The mantra of ‘buy low, sell high’ might sound like an old cliché, but it persists because it’s true. Locking in a discount price on a quality asset has long been used as a sure ticket to generating profits down the road.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The only hard part to it, for stock traders, is recognizing the right stocks to buy at bargain prices. Stock prices can fall for a myriad of reasons, and those reasons don’t always boil down to fundamental soundness – stock prices can fall after a change in management, or a shift in business strategy, as investors wait to see how events shake out.

To spot these bargains, investors can turn to Wall Street’s analysts for help. These professional stock watchers build their reputations on the quality of their calls, sorting through reams of data to find and recommend just the right stocks.

With this in mind, we’ve used the TipRanks database to pinpoint two beaten-down stocks that analysts believe are gearing up for a rebound. In fact, despite having experienced a decline of over 40% over the past year, the two tickers have scored enough praise from the Street to earn a “Strong Buy” consensus rating. Let’s take a closer look.

Ameresco, Inc. (AMRC)

We’ll start in the renewable energy sector, with Ameresco. This company provides clean energy solutions to improve efficiency, distribution, and the supply of cleaner energy, as well as supply management, infrastructure, and alternative energy sources.

Ameresco operates in the US, Canada, and the UK, and boasts more than 1,500 employees across its offices. The company works with partners in a wide range of industries, including healthcare, higher education, housing, industrial and commercial real estate, transport, and related infrastructure, utility companies, and the public sector. Ameresco’s services and solutions help eliminate the financial obstacles that frequently hamper clean and green energy projects.

There are strong social and political pressures supporting a generative economic shift toward cleaner and greener energy, and as of December 31, 2023, the company has raised some $4.5 billion in project financing while delivering over $13 billion in energy solutions.

Some recent examples, from this April, show the type of projects that Ameresco is involved in. At the beginning of the month, Ameresco commenced construction of a biogas cogeneration project in the California capital of Sacramento. The project is designed to make use of the West’s largest inland sewage discharge for the generation of renewable heat and power. In a second announcement, on April 18, the company publicized its contract in Columbia County, Oregon, to modernize a historic building while upgrading energy efficiencies.

On the financial side, Ameresco reported $441.3 million at the top line in 4Q23, a result that was up 33% year-over-year and beat the forecast by $41.3 million. The company’s bottom line figure for the quarter was 69 cents per share by non-GAAP measures, which was 10 cents per share better than had been expected.

Despite Ameresco’s solid business portfolio and its ability to generate sound revenues, the company’s stock has fallen 47% over the past 12 months.

Analyst Kashy Harrison, covering Ameresco for Piper Sandler, notes that the company’s business is strong – but that its execution has shown problems. Yet, despite recent challenges, the company seems to be adopting a more cautious approach, leading the analyst to maintain a bullish stance on its long-term prospects.

“AMRC’s challenge recently has not been demand but successful execution (2023 miss; 2024 EBITDA guidance reduced two quarters in a row). Following missteps, AMRC has taken a more conservative bottom-up approach to guidance (vs. top-down prior), has risked projects timelines with business leaders, and isn’t counting on book/ship business to meet guidance. If AMRC can meet 2024 EBITDA guidance and bring 200 MWs of Energy Assets under development online as scheduled then we believe investors may become more comfortable on valuing the business on FY25,” Harrison opined.

Getting to his own bottom line, Harrison adds, “Sticking with the execution theme, we believe the SCE project saga is inching closer to a conclusion (EIX has removed significant delay risk from SEC filings) and believe the conclusion could be a catalyst for the stock that unlocks some cash from working capital.”

The analyst goes on to give AMRC stock an Overweight (i.e. Buy) rating, with a $30 price target that implies a one-year gain of 38%. (To watch Harrison’s track record, click here)

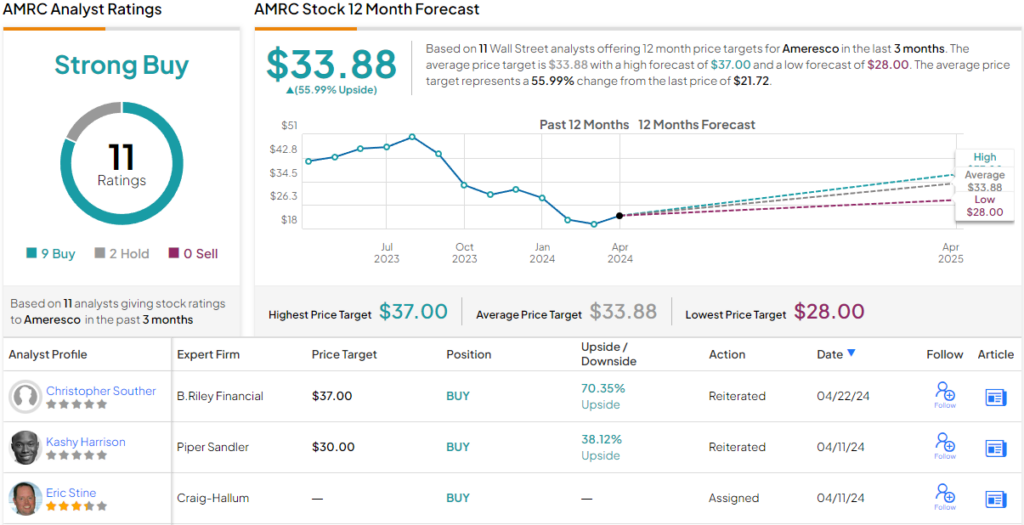

Overall, Ameresco’s Strong Buy consensus rating is based on 11 analyst reviews, with a breakdown of 9 Buys and 2 Holds. The shares are trading for $21.72, and the $33.88 average target price suggests the stock will gain 56% in the coming months. (See AMRC stock forecast)

WNS Limited (WNS)

Next up is WNS Limited, a company based in Mumbai, India, and working in the field of business process management. This is a profitable business niche, providing an essential set of services to enterprise clients. WNS’s location, in India, is an asset for the company in this field; India is a fast-growing economy and the world’s most populous country, with a growing middle class eager to take on white-collar work. In addition, India’s white-collar workforce is well conversant in English, the lingua franca of global business.

This provides a solid foundation for WNS. The company serves a global clientele, providing digital technology and analytics for its client base, some 600 businesses in 13 countries on 4 continents. WNS employs over 60,000 people, and has built up a store of expertise in digital transformations based on deep industry knowledge of its clients. Services include customer experience, finance and accounting, HR, procurement processes, and research and analytics.

WNS recently reported its financial results for fiscal 4Q24. At the top line, the non-GAAP revenue climbed year-over-year by 6.9%, to $336.8 million. The company reported adjusted diluted earnings of $1.12 per share for fiscal Q4, an increase from the $1.18 figure from the prior year quarter.

Management has issued its financial outlook for fiscal 2025, projecting a net revenue range of $1.293 billion to $1.357 billion and an adjusted EPS range of $4.34 to $4.59. At the midpoint of these ranges, the forecast stands at $1.325 billion in net revenue and $4.47 in adjusted EPS for fiscal 2025. These figures fall below consensus forecasts of $1.375 billion in net revenue and $4.57 in adjusted EPS.

Down by 52% over the past year, WNS stock rides the rollercoaster of investor sentiment. But the good news for shareholders is that this sentiment may take a turn for the better.

Barrington’s 5-star analyst, Vincent Colicchio, is advising his clients to buy the stock, and he believes it could hit $60 within a year. For perspective, WNS stock closed at $43.02 today, so this implies upside of ~40%. (To watch Colicchio’s track record, click here)

“We expect the company’s revenue to accelerate in fiscal 2026 and beyond as the business environment improves and it finds new ways to add value to its clients, including the application of generative AI technology. Trading at a 58% discount to the peer group average on PEG multiples, as described above, we believe WNS shares are undervalued,” Colicchio opined.

Overall, the Strong Buy consensus rating on this stock is based on 9 unanimously positive analyst reviews. The $74.56 average target price, somewhat more bullish than the Barrington view, suggests a one-year gain for the stock of 73%. (See WNS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.