Intel Corporation (NASDAQ:INTC) has been having a rough patch. This major semiconductor player’s performance has been weighed down by the challenges of higher costs, supply-chain disturbances, and cut-throat rivalry in the semiconductor industry. The lackluster prospects of the PC and tablet markets are largely weighing on the stock’s capability to rebound.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to TipRanks data, analysts and hedge fund investors are taking an apprehensive tone toward the stock. However, financial bloggers and retail investors are remaining upbeat about INTC stock’s upside potential.

INTC stock has lost 43.2% so far in 2022. Further, the macroeconomic hurdles ahead do not point to a quick recovery in the cards.

Intel Is Sailing in Troubled Waters

Intel posted disappointing earnings results for the second quarter of 2022, with both revenue and earnings declining from the year-ago period. The company’s Client Computing and Datacenter and AI Groups businesses have been adversely impacted by sustained adverse market conditions. Citing the sluggish PC market as a concern, Intel also slashed its full-year guidance.

The semiconductor giant has also scaled back the valuation of its self-driving unit Mobileye to $30 billion from an initial valuation of $50 billion.

Furthermore, high inflation levels, weak global economic conditions, and pandemic-led purchases are expected to weigh on global shipment levels of traditional PCs and tablets.

The dynamics of the semiconductor industry have changed significantly following the pandemic-led boom. Despite growing digitization trends, sluggish consumer spending on PCs, laptops, and smartphones, along with supply-chain disturbances and chip shortages, has kept the space clobbered.

Meanwhile, this U.S. chipmaker is expected to enjoy additional benefits than some of its rivals, from the recently passed Chips and Science Act. Also, Intel has managed to deliver an earnings beat in almost all the quarters in the last couple of years, except one. If the trend remains in the coming period, INTC stock should get some support.

Is Intel Buy Sell or Hold?

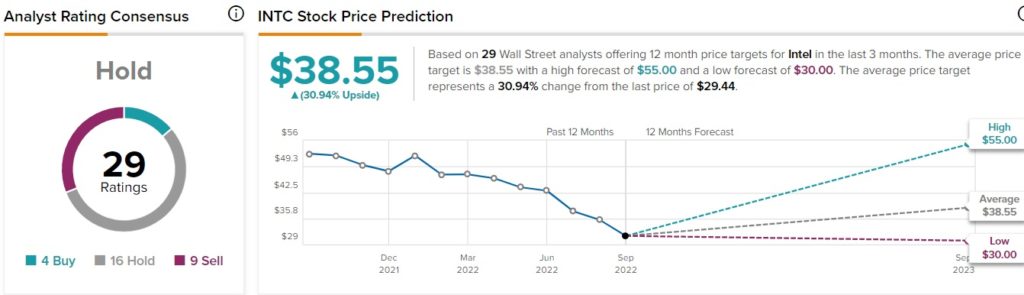

Analysts have mixed feelings about Intel stock. According to TipRanks, Street is neutral about INTC’s stock, which carries a Hold consensus rating based on four Buys, 16 Holds, and nine Sells. Further, hedge funds look apprehensive about INTC stock, as they have sold 1.3 million shares of INTC stock in the last quarter.

Meanwhile, financial bloggers and retail investors look bullish about INTC stock. Financial bloggers‘ opinions are 76% Bullish on INTC stock, above the sector average of 64%. Moreover, retail investors have increased their holdings in the INTC stock by 1.2% in the last 30 days.

Finally, Intel stock’s average price target of $38.55, signals a 30.9% upside potential from current levels.

Conclusion: Tough Times Ahead for Intel

Intel is firing on all cylinders to restore its lost sheen. Notably, the semiconductor giant has an impressive dividend yield of 4.93%, much higher than the sector average of 0.94%. However, the outlook for the chip industry remains cloudy as long as the macroeconomic challenges remain. Therefore, investors willing to hold a position in the stock can wait on the sidelines to get some more visibility about the semiconductor industry’s prospects.

Read full Disclosure