President John Kennedy famously said that a rising tide lifts all boats, and that is looking to be the case in today’s bullish stock market environment. The big question for investors now is, where to buy in, to ride that rising tide?

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The stock analysts at Bank of America may have some suggestions. They’ve been scouring the market – looking for lesser-known names that offer solid potential for gains.

On two of these stocks, the analysts have upgraded their stance – a clear sign for investors that these shares deserve a closer look. The Bank of America choices come from widely different areas of the stock market, making them a clear example for investors that the current bullish turn is broad-based.

Using the TipRanks database, we’ve delved into what makes these stocks stand out. Here’s a closer look at the details.

KE Holdings (BEKE)

We’ll start in China, with KE Holdings. This company, as its name states, is a holding company; it works in China’s real estate sector, in which it is the largest online real estate transaction platform. The company facilitates both online and offline transactions and services in the Chinese real estate sector. Even with the recent headwinds it has been facing (a slowing economy, developer bankruptcies, accusations of shoddy construction), Chinese real estate remains a huge market. KE Holdings has leveraged that into a big business, generating some US$11 billion in revenues in 2023 and building up a market cap of more than $27 billion.

Starting in mid-September, KE Holdings has seen its stock price climb – at the same time that the Chinese government has started pushing a set of stimulative policies. The government has lowered the reserve requirement ratio that the banks must meet, as well as loosening purchase restrictions in the real estate sector. The immediate result was to make it easier for buyers to access capital, which has stimulated purchasing activity in the real estate markets.

For KE, the result has been clear. The stock hit a recent bottom in mid-September, and although share performance in October has seen both ups and downs it remains elevated from its recent low – with a net gain of more than 65%.

We’ll soon find out how KE Holdings performed during the third quarter of this year, but we can look back at the 2Q24 numbers for an idea of where the company is headed. Revenues in Q2 came to US$3.2 billion, up almost 20% year-over-year and $120 million over the estimates, while the bottom-line figure, of 31 cents EPADS by non-GAAP measures, was 10 cents per share better than had been forecast. The company registered a gross transaction value during the quarter of US$115.5 billion, an increase of 7.5% from the prior-year period.

This all gives KE Holdings a solid foundation to work from, and that is an advantage that has caught the attention of Bank of America analyst Miranda Zhuang. The China real estate expert writes, “We upgrade KE Holdings to Buy from Neutral, because: 1) as the clear market leader in property brokerage in China, it is a key beneficiary of the recent China policy pivot and potential cyclical recovery; 2) we expect it to outgrow the housing market during this recovery and also in the long term, given a) it has high exposure to the better segment within the housing market – existing-homes (>60% GTV mix), tier-1 cities (c.40% revenue mix); b) it is gaining share in the existing + new home sales market, from 18% in 2023 to 22%+ in 2025E (BofAe); and c) its new growth engine – home renovation and rental services – is growing fast to address another multi-trillion (RMB) market.”

Looking ahead, Zhuang adds, “Though housing market uncertainties remain and BofA has not raised property market estimates, we believe the risk-reward for KE Holdings has become more attractive.”

The upgrade to Buy comes along with a $28 price objective, implying a one-year upside potential of 26%. (To watch Zhuang’s track record, click here)

