Even with a brief drop this week, the markets are showing strength this year, with the S&P 500 climbing 8%. However, there’s a big question on investors’ minds: Can this momentum keep up?

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

David Kostin, Goldman’s chief US equity strategist, has given four scenarios for investor consideration: “(1) in a ‘catch up,’ the S&P 500 would end the year at 5800 (+12% from today), (2) in a ‘catch-down,’ the S&P 500 would fall to 4500 (-14%), (3) continued mega-cap exceptionalism would lift the index to 6000 (+15%), and (4) recession fears would push the index down to 4500 (-14%).”

It remains to be seen which scenario will play out. Nonetheless, Goldman Sachs analyst Richard Law has made two specific stock recommendations, foreseeing substantial upside potential of over 120%. Law’s bullish outlook is shared by others in the market; according to the TipRanks database, both stocks carry a Strong Buy consensus rating from analysts. Let’s take a closer look.

Olema Pharmaceuticals (OLMA)

The first Goldman pick we’ll look at is Olema Pharma, a medical research firm working at the clinical stage with a focus on the discovery, development, and commercialization of new therapies specifically targeted at women’s cancers. Olema has a research pipeline built around a leading drug candidate, OP-1250 (also called palazestrant), which is under investigation in six separate research tracks. Of these, five are at the clinical trial stage.

Those five clinical tracks involve testing OP-1250 as a monotherapy and as a combo therapy in conjunction with several other anti-cancer drugs in the treatment of ER+/HER2 metastatic breast cancer. The most advanced track, studying the drug as a monotherapy, is entirely under Olema’s direction; several of the other tracks involve partnership programs with larger drug companies.

The company’s most advanced is the Phase 3 pivotal monotherapy trial of OP-1250. This study was initiated during 4Q23, and top-line results are expected during 2026.

In the meantime, there are several milestones expected for this year. In May, the company will present interim results from the Phase 2 clinical trial of OP-1250 in combo with ribociclib at the ESMO Breast Cancer Annual Congress in Berlin. Next, during Q3, the company is expected to initiate a Phase 1b/2 study of its leading candidate in combo with everolimus. And finally, late this year, Olema expects to file the Investigational New Drug application for its candidate OP-3136 with the FDA

In all, this biopharma has a full plate, and that has caught the attention of Goldman Sachs’ Richard Law.

“OLMA’s Ph. 2 late line mono data showed impressive efficacy even in the elusive ESR1-WT population. While the mESR1 data look in-line with competitors, the ESR1-WT data are arguably the best-in-class. Applying statistical adjustments on Ph. 2 results using EMERALD learnings for Ph. 3 OPERA-1 in 2-3L showed palazestrant could achieve approval in both mESR1 and ESR1-WT, although we are less confident on why it is able to succeed in ESR1-WT while others with similar MOA could not. Our Buy rating is driven by pala’s best-in-class potential in a large ER+/HER2- breast cancer market and the possibility of OLMA securing a biopharma partnership deal (OLMA announced as priority in 2024) that could bring additional value to the stock,” Law opined.

Law’s Buy rating on OLMA comes with a $24 price target, implying the stock will gain 128% on the one-year horizon. (To watch Law’s track record, click here)

Overall, it’s clear, from the unanimous Strong Buy consensus rating, that Wall Street agrees with the bullish take; this stock has 7 recent positive recommendations. The shares are priced at $10.51 and their $25 average price target suggest a one-year upside potential of ~138%. (See OLMA stock forecast)

Mineralys Therapeutics (MLYS)

The second Goldman pick is Mineralys, another clinical-stage biopharmaceutical company. Mineralys is laser-focused on addressing the consequences of elevated levels of aldosterone, a hormone that, at elevated levels, can cause serious hypertension. Aldosterone is part of the natural control for potassium and salt levels in the bloodstream; when these get out of whack, high blood pressure, or hypertension, is the usual result. Approximately 25% of patients with high blood pressure also have elevated aldosterone.

