With the ebbs and flows of global markets, industries are born, mature, and sometimes fade away into the abyss of irrelevance. In recent years, we have seen crypto-mining, electric vehicles, and now the cannabis industry taking off. Although already legal in 36 states, the substance is still federally illicit, placing the publicly traded companies dealing with it in a precarious, yet potentially prosperous position.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Once full legalization is reached in the U.S., most any company which handles cannabis will benefit. However, the looming question is whether or not legality will come, and more specifically, when?

In a lengthy report, Owen Bennett of Jefferies Group covered the nascent industry with enthusiastic optimism. He expects several events to occur in the rather near future, forever changing and cementing not just the cannabis industry, but also shifting the fates of the alcohol and even pharmaceutical industries.

Owen predicts that within the next 12 months, federal legislation will offer protections to firms willing to invest in cannabis companies, and later, will offer full U.S. legality by 2026. With nationwide legalization also comes interstate commerce, further driving the industry to higher valuations.

Additionally, increasing normalization of the substance by the general public and its derivatives will lead to growth in commercialization and sales.

The analyst estimated that in the U.S., sales of cannabis related products were up 40% from 2019 to 2020, representing $17.2 billion. He expects that number to more than double by 2025, and then double again by 2030.

Owens went on to write about mergers and acquisitions (M&A), saying this tool will be pivotal for the more than 27,000 “plant touching businesses currently in operation,” and that consolidation into fewer, but more valuable entities, is inevitable. He explained that due to current restrictions and regulations on business, organic growth is hard to come by.

Consolidations by way of M&A provide a quick way to expand, and therefore can secure companies’ leading positions before more competition enters the market, following eventual legalization.

Giving suggestions for long-term growth, Owens elaborated that companies will need to have “exposure to key US states (Cali a must-have), strong branding/wholesale reach, robust BS, cultivation positioned for interstate commerce, and CBD/intl. Optionality.”

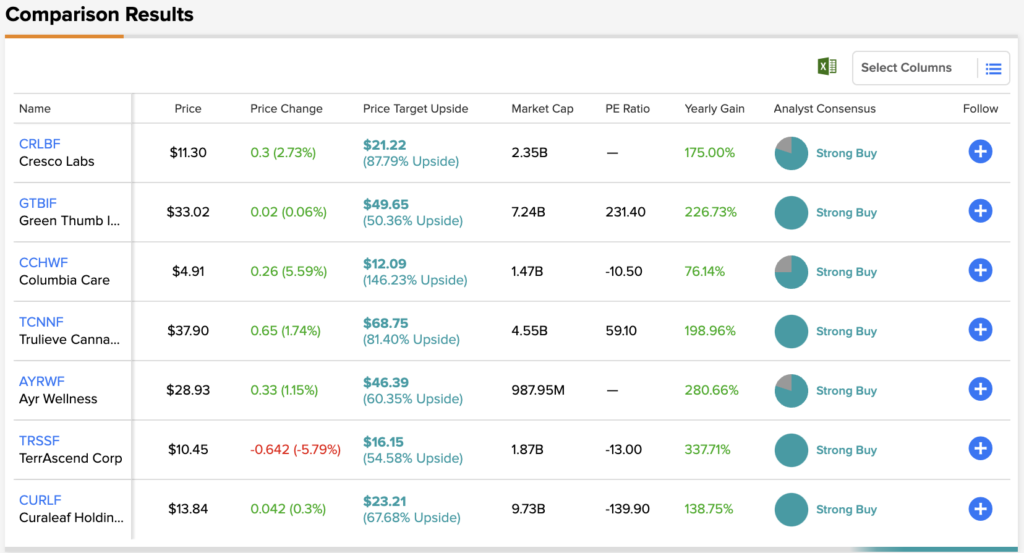

The analyst provided seven stocks to keep an eye on, those being Cresco Labs (CRLBF), Curaleaf Holdings (CURLF), Green Thumb Industries, Inc. (GTBIF), Columbia Care (CCHWF) Trulieve Cannabis (TCNNF), TerrAscend Corp. (TRSSF) and Ayr Wellness (AYRWF). He believes each one could have a potential 12-month upside of over 100%, and each rated as a Buy. Cresco is his top pick, but he also find Curaleaf and Green Thumb to be compelling.

On TipRanks, all seven stocks have ratings of Strong Buy, with average potential 12-month upsides ranging from 50.36% to 146.23%.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.