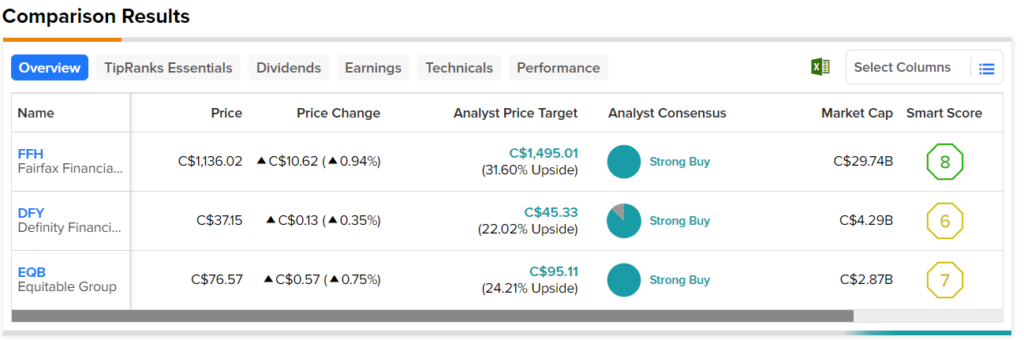

Canadian financial stocks are generally solid investments that perform well over time. Therefore, in this article, we used TipRanks’ stock screener to find three Canadian stocks in the financial sector that sport Strong Buy ratings from analysts and have over 20% upside potential, according to analysts’ 12-month price targets. The three stocks that made it to the list are Fairfax Financial (TSE:FFH), Definity Financial (TSE:DFY), and Equitable Group (TSE:EQB).

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

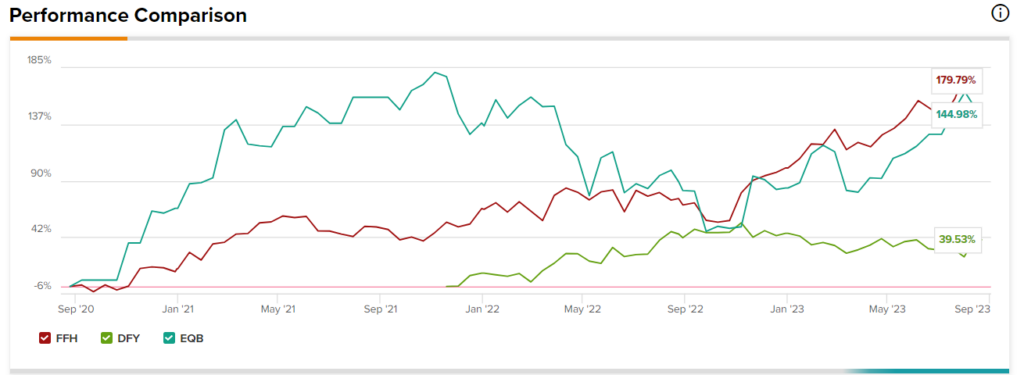

All three stocks have performed well in recent years, as shown in the chart below. However, DFY only went public in 2021, which is why the chart data doesn’t go as far back for the stock.

Fairfax Holdings is a holding company that mainly provides property and casualty insurance as well as reinsurance and investment management. It currently trades at a P/E ratio of 4.9x and a forward P/E ratio of 6x for Fiscal 2023. Analysts collectively expect 31.6% upside potential from the company.

Definity Financial is similar to Fairfax. It’s also a property and casualty insurance company. It offers auto, property, liability, and pet insurance. The stock has an 8.1x P/E ratio but a 16.2x forward P/E. The good news is that it’s a growing company. Its earnings are expected to grow by 11.8% and 12% for 2023 and 2024, respectively. Analysts, on average, forecast DFY stock to rise by 22% in the next 12 months.

Equitable Group operates a digital bank through Equitable Bank (also known as EQ Bank). It offers single-family and commercial mortgages, securitization financing for insured properties, and deposit services, such as investment certificates and high-interest savings accounts. It has an 8.2x P/E ratio and a 7.1x forward P/E. Earnings growth is expected to come in at over 17% for the year, and analysts forecast 24.2% upside potential from the stock.