Who doesn’t like a bargain? In these days, with price inflation hitting hard, we all want to find the best price on every purchase – and that includes our stock purchases. Bargain-conscious investors can still find those fundamentally solid stocks that are trading low; this is the essence of successful stock investing.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

To make it easy, we’ve done some of the background research. We’ve located three stocks that are down 50% or more, and confirmed that these are Strong Buy stocks, that have gotten plenty of recent approval from the Street’s stock pros. And we’ve also dipped into the latest market data, from the TipRanks database, to add some context and color. The result is three stock picks that you should read up on.

Cyteir Therapeutics (CYT)

We will start with an interesting healthcare stock. Cyteir is developing targeted approaches that exploit weaknesses in cancer cells’ DNA, in induce a ‘synthetic lethality’ in tumor cells while leaving healthy tissues unharmed. The company has four drug candidates in its development pipeline, including 3 in preclinical stages. The fourth product, CYT-0851, has recently made the jump into clinical trials as a treatment for solid tumors and hematologic malignancies, both as a monotherapy and in combination with other drugs.

In January of this year, CYT-0851 began a Phase 1 clinical trial as a combo therapy with three ‘standard-of-care’ chemotherapy drugs, rituximab plus bendamustine, gemcitabine, and capecitabine. The company announced dosing of the first patient on January 12, and the trial will test the combo therapies against both solid and hematologic tumors. Cyteir plans to have initial safety data available by the end of this year.

As a monotherapy, CYT-0851 is shifting from the Phase 1 to the Phase 2 segment of its trial study. The announcement came on February 8, and marks the beginning of Phase 2 testing with an expansion cohort and drug dosing based on the recommended dose determined in the earlier Phase 1 study. The company plans to enroll six disease-specific cohorts in this study.

Despite the positive progress on the pipeline, CYT shares are down by 61% over the past 12 months. CYT share value has been negatively impacted by overall market conditions, and Northland analyst Tim Chiang sees the recent underperformance as a buying opportunity.

“We believe the recent correction in biotech creates a compelling buying opportunity in CYT,” Chiang opined. On the company’s approach, he is upbeat, saying, “Synthetic lethality represents a clinically validated approach to drug development and arises when there is a deficiency in either of two conditions that are tolerable alone in cells but lethal together.”

Everything that CYT has going for it prompted Chiang to rate the stock an Outperform (i.e. Buy). The cherry on top? His $16 price target implies ~133% upside from current levels. (To watch Chiang’s track record, click here)

Overall, CYT has received 3 analyst reviews, and they all agree that this one is a Buy proposition – giving the shares their Strong Buy consensus rating. CYT is selling for $6.84 and the $28.67 average target is even more bullish that Chiang’s above, and indicates room for an impressive share appreciation of ~318% this year. (See CYT stock forecast on TipRanks)

Inozyme Pharma (INZY)

Next up, Inozyme Pharma, works on the treatment of rare diseases of vascular, skeletal, and soft tissues. The company focuses on abnormal mineralization disorders, a class of dangerous conditions that lead to permanent crippling illness – and that do not currently have effective treatments on the market. Inozyme’s research program is based on treatment for two genetic deficiencies, in the ENPP1 and ABCC6 genes.

The development pipeline features INZ701, which is in early clinical trials. The drug candidate is being tested against both gene deficiencies. INZ701 is a soluble protein that can circulate around the body freely.

This past November, Inozyme announced dosing of the first patients in the first-in-human clinical trial of INZ701, a Phase 1/2 trial of adult patients with ENPP1 deficiency. The drug is being evaluated as an enzyme replacement therapy of the underlying genetic disorder. Preliminary data from this trial is expected during this 1H22.

Also underway is a Phase 1/2 trial of INZ701 in the treatment of ABCC6 deficiency. Patients have not yet been dosed, but the enrollment phase of this clinical trial has begun. The company expects to commence dosing soon, and to have initial safety data available by the end of 2Q22.