This points toward a large potential market for Mineralys to address. Among Americans age 20 and up, there are some 122 million who have high blood pressure, with or without treatment. The prevalence of uncontrolled hypertension, and its effect on the organs such as the heart and kidney, has a huge dollar impact on the economy, in the form of preventable health care spending and time missed from work. Mineralys has developed a new drug candidate, lorundrostat, to address this medical need, and has advanced the drug well into clinical trials.

The company recently launched a pivotal Phase 3 trial of lorundrostat, the Launch-HTN study. This is the second ongoing pivotal of the drug, on patients with uHTN or rHTN. The study, which was initiated during 4Q23, looks at the drug when added to the patients’ existing blood pressure treatment regimen.

The first of the two pivotal trials, Advance-HTN, also continues apace. Mineralys is using this trial to examine the safety and efficacy of lorundrostat used as an add-on therapy ‘to an AHA guidelines-based standardized background treatment regimen of either two or three antihypertensive medications.’

Mineralys expects to have topline data from the Advance-HTN trial ready for release during 4Q24, as well as to have topline data from Launch-HTN during 2H25.

Checking in again with analyst Richard Law, we find him upbeat on this company, based on the previous successes in its Phase 2 trials and the dollar potential of the addressable market in hypertension treatments.

“Despite spironolactone becoming the SOC in resistant HTN, there is still an unmet need due to its gynecomastia and hyperkalemia effects. Lorundrostat’s Ph. 2 already showed ~10 mmHg placebo-adjusted SBP reduction. Patients with obesity showed an even greater ~17 mmHg reduction. We believe this level of efficacy can achieve best-in-class and MLYS’s targeted approach for obesity-related HTN in the 3/4L settings could still treat 7-8M targetable patients in the US alone. We model lorundrostat achieving ~$2.8B WW non-risk-adjusted, or ~$1.1B risk-adjusted, peak sales in 2040. Our Buy rating is driven by MLYS potentially showing best-in-class efficacy in a large obesity-related HTN market,” Law opined.

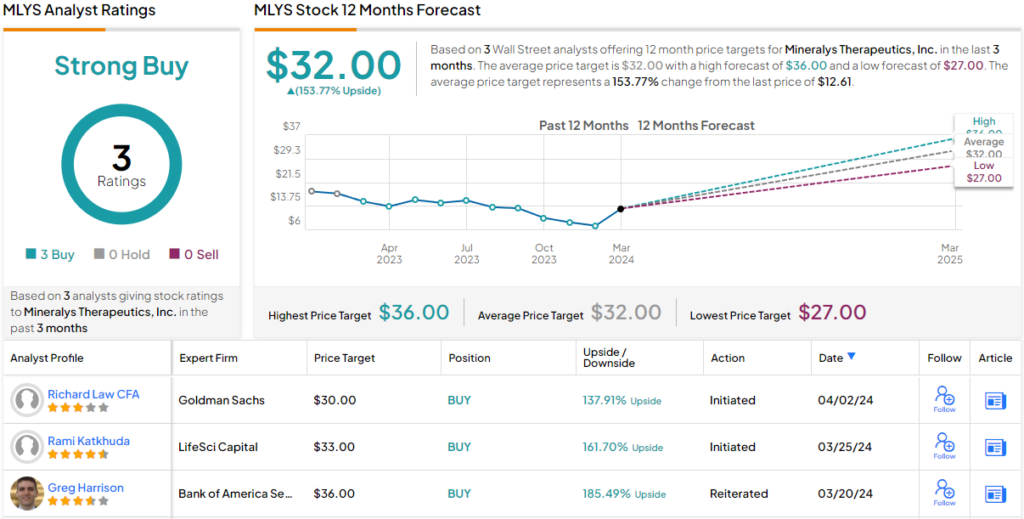

Law’s Buy rating on MLYS is backed by a $30 price target, indicating a 138% upside over the one-year horizon.

All in all, there are 3 recent analyst reviews of this stock, and they are all positive, for a unanimous Strong Buy consensus rating. Mineralys shares are trading for $12.61 and their average price target of $32 is somewhat more bullish than the Goldman view, suggesting a robust 154% gain in the coming year. (See MLYS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.