Cloudera, Inc. (CLDR) has struggled since its IPO back in 2017 as the demand for Hadoop-based products has declined at a rapid pace. But Cloudera has turned the page on that era by first merging with Hortonworks in 2019, and then beginning the process of retooling the combined company’s product lines.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The merged company has a new vision, and it isn’t structured around Hadoop. Cloudera offers the Cloudera Data Platform (CDP), a suite of applications that provides data management and analytics services for large enterprise customers within a hybrid multi-cloud environment.

The platform is unique in that it provides nearly seamless support for both public and private data management. Located both on-premises and in the cloud, customers are able to structure and optimize data and data processing where they are best suited. For example, customers can take advantage of the scaling and performance associated with the cloud, while securing sensitive data on-premises.

Stock Chart

Q4 2021 marked the first time that both the public and private versions of the software have been available to large enterprise customers. As a result of initial investor optimism, Cloudera stock surged to a new 52-week high in February before suffering a correction along with the rest of the software industry.

In addition to the tech stock correction, Cloudera recently published its Q4 2021 financial results. Weak guidance for the next quarter caused the stock price to extend its bearish momentum.

Q4 2021 Financial Results

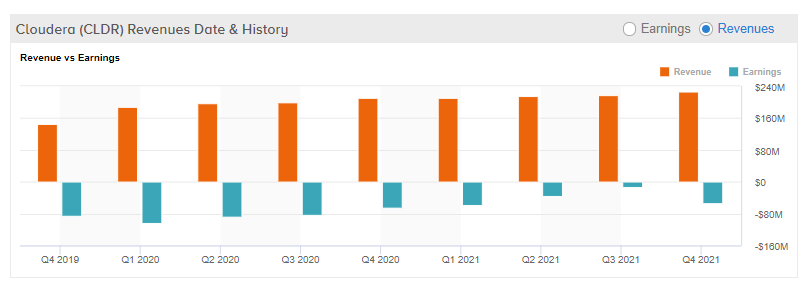

In spite of the pandemic-related headwinds and company transformation, Cloudera managed to grow quarterly revenue by 7% year-over-year, while subscription growth of 14% was even better.

These results are good considering the early stage of product introduction and the pandemic, which likely impeded on-premises sales.

While the quarterly financial performance was reasonable under the current conditions, the forward-looking guidance was underwhelming, with a forecast of 3% year-over-year revenue growth for Q1 2022 and 5% growth in subscription revenue. The forecast is predicated on continued pandemic-related economic weakness in the first quarter and the continued transition from legacy products to the new CDP platform, which may increase the net expansion rate, already in excess of 120% for the Q3 and Q4 cohort of CDP adopters.

Cloudera – Now A Data Science And Data Streaming Company

Despite disappointing guidance, there is room for investor optimism now that Cloudera has turned the corner with its homogenous platform for data management and warehousing. Management can now focus on building a bright future with new applications that can drive increased customer value. Cloudera has announced that it will soon be offering CDP data engineering, CDP data visualization, and CDP operational database on the public cloud. The new functionality will help drive adoption of the CDP public cloud, which will also have a user consumption fee component.

Cloudera recently acquired Eventador, an SQL streaming analytics company, providing data scientists with tools for building real-time data pipelines, dashboards, and business models.

Wall Street’s Take

From Wall Street analysts, Cloudera earns a Hold consensus rating, based on 2 Buys and 7 Holds. Additionally, the average analyst price target of $15.71 puts the upside potential at 24%. (See Cloudera stock analysis on TipRanks)

Summary And Conclusions

Over the last few years, Cloudera has transformed from a Hadoop-based software company into an industry leader in hybrid/multi-cloud Big Data management and warehousing, merging with another Hadoop company, Hortonworks, along the way.

With the merger complete and the new product (CDP) released and in use by several large enterprise customers, Cloudera has now turned a corner and is starting to focus on new data science applications for the public cloud that should improve net expansion of customer revenue.

While guidance was weak, it was also conservative and does not consider the potential revenue from new applications that are difficult to predict. The world is also emerging from the pandemic and this will present a tailwind for the company’s on-premises portion of the platform.

With the recent share price decline, Cloudera may present a great opportunity to invest in a Big Data company at a significant discount. At present, Cloudera’s Price/Sales Ratio is 4.16, significantly less than other Big Data companies such as Snowflake (SNOW) or Palantir (PLTR), which have Price/Sales Ratios of 83 and 41.5, respectively.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.