The First Trust SkyBridge Crypto Industry and Digital Economy ETF (NYSEARCA:CRPT) has been red hot, riding the crypto bull market to a scorching 196.1% gain over the past year. However, while the ETF deserves credit for this standout performance, I’m bearish on it for now and steering clear because of two red flags that lurk beneath the surface — its extreme exposure to a pair of volatile stocks and its high expense ratio.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What Is the CRPT ETF’s Strategy?

Before taking a look at the concerns, let’s briefly review CRPT’s strategy. According to fund sponsor First Trust, CRPT “is designed to provide exposure to companies that SkyBridge views as firms that are driving cryptocurrency, crypto assets and digital economies related innovation.”

The fund launched in September 2021 and has $51.7 million in assets under management (AUM).

CRPT invests in companies from all facets of the crypto landscape. This includes crypto exchanges like Coinbase (NASDAQ:COIN), Bitcoin (BTC-USD) miners like Marathon Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT), and semiconductor stocks like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) (whose Graphic process unit chips are used by miners to mine Bitcoin).

It even includes the big tech giants like Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOGL), who have various irons in the fire when it comes to crypto, even though it certainly isn’t a major part of their respective businesses.

I’d actually say that CRPT does a pretty good job of covering all bases and casting a wide net when it comes to investing in companies that are involved in crypto. The issue isn’t really what it is investing in, it’s more about how much it is investing in some of its holdings, as we’ll discuss below.

Massive Exposure to Just Two Stocks

CRPT owns 31 stocks, and its top 10 holdings make up an incredibly high 91.5% of assets, so this is an extremely concentrated ETF.

Below, you’ll find an overview of CRPT’s top 10 holdings using TipRanks’ Holdings Tool.

Not only do the fund’s top 10 holdings make up over 90% of its assets, but just the top two holdings, Coinbase and Microstrategy (NASDAQ:MSTR), account for a whopping 44.7% of the fund.

To be fair, Coinbase and Microstrategy have been great stocks over the past year, as rising crypto prices have driven their shares significantly higher. Coinbase is up 205.8% over the past year, and MicroStrategy is up 465.7%.

While they have performed well, investors should note that these are still extremely volatile stocks that typically fall significantly when the price of Bitcoin is down.

TipRanks’ Smart Score System isn’t enthused about either of these stocks, giving Coinbase an Underperform-equivalent Smart Score of 2 and MicroStrategy a Neutral-equivalent Smart Score of 4. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market factors.

We are in the midst of a crypto bull market, so it’s easy to forget it now, but it wasn’t long ago that these stocks performed poorly as crypto prices tanked in 2022, causing CRPT to fall 80.8% that year.

When the crypto market is humming along, CRPT is going to do well, but the next time it slumps, investors may need to run for cover.

Zooming out a bit further, not only is over 44% of the fund in just these top two holdings, but 78.4% is devoted to just its top five holdings, which include volatile Bitcoin mining stocks. There’s simply no way around the fact that this is an extreme amount of concentration in just a few stocks, and volatile ones at that.

A Sky-High Expense Ratio

My other concern about CRPT is that it is an expensive ETF with an expense ratio of 0.85%. This is significantly higher than the average expense ratio for all ETFs, which currently sits at 0.57%. This 0.85% expense ratio means that an investor will pay $85 in fees on a $10,000 investment annually.

These fees can really add up over time. For example, if the fund returns 5% annually going forward and maintains its current expense ratio, an investor putting $10,000 into the fund will pay a whopping $1,049 in fees over 10 years. Paying high fees like this can take a bite out of the principal of one’s portfolio over time, so it’s always important for investors to be mindful of fees.

If the ETF keeps performing well, as it has over the past year, most investors will not mind paying the high fee. But if the ETF performs poorly again, as it did in 2022, these high fees add insult to injury.

Is CRPT Stock a Buy, According to Analysts?

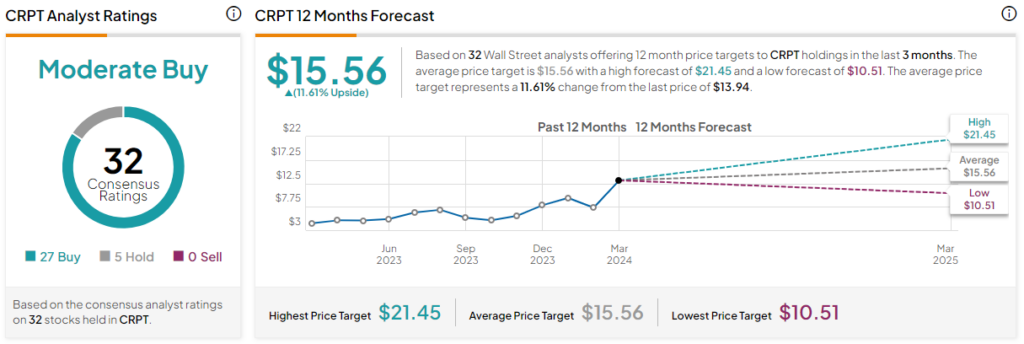

Turning to Wall Street, CRPT earns a Moderate Buy consensus rating based on 27 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average CRPT stock price target of $15.56 implies 11.6% upside potential.

The Takeaway: Caution Is Warranted

CRPT deserves a lot of credit for its strong performance over the past year. While I’m bullish on the crypto market in general (and the ETF could continue to do well for a while if crypto prices keep rising), I’m bearish on CRPT overall, given its massive position in just two volatile stocks with underwhelming Smart Scores: Coinbase and MicroStrategy. This leaves investors with a lot of potential downside exposure.

Furthermore, the fund is very costly, with a well-above-average expense ratio of 0.85%.

The fund has performed well over the past year, but it was also down more than 80% in 2022 when crypto prices were in a prolonged downtrend, so investors should be mindful of this.

Investors have plenty of other options for gaining exposure to the crypto space. They can invest directly in cryptocurrencies like Bitcoin and Ethereum (ETH-USD) or invest in Bitcoin through one of the many new low-cost Bitcoin ETFs like BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) or ARK Invest’s ARK 21Shares Bitcoin ETF (BATS:ARKB), which feature fees that are a fraction of CRPT’s. In fact, many of these ETFs are waiving their fees for the time being as they compete to draw in funds, which behooves investors.

For those who want to specifically invest in the types of crypto-involved stocks that CRPT invests in, there are lower-cost options that offer a bit more diversification and less concentration, such as the Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG). It should be noted that FDIG also features a large Coinbase position, but overall, its top 10 holdings make up a much more manageable 62.9% of assets, and its expense ratio is less than half of CRPT’s.