Do you want to get rich slowly? Are you looking to grow your account with consistent dividends? I invite you to check out Farmers National Banc (NASDAQ:FMNB), which isn’t about farming but could help you plant the seeds of wealth for the long term. I am definitely bullish on FMNB stock and consider it to be a great small-cap pick for conservative investors.

Headquartered in Canfield, Ohio, Farmers National Banc was founded way back in 1887. With $5 billion in banking assets, Farmers National Banc isn’t huge by any stretch of the imagination. Yet, it’s a dependable financial institution, and if you’re a mature investor instead of a thrill seeker, then FMNB stock should be right up your alley.

Farmers National Banc: A Rock-Solid Dividend Payer

Dividends are a nice bonus, but first and foremost, an investable company needs to be rock-solid from a financial standpoint. Farmers National Banc fits this description, not with outlandishly fast growth, but with “steady Eddie” improvement.

For example, Farmers National Banc’s balance sheet improved from $4.08 billion in total assets at December 31, 2022, to $4.97 billion at September 30, 2023, followed by $5.08 billion at December 31, 2023. Also, in the fourth quarter of 2023, Farmers National Banc reported loan growth of $29.6 million, or 3.7%, on an annualized basis.

Again, it’s all about slow but steady growth for Farmers National Banc, not headline-grabbing “moon shots.” Amazingly, Farmers National Banc has delivered 164 consecutive quarters of profitability. Can you say that about your bank? Speaking of profitability, Farmers National Banc posted earnings of $0.39 per share in Q4 of 2023, beating the consensus estimate of $0.35.

Finally, I must mention Farmers National Banc’s history of growing its quarterly dividend payments over time. The company’s most recently declared quarterly cash dividend is $0.17 per share. If we divide that by the current share price of around $14, this comes out to a dividend yield of 1.24% per quarter, or nearly 5% per year — not too shabby, wouldn’t you agree?

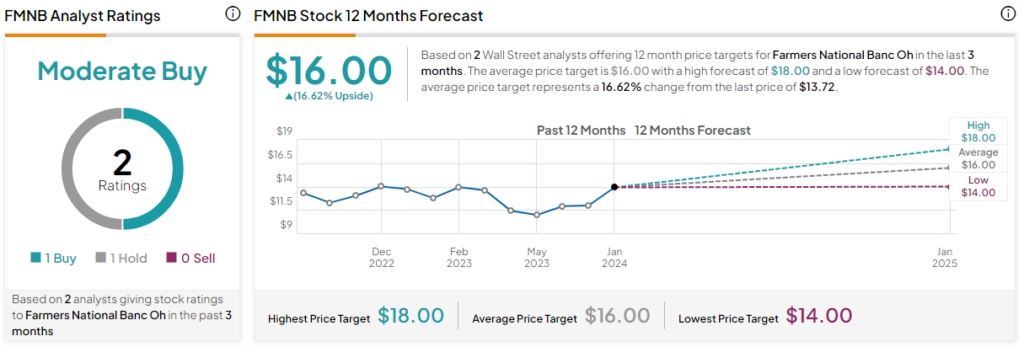

Is FMNB Stock a Buy, According to Analysts?

On TipRanks, FMNB comes in as a Moderate Buy based on one Buy and one Hold rating assigned by analysts in the past three months. The average Farmers National Banc stock price target is $16, implying 16.6% upside potential.

Conclusion: Should You Consider FMNB Stock?

There’s an important lesson here. Farmers National Banc proves that old businesses can offer a lot of value to their shareholders and shouldn’t be ignored. So, if you’re seeking a slow-but-steady opportunity with a financially solid business that respects its shareholders, this is a great time to consider FMNB stock.