Streaming giant Netflix (NASDAQ:NFLX) has pivoted to an advertisement-supported model to bring back the stock’s lost sheen. As per a WSJ report, Netflix expects to have over 40 million unique viewers by late 2023 on the ad-supported tier of its streaming service. This preliminary prediction includes 13.3 million viewers from the United States.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Further, the streaming service provider aims to reach a worldwide unique viewership of at least 4.4 million by the end of 2022. Notably, the company’s preliminary estimates that were presented to potential advertisers covered about a dozen other markets like Brazil, Mexico, Japan, the U.K., France, Germany, Korea, Spain, Italy, Australia, and Canada.

Given the flexibility of sharing the subscription, the unique viewership is likely to outpace the subscribers for the ad-supported tier.

How’s Netflix’s Ad Strategy Coming Along So Far?

Netflix is charging a premium for the advertisements as it bags a subscriber base of 220 million. According to The Wall Street Journal, the company has proposed charging about $65 for every 1,000 viewers. The streaming platform is asking for a year-long upfront commitment from ad buyers. Netflix is also aiming to keep a higher limit of $20 million on the annual ad spending on its streaming platform.

Notably, it is being speculated that Netflix is planning to launch the ad-supported plan by late this year.

Another report by Variety claims that Netflix is expected to charge somewhere between $7 and $9 per month for the ad-supported tier.

Is Netflix Good to Invest in?

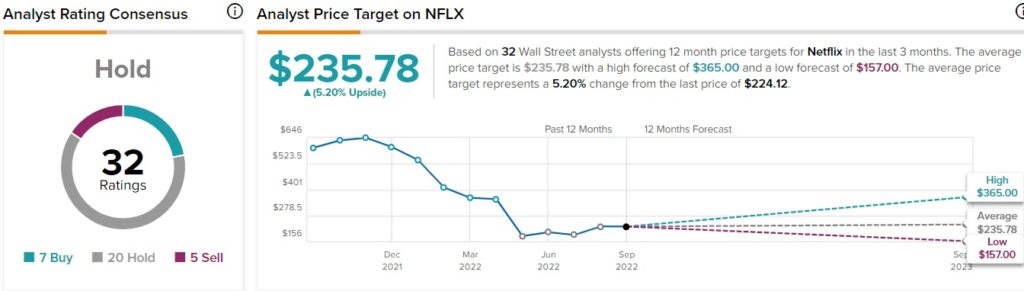

Although the streaming pioneer’s ad strategy holds potential, investors can still wait on the sidelines before parking money in Netflix stock. According to TipRanks, the Street is neutral about NFLX stock, which carries a Hold consensus rating based on seven Buys, 20 Holds, and five Sells.

Further, hedge funds and retail investors seem apprehensive about NFLX stock. Hedge funds have sold 57,500 shares of NFLX stock in the last quarter. Retail investors have also decreased their portfolio holdings in Netflix stock by 1.6% in the past 30 days.

Meanwhile, financial bloggers seem bullish about NFLX stock. Financial bloggers’ opinions are 75% Bullish on NFLX stock, above the sector average of 65%.

Finally, NFLX stock’s average price target of $235.78, signals a 5.2% upside potential from its current level.

Conclusion: Netflix’s Ad Strategy Appears Strong, Results Blurry

Netflix’s latest projections on its material for ad buyers come as a breather after the company lost subscribers for two straight quarters. Shares of NFLX stock jumped 2.8% on September 14 following WSJ’s report. However, it is unclear whether Netflix will be able to make a successful landing with the ad-based plan offering.

Netflix is charging advertisers high premiums in the face of intensifying competition in the streaming market, which might adversely hurt the strategy’s positive output. Meanwhile, recent recruits in the top positions and encouraging details about the ad features are slowly building optimism among investors about the company’s efforts to rewrite its success story.

Read full Disclosure