Inflation remains high, and that was on the mind of Jerome Powell as the Federal Reserve chair gave testimony to the Senate Banking committee today. Powell made it clear that the central bank is likely to lift interest rates higher than previously anticipated. Currently, the Fed’s key funds rate is set in the range of 4.5% to 4.75%.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

“Although inflation has been moderating in recent months, the process of getting inflation back to 2% has a long way to go, and is likely to be bumpy… The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said.

His comments have reignited worries that the Fed will trigger a recession to kill inflation. In bond markets, the 2-year note yield rose to near 5%, well above the 10-year note’s 3.9%, an expansion of the yield inversion usually seen as a recession indicator.

While the Fed’s policy of tighter money and higher rates is squeezing capital and threatening deeper economic pain, and equities generally are edging down in response, this doesn’t mean that investors can’t find upbeat stock prospects. Plenty of stocks are set to gain as interest rates go up – and Wall Street’s analysts have been helping us find them.

We’ve used the TipRanks database to pull up details on two of those picks, stocks ready to capitalize on higher interest rates. Let’s take a closer look.

BGC Partners (BGCP)

BGC Partners is a small-cap financial services company, based in New York City and formed in 2004 when its parent company Cantor Fitzgerald spun off its brokerage business. BGC has been an independent entity since then, and currently offers clients a range of broker services and trade execution, with voice, electronic, or hybrid brokerage options. The company’s products include fixed income securities, interest rate swaps, equities and related products, credit derivatives, commodities, and futures.

In recent comments, looking at current economic and market conditions, the company’s Chair and CEO, Howard Lutnick, said he believes the higher interest rate regime being put in place by the Fed will push a return to a more normal market condition, one with a high level of correlation between credit issuance and volumes. The result, in his view, will be positive market conditions that give a tailwind to companies able to navigate them.

BGC’s most recent quarterly release, for 4Q22, may back up the CEO’s comments. BGC reported $436.5 million in revenue, down 5.4% year-over-year but 2% better than predicted. The adjusted EPS, of 16 cents, was down 1 cent y/y, but beat the forecast by 6.6%. More importantly, the company’s guidance for Q1, with revenue of $515-$565 million, was well above the consensus estimates of $509 million.

In coverage of this stock for Credit Suisse, analyst Gautam Sawant takes a bullish view, and writes: “Moderating volatility and higher interest rates are contributing to a favorable operating environment for BGCP in 2023… Macroeconomic factors are improving the fundamental story for the firm’s voice/hybrid interdealer-broker business. We note the FMX Platform is also on track for a 2Q23 launch. We believe BGCP remains well positioned for top-line growth from a stronger trading environment across rates, credit and FX, energy and equity products in 2023.”

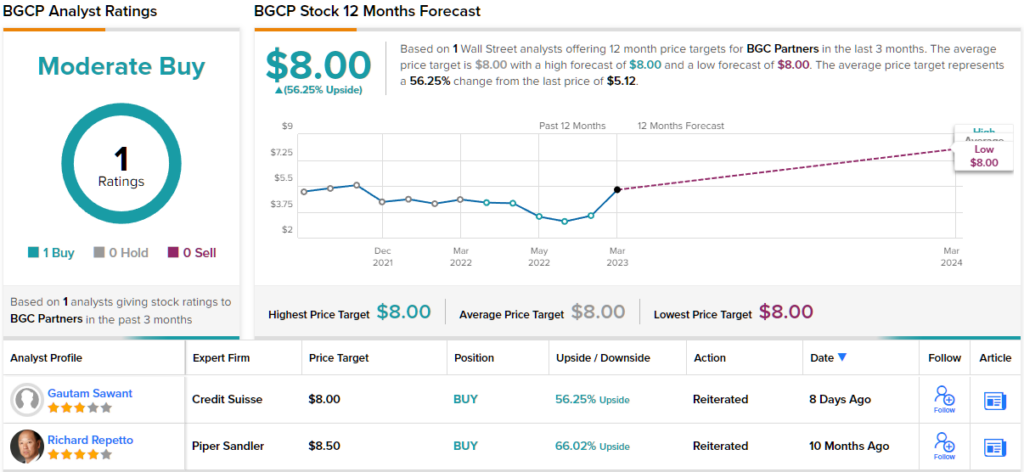

Against this backdrop, it’s no wonder that Sawant rates BGCP a Buy, and his price target of $8 implies it has a one-year upside potential of 56% (To watch Sawant’s track record, click here)

BGC Partners has slipped under most analysts’ radar; Sawant is the only bull in the picture right now- with the stock displaying a Moderate Buy analyst consensus. (See BGCP stock forecast)

Corebridge Financial (CRBG)

The second stock we’ll look at is another financial services firm. Corebridge spun off of the insurance giant AIG last year, and went public through an IPO. The company now offers a range of retirement solutions and insurance products to customers in the US markets. Among Corebridge’s offerings are annuities, asset management, and life insurance.

The IPO saw 80 million shares hit the market, with an offer price of $21 each. The IPO raised $1.68 billion, making it one of the year’s largest initial public offerings. Corebridge did not raise new capital through the event, as all proceeds went to AIG.

In February of this year, Corebridge reported its 4Q and full-year results for 2022, and beat expectations at the bottom line. The company showed an operating income, after taxes, of $574 million for the quarter, which came to 88 cents per share. This EPS figure was well above the 69 cents forecast, a solid beat of 27%.

In a metric that should interest investors, Corebridge’s report showed that it has paid out $296 million in dividend payments since the IPO. This has come from three consecutive 23-cent per common share dividend declarations, since the payments were commenced in October. The most recent declaration, made last month, set the March payment for the 31st of the month. At the current rate, the dividend annualized to 92 cents and yields 4.6%; this is more than double the average dividend yield found among S&P-listed firms.

Corebridge has caught the eye of 5-star analyst Mark Dwelle, from RBC, who writes of the company: “Corebridge is well levered to rising interest rates as this is a positive to net investment spreads as well as providing flexibility in enhancing product features to drive incremental new business flows… we expect positive impacts to become increasingly evident in ’23.”

“We expect that the company could initiate its share buyback program beginning in Q2/23 (a dividend was already instated last year). We remain positive on CRBG shares and think that the valuation (0.6x book ex AOCI) doesn’t fully appreciate the earnings power of the company,” Dwelle added.

In Dwelle’s view, Corebridge is off to a strong start as a public entity, and he rates the shares an Outperform (i.e. Buy). He sets his price target at $26, suggesting ~30% upside for the stock over the next 12 months. (To watch Dwelle’s track record, click here)

In its short time on the public markets, 6 analysts have filed reviews of CRBG shares, including 4 to Buy and 2 to Hold for a Moderate Buy consensus rating. The stock is selling for $20.04 and its $27.67 average price target indicates potential for 38% share appreciation from that level. (See CRBG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.