Semiconductor sales could be impacted after the U.S. decided to double down on its anti-China semiconductor policy. Analyst Vivek Arya promptly capitalized on the news and provided coverage on the semiconductor sector. According to Arya, various blue-chip semiconductor companies could lose up to 10% in annual sales, with Intel (NASDAQ:INTC), NVIDIA (NASDAQ:NVDA), and Lam Research (NASDAQ:LRCX) being the most likely losers.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I decided to juxtapose Arya’s argument and place a hold rating on Intel, NVIDIA, and Lam Research, as I believe these enterprises are part of an intra-industry secular growth trajectory that would phase out most systemic headwinds.

Intel

Intel has lost almost half of its market value since the start of the year amid an array of systemic headwinds. However, despite its recent stumbles, Intel’s embedded growth remains promising, and financial market participants could soon change their attitude toward the stock.

Intel’s cash cow is its desktop CPU (central processing units) segment which holds down a market share of 69.5%. Moreover, the company’s exposure to the GPU (graphics processing unit) domain is highly lucrative, considering the GPU domain’s proliferating at a CAGR (compound annual growth rate) of 33.6%.

Furthermore, Intel’s autonomous driving unit (Mobileye) spin-off could be tremendously beneficial as the detachment allows the segment to brand itself more effectively. Intel’s set to retain full ownership of the entity, which could streamline its balance sheet while retaining access to valuable future cash flows.

Lastly, Intel provides lucrative total return prospects as the security is undervalued with a price-to-earnings ratio of 6.5x, along with a compelling dividend yield of 5.63%.

Is INTC a Good Stock to Buy?

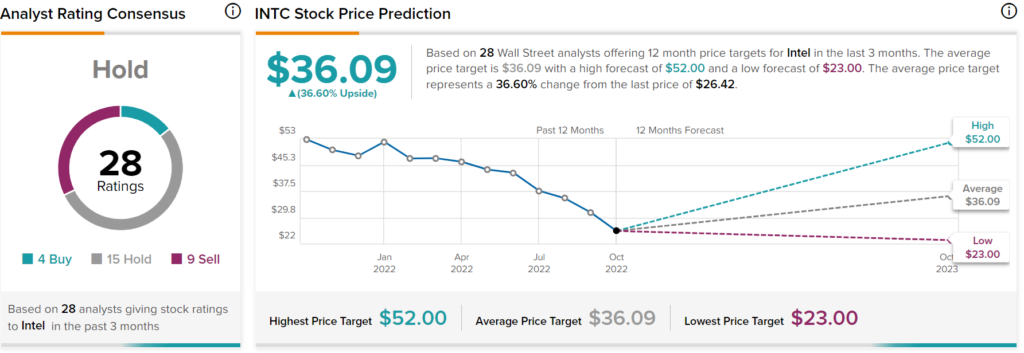

Turning to Wall Street, Intel earns a Hold consensus rating based on four Buys, 15 Holds, and nine Sells assigned in the past three months. The average INTC stock price target of $36.09 implies 36.6% upside potential.

Nvidia

Nvidia’s year-to-date slump is possibly due to two reasons. First is the company’s interlinkage with the crypto-mining space, which has clearly taken a hit in the past few months. Yet, I feel as though the narrative is overblown as Nvidia owns approximately 79% of the fast-growing GPU market, servicing an array of industries, including gaming.

The second reason why Nvidia’s stock has struggled this year is because of its high beta coefficient. A stock’s beta measures its sensitivity to the overall market, and Nvidia was always going to shed weight in 2022’s bear market. However, the worst of the broad-based stock market drawdown is likely past us, and Nvidia’s stock will likely see impressive returns once the market begins to pivot.

Lastly, Nvidia is on a secular trajectory with a 5-year revenue CAGR of 28.94%. The company’s secular trend is a by-product of its product pricing power, communicated by its impressive EBITDA margin of 35.91%.

What is a Good Price for NVDA Stock?

Turning to Wall Street, Nvidia earns a Moderate Buy consensus rating based on 23 Buys and nine Holds assigned in the past three months. The average NVDA stock price target of $200.67 implies 68.8% upside potential.

Lam Research

Lam Research is one of the few semiconductor companies that beat its latest financial quarter’s earnings estimate, with the company’s earnings-per-share beating analysts’ estimates by $1.51. Lam Research runs on attractive profit margins, with its operating income leaning on a 31.5% margin of safety. Therefore, it’s valid to conclude that the company displays a high degree of operating leverage, meaning its bottom-line earnings is recession resilient.

In recent news, Lam’s established a new R&D lab in Bengaluru, India. The workspace is said to be its most advanced scientific facility in the region and is well-placed to leverage the growing intellectual capital pool that India provides.

Furthermore, Lam’s market-based prospects are looking up. Citigroup recently listed Lam Research as a conviction play, citing quality as a factor. To elaborate on the latter, quality refers to companies with robust financial statements and wide market shares, which results in outperformance during late-stage bear markets.

Another appealing feature of Lam Research is that it’s fundamentally undervalued. The stock’s price-to-earnings ratio is at a 37.5% discount to historical averages, meaning that smart-money investors could soon enter the fray.

Is LRCX a Good Stock to Buy?

Turning to Wall Street, Lam Research earns a Moderate Buy consensus rating based on 11 Buys and seven Holds assigned in the past three months. The average LRCX stock price target of $533.06 implies 69% upside potential.

My Concluding Thoughts on INTC, NVDA, and LRCX Stocks

Vivek Arya’s bearish call on semiconductor stocks should be taken with a pinch of salt as the sector is expanding at an exponential rate. Intel, Nvidia, and Lam Research are three “best-in-class” stocks that could experience an upswing sooner rather than later.