The world has long been accustomed to grabbing a Coke and a smile. This practice has done wonders for beverage maker Coca-Cola (KO), and its acceptance worldwide hasn’t hurt either.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Coca-Cola recently posted its earnings report and is bringing smiles to investors all over. The company notched up 1% in premarket trading on Monday, and although most of those gains have been given back, the stock is still up 0.25%.

Meanwhile, I’m bullish on Coca-Cola. Though there are some causes for concern ahead, this uniquely American contribution to world culture should be able to move through a possible recession with little trouble.

The last 12 months for Coca-Cola stock have been an excellent example of substantial growth. It took a while to get started, and featured some ups and downs along the way, but now, Coca-Cola is up more than $15 per share in the last year. Given that it started close to $50 this time last year, that’s a solid gain from a company that’s been around for decades.

The latest news, meanwhile, shines a light on why Coca-Cola stock is doing so well. The company posted its earnings report, and it featured beats on all fronts. The company brought in $0.64 per share in earnings against projections calling for $0.58 per share. Meanwhile, revenue was also a beat; Coca-Cola brought in $10.5 billion, which easily outstripped projections calling for $9.83 billion.

Wall Street’s Take

Turning to Wall Street, Coca-Cola has a Moderate Buy consensus rating. That’s based on 10 Buys and four Holds assigned in the past three months. The average Coca-Cola price target of $68.33 implies 4.8% upside potential.

Analyst price targets range from a low of $60 per share to a high of $76 per share.

Support Oddly Lagging for a Market Winner

While things seem to be going swimmingly at Coca-Cola, there is a surprising dearth of support for it among current investors.

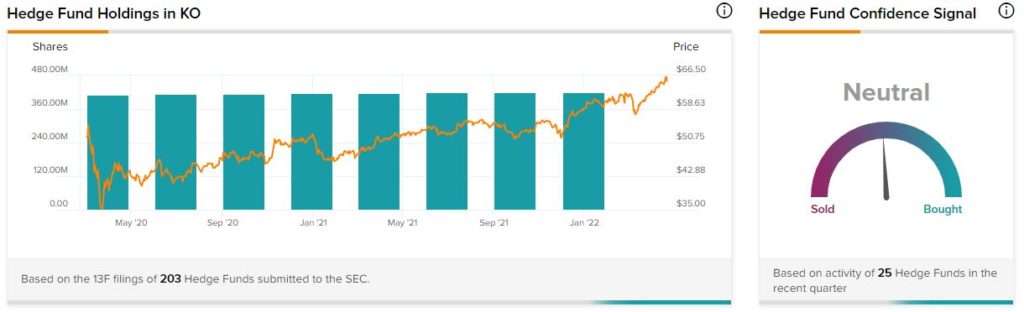

Hedge funds, for example, are paring back their involvement. Based on the TipRanks 13-F Tracker, hedge fund investment declined in the last quarter. It’s worth noting, however, that hedge funds have always had a certain involvement, and it’s been remarkably stable.

For instance, in the latest quarter, hedge funds went from owning 419,655,538 shares to owning just 419,522,832 shares. That’s not exactly a marked decline. The quarter before that, meanwhile, had hedge funds bolstering their involvement from 419,603,147 shares to 419,655,538. Clearly, movement is minimal.

Meanwhile, insider trading at Coca-Cola is clearly weighted to the selling side. In the last three months, insider sellers have outstripped buyers by 31 to 15, nearly a two-to-one difference. Perhaps more telling, January 2022 was the first time in a year there was insider buying at all. April 2021 to December 2021 saw only selling from insiders.

However, retail investors who hold portfolios on TipRanks are unfazed. In the last seven days, TipRanks portfolios holding Coca-Cola stock have increased 0.3%. In the last 30 days, this figure increased 8.1%.

Coca-Cola’s dividend history, meanwhile, bears up well given the market. It’s been paid regularly and increased just as regularly for the past several decades. That includes during the pandemic period, which is a major achievement on its own.

A Cultural Phenomenon You Can Invest In

Coca-Cola is a surprisingly resilient stock. Despite losing the Russian business completely, like so many other companies these days, the company still is holding fast to its earlier projections for organic growth rates.

However, even the company sees some problems coming. Coca-Cola CEO James Quincey noted that customers won’t “swallow inflation endlessly.” This is assuredly true, but Quincey almost overstates the danger here, I feel.

It’s one thing for customers to balk at even a 20% price hike on something like a car or a television. That price jump is much more noticeable and, therefore, more likely to engender a reaction.

However, a 20% price hike on a case of Coca-Cola’s finest is a much smaller move in objective terms. It’s also the kind of thing that customers are likely willing to keep on hand as a smaller indulgence.

Throw in the fact that Coca-Cola is heavily diversified in the drinks market, and its probability of survival only increases. The company has, of course, various sodas. It also has sports drinks like Powerade.

Several water brands are Coca-Cola brands, including Dasani and Aquarius. Coffees like Costa Coffee and teas like Gold Peak and Honest Tea are both in play. If one sector loses, it’s a safe bet that another sector will hold.

Concluding Views

Coca-Cola has been a part of American culture—and even world culture—for decades. The idea that people will suddenly stop drinking Coke due to price hikes for inflation seems an overblown concern. The idea that people might start cutting back is a distinct possibility, though.

Hedge funds reducing involvement is a concern, but a small one due to how shallow the moves are. The insider selling patterns are much more disturbing, however, especially considering how far apart they are. Yet retail investors remain interested, and the dividend is holding nicely.

Few would reasonably consider Coca-Cola a growth stock due to its sheer longevity. It’s made substantial growth over the last year, and it may even be able to continue that growth based on the difference between current prices and the upper price targets. Coca-Cola is much closer to its lowest price targets, after all.

Take these points together and add them up, and it looks like a solid set of reasons to be bullish on Coca-Cola, a heavily-diversified small indulgence that has been part of the world’s cultural landscape for decades.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure