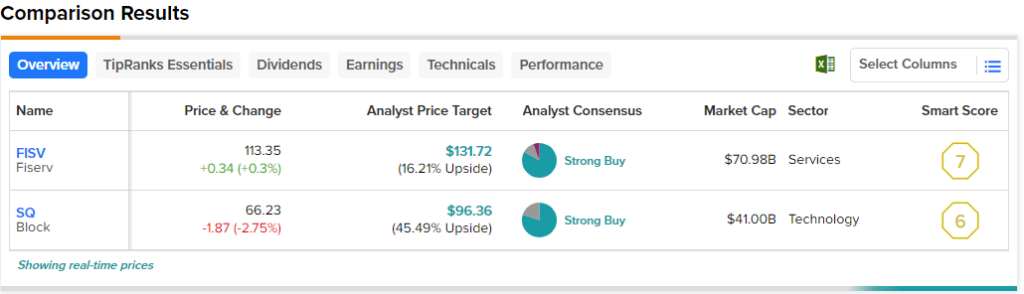

In this piece, I used TipRanks’ comparison tool to evaluate two fintech stocks — Fiserv Inc. (NASDAQ:FISV) and Block Inc. (NYSE:SQ) — and determine which stock is better. While both are in the green year-to-date, Block has plummeted over the last 12 months, off 47% versus Fiserv’s 12.3% gain. Some investors might wonder if there’s additional upside for Fiserv and whether Block offers a buy-the-dip opportunity. Meanwhile, a closer look suggests that FISV is the better stock. Let’s examine the two companies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fiserv (NASDAQ:FISV)

A quick review of Fiserv’s financials indicates that this is a high-quality stock with a decent valuation relative to the rest of its industry and to its own five-year history. Thus, a bullish view looks appropriate, although Fiserv looks more like a long-term buy-and-hold position rather than a tradeable stock with short-term goals in mind.

Fiserv is trading at a price-to-earnings (P/E) ratio of about 28.8 times. While that’s higher than the three-year average of 18.7 times for the diversified financials industry, it’s far lower than the industry’s current P/E of 263 times. Also, Fiserv’s mean P/E over the last five years is about 49.7 times.

The company is also trading at a price-to-sales (P/S) ratio of about 3.95 times, higher than the industry’s current P/S of 3.4 times and its three-year average of 2.1 times. However, Fiserv’s current P/S is lower than its mean P/S over the last five years of about 5.6 times.

While Fiserv’s revenue growth has slowed significantly, it still enjoys a robust gross margin of 55% and a solid net income margin of 14%. The company also generates plenty of cash — $4.6 billion in cash from operations and $3.1 billion in free cash flow for the last 12 months. Fiserv also generates stable revenues and earnings

Overall, Fiserv looks like a high-quality company, and high-quality stocks tend to do remarkably well during a recession. Fiserv stock could be holding up rather well, given that a recession may be right around the corner. Of course, recessions tend to be a challenge for fintech stocks in general. Thus, a better entry point might appear, but Fiserv’s stability points to long-term staying power.

What is the Price Target for FISV Stock?

Fiserv has a Moderate Buy consensus rating based on 15 Buys, two Holds, and one Sell rating assigned over the last three months. At $131.72, the average Fiserv stock price target implies upside potential of 16.2%.

Block (NYSE:SQ)

The first thing investors will notice about Block is that it’s unprofitable, which is a big problem in today’s investment environment because the market has been punishing unprofitable companies. A closer look reveals other potential problems as well, suggesting a bearish view might be appropriate.

Block is trading at a P/S of about 2.3 times, versus its mean P/S of about 7.5 over the last five years. Although Block looks undervalued based on its P/S, fundamental analysis reveals why it may deserve a lower valuation than its peers.

For example, Block’s revenue was similar to Fiserv’s in 2022, at $17.5 billion for the former and $17.7 billion for the latter. However, Block was not able to turn a profit, recording a net loss of $540.8 million for 2022. The company was profitable in 2019, 2020, and 2021, but it became unprofitable again in 2022 despite coming up just shy of 2021’s $17.7 billion in revenue.

Another problem is that Block is exposed to crypto, with one estimate suggesting the company owns over 8,000 bitcoins (BTC-USD). In fact, CEO Jack Dorsey has emphasized that cryptocurrency will play a significant role in Block’s future, including plans to sell bitcoin mining kits announced last month.

Finally, there are some concerning trends regarding Block’s business mix. One analyst noted that volume comparisons with Fiserv, Clover, and Toast suggest Block is losing market share to its competitors. Other concerns include a growing dependence on payday lending for CashApp.

Block’s gross margin of 35% is also weaker than Fiserv’s. Finally, Block was barely free-cash-flow positive ($5.1 million in 2022), and it only generated $175.9 million in cash from operations.

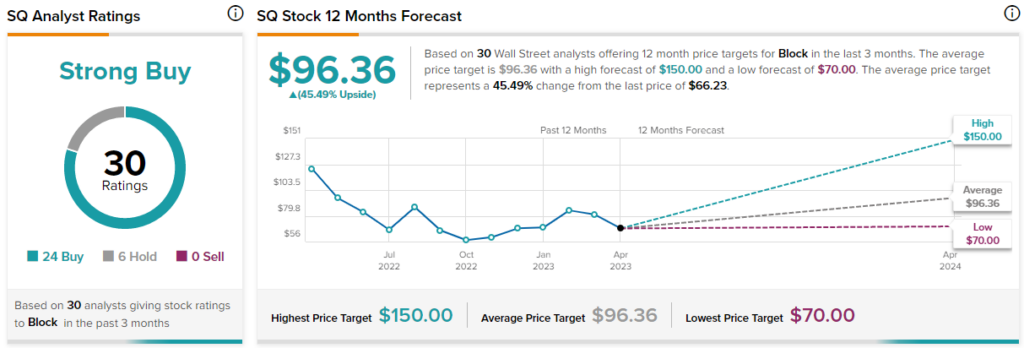

What is the Price Target for SQ Stock?

Block has a Strong Buy consensus rating based on 25 Buys, five Holds, and zero Sell ratings assigned over the last three months. At $96.36, the average Block stock price target implies upside potential of 44.33%.

Conclusion: Long-Term Bullish on FISV, Bearish on SQ

Fiserv is clearly a high-quality stock based on its fundamentals, strong margins and free cash flow, and other factors. Meanwhile, Block’s lack of profitability and general weakness leave little to appreciate.

In short, Fiserv offers staying power and plenty to like, while it’s virtually impossible to find anything to like about Block. Notably, Fiserv looks like a long-term buy-and-hold with the caveat that a better entry point might appear. Thus, investors might consider establishing a small position at current levels while looking for a better entry point to add to that position.