was dubbed “the Tesla of trucks” at the time of its SPAC in 2020, which gave it a valuation of $12 billion (above that of Ford at the time), has seen its shares tumble by 98% from their high. The only thing keeping NKLA above water is that its stock is held by a large army of individual investors, who must be still hoping for a turnaround – but probably will be either heavily diluted or entirely wiped out.

Not everything is grim in the electric vehicle sphere; it is also true that many of the EV startups are legitimate aspiring auto-technology leaders, not fraud-ridden failures like RIDE. It must be noted that the mere fact of negative income doesn’t necessarily mean failure: most startups, especially in such a capital-intensive industry as autos, continue burning cash long after they begin to deliver their products.

Lucid Future Ahead?

An EV-maker Lucid (LCID) hasn’t had a smooth ride since its much-hyped SPAC in February 2021, the biggest such deal ever, which gave it a more than $24 billion valuation. The main benefactor of the deal was Lucid’s majority shareholder, Saudi Arabian Public Investment Fund (PIF), which held an 85% stake in the company before its becoming public. The PIF basically saved LCID from failure in 2018.

After Lucid’s listing, its shares rallied strongly, briefly lifting its valuation above that of Ford despite having almost no revenues at the time. After a wild ride, the company’s stock is down 87% from its peak in end-2021, even after the 25% surge in the past month. It has regained some of its hype as of late, after the announced partnership with Aston Martin (AML). However, a deal with another loss-making automaker is not expected to help LCID with its cash balance problems. Besides, the company has recently ventured into the Chinese market, a bad-timing decision given the weakness of the Chinese economy and the stiff competition from local EV-makers.

LCID doesn’t just sell dreams but makes beautiful, solidly performing cars. However, the demand isn’t that great, mainly because of their high price tags. Without Tesla’s cash pile, LCID can’t compete in the price war started by Elon Musk. Although Lucid has been turning in positive revenues since 2021, it is still reporting heavy and growing net losses. The company recently raised $3 billion from an additional share offering, heavily diluting existing investors, but at least gaining some cash buffer to continue production. Still, the company continues to burn cash at a high rate, much higher than its revenues. It has a high chance to survive with additional investments or stock offerings until it finally becomes profitable – but its shareholders shouldn’t count on getting back the value of their investments any time soon.

The same can be said about the holders of shares in Rivian (RIVN). Although it is doing better than most EV companies (except for Tesla, of course), it still produces more cars than it sells – and it doesn’t produce that much, rather, it sells too little – underscoring lower-than-thought demand for its products. Meanwhile, it has been reporting huge operating losses, meaning that it will take a very long time for it to display positive profit numbers.

It must be said that Rivian doesn’t have a problem with financing its operations: the cash in its coffers amounted to almost $12 million at the end of the first quarter of 2023. It turns in large, increasingly growing revenues, but with an accelerating increase in costs, the losses are mounting, and the cash pile is slowly burning. While the company is succeeding to make good on its promise to scale up production, the competition is heating up, both from pure-play EV-makers and from the established car producers wading into the electric sphere. It will not be an easy ride for RIVN, but it has better chances to survive for a long enough time to become profitable than other EV startups.

Meanwhile, the stock of the once-called “Tesla Killer” Rivian has lost 81% since its IPO in November 2021, even accounting for an 83% surge in the last month. The huge loss led to RIVN’s removal from Nasdaq 100 Index (NDX) in June this year. However, a new deal with Amazon (AMZN) to deliver electric vans for its European operations gave it a much-needed jolt. AMZN is a long-term backer of Rivian, having first invested in the company in 2019. All in all, RIVN is seen as the only EV-maker stock with long-term prospects of adequate investor return, albeit it remains a very risky bet.

Source: Google Finance

EVs Are The Future; Not Many EV Makers Will Make It There

The 2021 EV bubble was propelled by Tesla’s success; will its current triumph reflate that bubble?

It may, up to a point. We are not in 2021 anymore; the enormous liquidity unleashed by the central banks and feeding into numerous bubbles is long gone. The market is now unwilling to fund cash-burning promises of future growth; investors are much more cautious and not easily blinded by hype.

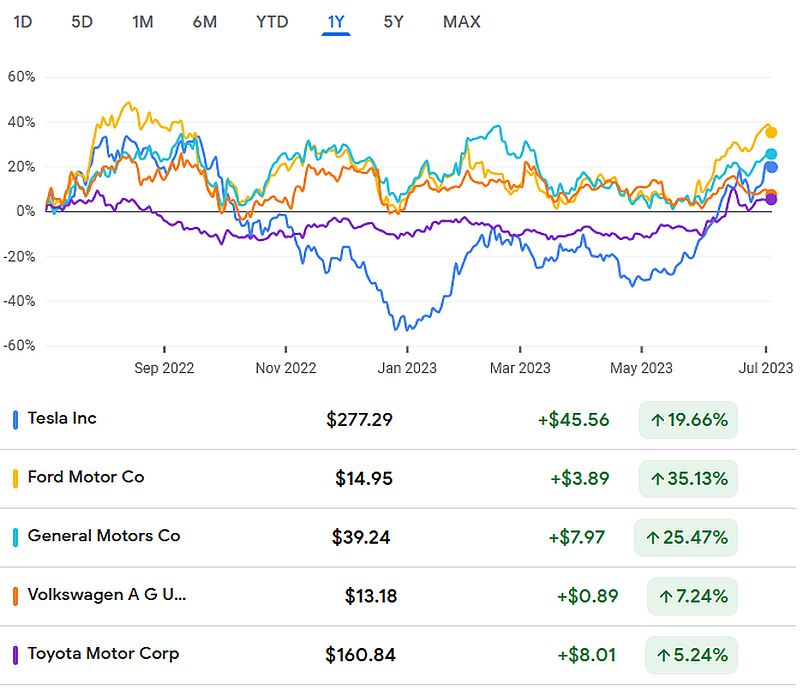

Source: Google Finance

Besides, the competition is becoming increasingly harsher, which is especially dangerous for small players in the capital-intensive and low-margin auto market. While Tesla remains the leader in the electric vehicle sphere, “the old industry” is catching up. Traditional automakers like Ford, GM, Volkswagen (VWAGY), Toyota (TM), and others are investing billions to maximize their EV market share. Those investments are bearing fruit, and fast: in just a couple of years, legacy automakers have advanced from being far behind the curve to having some of the most popular electric cars on the market. Large and established dealers and service providers networks are also a substantial advantage.

No doubt, EVs are the future of driving. The electric vehicle market is growing by the hour and is expected to see explosive growth over the next decade. Still, not many EV makers will survive long enough to be a part of that future. In a few years, there will probably be a lot of electric Volkswagens, Fords, and Teslas, chased by a fleet of cheap Chinese-made EVs; the chances that in 2030 any of us will drive a Lucid – or even a Rivian – are much, much lower.