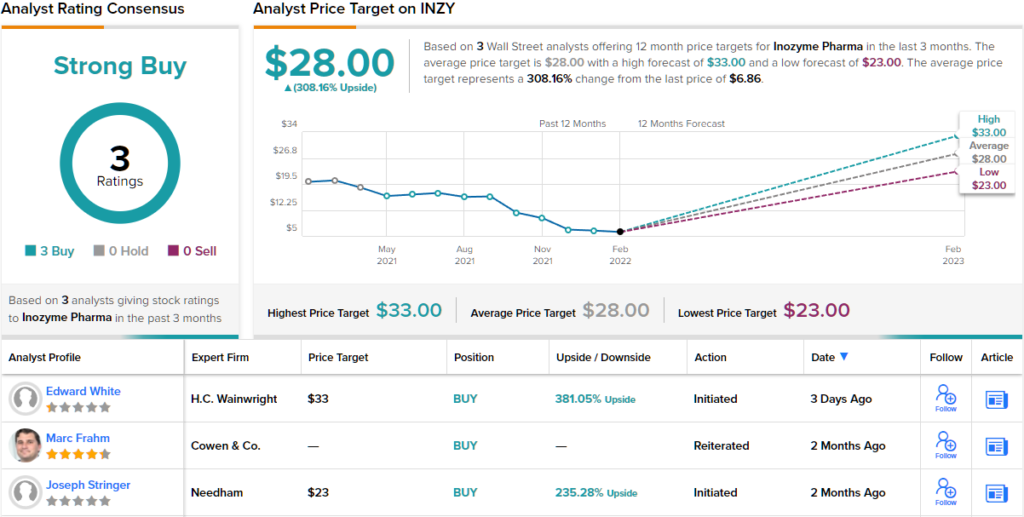

While Inozyme has gotten its clinical trials underway, the stock has declined 67% since this time last year. According to H.C. Wainwright analyst Edward White, however, investors can use this as an opportunity.

“We are Bullish on Inozyme for the following two reasons: (1) INZ-701 could be a potential treatment for the debilitating ENPP1 Deficiency. (2) ABCC6 Deficiency is a promising and larger second potential indication for INZ-701,” White noted.

“We project revenues of $615M for INZ-701 in ENPP1 Deficiency and $875M for INZ-701 in ABCC6 Deficiency in 2030. We note that there is a potential for a priority review voucher (PRV). We believe a PRV could be worth $100 million but do not include the PRV in our valuation at this time. We note that a recent PRV was sold by Albireo Pharma for $105M,” the analyst added.

In line with this upbeat view of the company’s chief product, White rates INZY shares a Buy. He gives the stock a $33 price target, showing his optimism in a robust 388% upside potential. (To watch White’s track record, click here)

Inozyme’s shares may be down, but the analysts like the stock – it has 3 positive reviews for a unanimous Strong Buy consensus rating. The stock is selling for $6.86 and its $28 average target suggests a one-year upside of 308%. (See INZY stock forecast on TipRanks)

Relay Therapeutics (RLAY)

We’ll wrap this list with Relay Therapeutics, a precision medicines company in the clinical stages of research. Relay has a proprietary platform, Dynamo, that uses experimental and computational approaches to create effect drugs to target conditions that have proven either intractable to resistant to past treatments. Relay’s program focuses on cancer treatment. The leading drug candidates, RLY-2608 and RLY-4008, are designed to treat PIK3CA mutant breast cancer and FGFR-2 altered cholangiocarcinoma respectively.

In December, Relay announced that preclinical data in its study of RLY-2608 had demonstrated effectiveness as both an independent agent and as a combination therapy. The data support the initiation of clinical trials of this drug candidate, and a first-in-human study dosed its first patient in January.

The other major drug candidate, RLY-4008, is somewhat further along the development path. RLY-4008 is also in a first-in-human trial, and the company announced last month that initial dosing and safety data supported initiation of an expansion cohort at a dose of 70 mg once daily. The drug candidate is being tested against FGFR-2-altered solid tumors, such as breast cancer and cholangiocarcinoma.

As the company gets started with the expansion of its clinical trial program, investors are wary, and the stock is down 54% over the past year.

However, Relay has been attracting positive attention from Wall Street analysts, who see the low price as an attractive entry point.

Among the bulls is Berenberg analyst Gaurav Goparaju, who likes the company’s research program, and writes: “RLAY manages oncology and genetic disease-focused internal and partnered pipelines with attractive lead candidates as well, of which three are in the clinic. On average, RLAY is capable of identifying a developmental candidate from the hit-finding stage in just 1.5-2 years, while conventional methods take ~3-5 years. We believe RLAY’s disease-agnostic discovery platform enables more efficient and effective discovery of highly selective and novel small molecule drugs against difficult and disease-associated protein targets.”

In his view, Goparaju sees this supporting a Buy rating on the stock, along with a $45 price target to indicate potential for ~105% upside. (To watch Goparaju’s track record, click here)

Overall, all four of the recent analyst reviews here are positive, giving Relay its Strong Buy consensus view. Shares are currently trading for $21.91, and their $46.75 average target suggests an upside of ~113% for the next 12 months. (See RLAY stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.