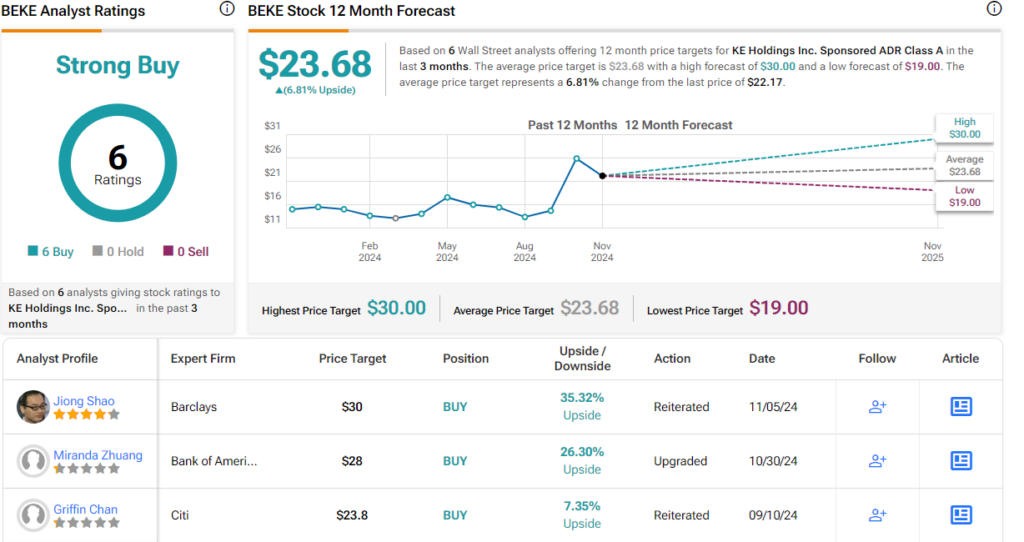

This stock, which offers investors a way to tap into China’s real estate market, boasts a unanimously positive Strong Buy consensus rating from Wall Street, based on 6 recent upbeat share reviews. The stock is trading for $22.17, and its $23.68 average target price suggests that it has a gain of 7% in store for the year ahead. (See BEKE stock forecast)

Incyte Corporation (INCY)

The next stock on our list is Incyte, a multinational biopharmaceutical firm with joint headquarters in the US and Switzerland. The company operates at both the clinical and commercial stages, with drug candidates in the clinical trial pipeline and approved products on the market for use by prescription.

The company’s leading product is its approved drug ruxolitinib, which is on the market in two formulations under the brand names Jakafi and Opzelura. As Jakafi, the drug is used in the treatment of myelofibrosis, a rare and dangerous blood cancer that affects the bone marrow. As Jakafi, ruxolitinib was approved for use in 2011, and since then has become Incyte’s major revenue driver, generating 65% of the company’s top line.

The Opzelura formulation of the drug is in the form of a dermatologic cream, and is approved in the US for the treatment of both atopic dermatitis and vitiligo. The drug, which is a Janus kinase inhibitor, was the first of its class approved for topical use in the US. Opzelura has also been approved in Europe as a vitiligo treatment, and is advancing in the Canadian regulatory process as well. As Opzelura, ruxolitinib accounts for another 12% of Incyte’s total revenue stream.

On the clinical trial side, Incyte has multiple programs ongoing – and expects to have several updates in the near-term. During the first half of 2025, the company will release data on a bioequivalence study of ruxolitinib in an extended release, or XR, formulation. Also next year, Incyte expects to have data available for release from Phase 1 studies of new drug candidates, mCALR and JAK2V617Fi. These studies are currently enrolling patients. And finally, later this year, Incyte plans to release additional data on the use of ruxolitinib as a twice-daily combination treatment with zilurgisertib and BETi.

This is only a sample of Incyte’s active development pipeline and upcoming catalysts; the company has multiple tracks in the research clinic, featuring 20 different compounds that have 17 different molecular targets.

On the financial side, Incyte generates impressive revenues. The company’s 3Q24 top line came to $1.138 billion, up 24% year-over-year and beating the forecast by $60 million. At the bottom line, the company runs a net loss, as is not uncommon in the biopharma industry. Incyte’s Q3 loss, of $1.07 per share by non-GAAP measures, was 3 cents deeper than had been anticipated.

Of note to investors, Incyte updated its 2024 revenue expectation for Jakafi, setting the guidance in the range of $2.74 billion to $2.77 billion. This is higher than the previous guidance, which had a top end of $2.75 billion.

For BofA analyst Tazeen Ahmad, the key point here is Incyte’s combination of a known revenue generator with plenty of upcoming catalysts. She writes, “Following another strong quarter, we are upgrading INCY to Buy from Neutral… We were cautious on competitive pressure to Jakafi in MF but think the strong continued demand indicates less risk at this point. We are also encouraged by continued growth for Opzelura with potential to expand into pediatric AD (approval expected in 2H25). We note 2025 will be a catalyst-rich year with several pivotal readouts and see multiple shots on goal given the breadth of the pipeline. While we think clinical validation is still needed, we expect some of these programs could address the upcoming Jakafi LOE in 2028.”

Ahmad’s upgraded Buy rating is paired with a $90 price objective that suggests a 19% upside for the stock in the next 12 months. (To watch Ahmad’s track record, click here)

Overall, Incyte’s stock gets a Moderate Buy consensus rating from the Street, based on 20 reviews with a breakdown of 8 to Buy, 11 to Hold, and 1 to Sell. The shares have a current trading price of $75.75, and their $76.65 average target price implies the stock will remain rangebound for the time being. (See INCY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.