Exchange-traded funds (ETFs) offer a cost-effective way to invest in a diversified portfolio of stocks or other assets. Moreover, the low investment requirements make ETFs attractive to investors with less capital. Today, we have leveraged the TipRanks ETF Screener to scan for gold mining industry-focused ETFs. SGDM and GDXJ are two such funds with about 30% upside potential this year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s explore what Wall Street thinks about these two ETFs.

Sprott Gold Miners ETF (SGDM)

The Sprott Gold Miners ETF tracks the Solactive Gold Miners Custom Factors Index. This index focuses on the performance of larger-sized gold companies listed on Canadian and U.S. exchanges. SGDM has $234.04 million in assets under management (AUM), with the top 10 holdings contributing 66.38% of the portfolio. Further, the ETF boasts a current dividend yield of 1.41%. Meanwhile, the expense ratio of 0.50% is encouraging.

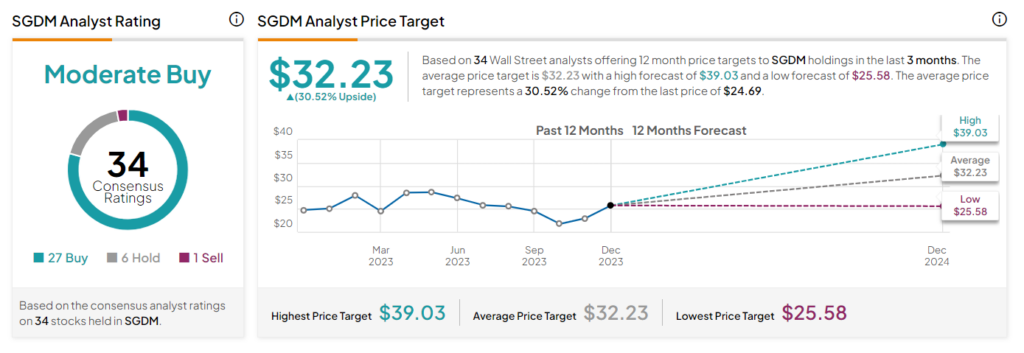

On TipRanks, SGDM has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 34 stocks held, 27 have Buys, six have a Hold, and one stock has a Sell rating. The average Sprott Gold Miners ETF price forecast of $32.23 implies a 30.5% upside potential from the current levels. The SGDM ETF has declined 3.2% in the past six months.

VanEck Junior Gold Miners ETF (GDXJ)

The VanEck Junior Gold Miners ETF replicates the performance of the MVIS Global Junior Gold Miners index of small-cap companies engaged in gold and silver mining. GDXJ has $4.46 billion in AUM, with its top 10 holdings contributing 44.25% of the portfolio. Notably, the fund has a current dividend yield of 0.73%. Its expense ratio stands at 0.52%.

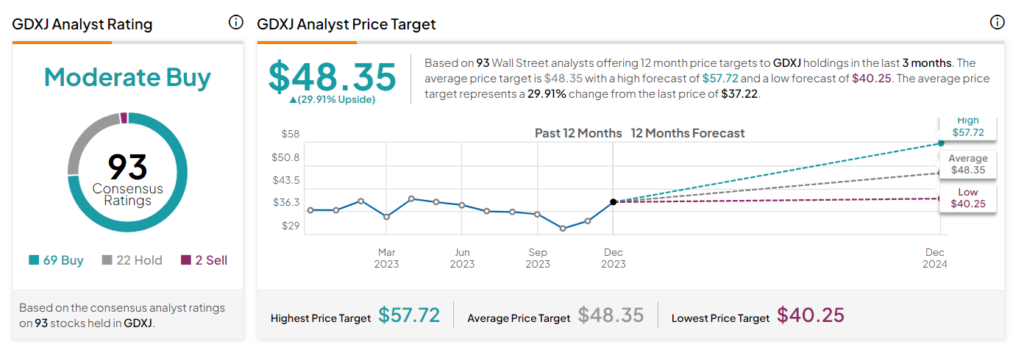

On TipRanks, GDXJ has a Moderate Buy consensus rating. Of the 93 stocks held, 69 have Buys, 22 have a Hold rating, and two have a Sell rating. The average VanEck Junior Gold Miners ETF price target of $48.35 implies a 30% upside potential from the current levels. The ETF has gained 4.8% in the past six months.

Ending Thoughts

Investing in ETFs often presents a lower risk profile compared to individual stocks due to diversification and the funds being passively managed by tracking pre-defined indices. Furthermore, the impressive upside potential in the SGDM and GDXJ ETFs might draw investors’ attention towards them.