Mastercard (MA), one of the largest payment transaction processors globally, has seen its stock drop significantly in recent months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The stock is currently down over 11% year-to-date. Multiple headwinds hound the company and the economy.

Because of this, the short-term stock prospects are murky. However, the fundamental business remains strong. I am neutral on the stock.

Mastercard Suspends Russian Operations

The Russian invasion of Ukraine has caused turmoil in world markets and a humanitarian crisis. The U.S. and Europe have unleashed a plethora of sanctions in an attempt to damage the Russian economy and isolate it from the rest of the world. However, sanctions may be unlikely to change the course of the conflict in the short term.

The U.S. has also banned oil imports from Russia. This will almost certainly cause increased fuel prices in the U.S, adding to already troublesome inflation.

Because of this, many American and European companies have pulled out of Russia, stopped doing business there, or taken other actions to show support for Ukraine.

Mastercard, along with Visa and American Express, has suspended its operations in Russia.

According to Mastercard, 4% of its revenue comes from Russia and 2% from Ukraine. This year’s sales are expected to exceed $22 billion, so a 6% decrease would cost over $1.3 billion in top-line sales.

How Inflation Affects Mastercard

Perhaps the more considerable worry is in the U.S., where inflation has reached 40-year highs. The Federal Reserve will soon respond with interest rate hikes in an attempt to slow it.

Because Mastercard makes most of its revenue from fees based on gross dollar volume, higher prices are not necessarily damaging.

However, the fear is that higher prices, rising interest rates, and global events could cause an economic slowdown or even a recession. When this happens, consumer spending falls, which would be particularly damaging to Mastercard’s results.

Mastercard also makes money from high-margin cross-border transactions. These were negatively affected in 2020 due to COVID-19. Another economic slowdown could have a similar effect.

Business Remains Fundamentally Sound

Mastercard earned $18.9 billion in sales in Fiscal Year 2021.

This was 23% more than in pandemic-stunted 2020 and 12% more than in 2019. Net income was also up considerably in 2021. Net income reached $8.7 billion, up from $6.4 billion in 2020, and $8.1 billion in 2019.

Likewise, diluted EPS rose to $8.76 in 2021 after coming in at $6.37 and $7.94 in 2020 and 2019, respectively. Mastercard also supports shareholders with a lucrative stock buyback program and a small dividend.

Mastercard repurchased $5.9 billion in shares in fiscal 2021, which amounts to a little less than 2% of the present market cap.

The dividend yields 0.6% currently. While the yield is small, the dividend has grown annually for the last ten years and is safe given the low payout ratio.

Wall Street Analysts

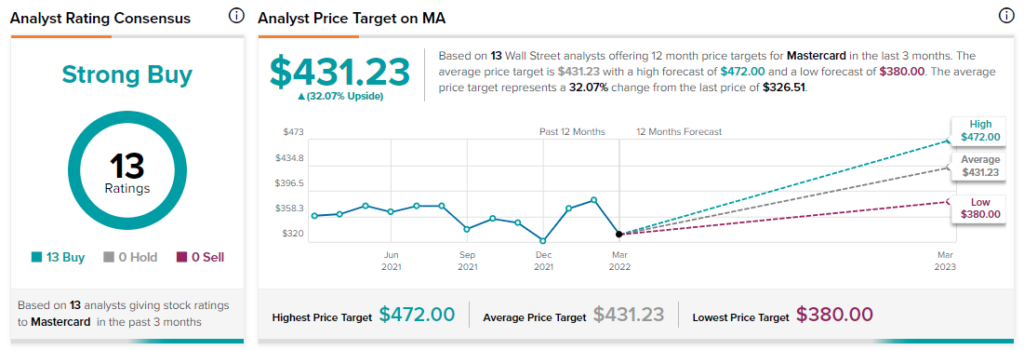

Analysts on Wall Street are extremely bullish on Mastercard stock. Analysts have a Strong Buy consensus rating based on 13 Buys and no Hold or Sell ratings. The clean sweep of Buy ratings are encouraging for investors, as is the small short interest with less than 1% of the float sold short.

The average Mastercard price target of $431.23 implies 32.1% upside potential from the current price.

Conclusion

Mastercard stock has fallen from its recent highs. It isn’t the only stock that has suffered as the Dow Jones Industrial Average, S&P 500, and Nasdaq have entered correction territory.

Headwinds relating to international tensions and worries over inflation have rattled investors.

Analysts are bullish on the stock despite these worries, and the latest earnings release was solid.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure