Celsius stock (CELH) has faced significant pressure recently, down 62% from its all-time high. This was driven by investor concerns over a potential slowdown in its growth trajectory and mounting competition in the energy drink market. Despite these fears, the company’s Q2 results were robust, demonstrating resilience even after extraordinary growth in previous quarters. Moreover, Celsius continues to expand its margins and capture market share in key regions, with international growth prospects looking particularly promising. Therefore, I maintain a bullish outlook on CELH stock.

Q2 Results: Positive Developments Across the Board

Celsius Holdings showcased positive developments across the board in its second-quarter results despite a challenging environment due to growing competition within the energy drink space. Its top- and bottom-line gains, on top of the outsized growth reported in recent years, are absolutely remarkable and suggest that the recent dip in stock price marks an overreaction. Let’s take a closer look.

Revenue Growth & Market Share Gains

Celsius posted a stellar 23% year-over-year increase in revenues in Q2, bringing in $402 million compared to $326 million in the same period last year. If we zoom out, the first half of 2024 recorded an even more impressive increase, with revenue surging 29% to $757.7 million. This remarkable performance was driven by both domestic and international markets, with North American sales up 23% and International sales up 30%.

At first glance, this quarter’s growth might seem concerning, as it’s the slowest in 19 quarters. That said, it’s essential to consider the context: Celsius is up against exceptionally high comps. The company posted outsized revenue growth rates of 111.6% in Q2 2023, 136.7% in Q2 2022, and 116.6% in Q1 2021. Given these bloated figures, it’s quite impressive that Celsius continues to achieve substantial revenue growth on top of its prior revenue levels. A slight deceleration is to be expected as the company solidifies its position in existing markets before pursuing expansion into new ones.

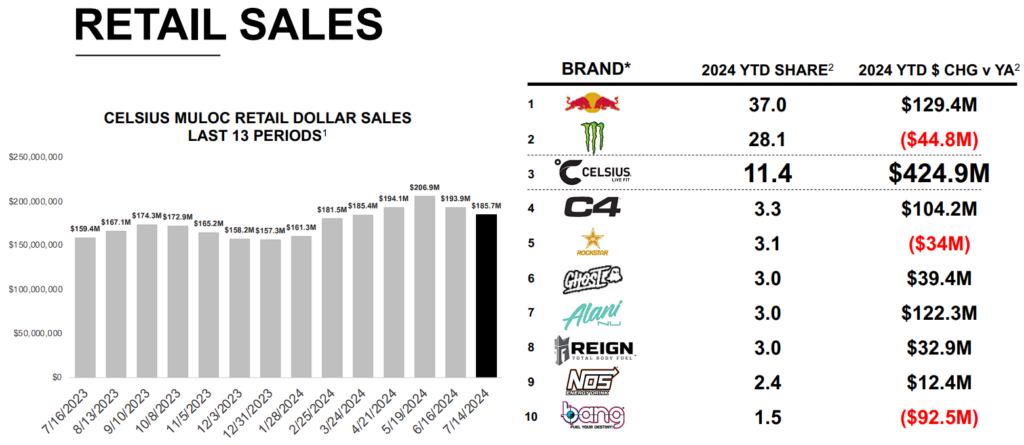

Celsius’ impressive performance was further highlighted by its continued success in expanding its market share despite the recent sluggishness in overall energy drinks sales. Celsius captured 47% of all category growth in Q2 despite facing increased competition and macroeconomic headwinds. This is amazing, as it effectively means that Celsius is driving nearly half of the industry’s growth, capturing a significant share of every dollar added to the market.

These numbers are particularly encouraging, especially when you consider that the company has yet to expand meaningfully internationally. Sales of Celsius in the U.K. and Ireland began during the quarter, while the company plans to launch in Australia, New Zealand, and France later this year. These markets are massive and should continue fueling Celsius’ growth, potentially resulting in a re-acceleration in revenue growth.

Profitability & Valuation

Celsius demonstrated equally impressive progress in improving its profitability during Q2. Its gross profit margins expanded notably, reaching 52%, up from 49% in the prior year period. This margin expansion was driven by a combination of reduced raw material costs and lower freight expenses, which contributed to a 236 basis point reduction in the cost of goods sold and an 81 basis point decrease in freight costs as a percentage of net sales. Accordingly, Celsius reported a 55% year-over-year increase in net income for the quarter, totaling $80 million, outpacing revenue growth by a wide margin.

Further, given Celsius’ recent share price drop and notable improvements in profitability, I believe the stock’s current valuation presents a compelling opportunity. Consensus estimates point toward EPS of $1.04 this year, implying a year-over-year growth of 34.5%. Wall Street also anticipates that EPS will grow by a further 27.9% and 33.3% in FY2025 and FY2026, respectively.

I consider these estimates to be conservative. Even so, with a forward P/E ratio of 38x, Celsius seems attractively priced based on its robust earnings growth and promising international expansion prospects.

Is Celsius Stock a Buy, According to Analysts?

Despite Celsius’ share price plunge, Wall Street analysts remain relatively bullish on the stock. CELH features a Moderate Buy consensus rating based on 10 Buys, three Holds, and one Sell assigned in the past three months. At $62.92, the average Celsius stock price target implies 65.45% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell CELH stock, the most accurate analyst covering the stock (on a one-year timeframe) is Jeff Van Sinderen of B. Riley Financial, with an average return of 172.66% per rating and a 61% success rate. Click on the image below to learn more.

The Takeaway

Despite recent pressures on Celsius stock due to heightened competition and concerns over growth, its solid Q2 performance and continued revenue and market share gains underscore its resilience. In fact, with strong profitability improvements and promising international expansion plans, the recent dip in stock price appears to be an overreaction. For this reason, I believe that CELH stock continues to present an attractive buying opportunity.