With artificial intelligence (AI) technology making waves, many investors are keenly following new developments in this space to identify lucrative investment opportunities. Baidu (NASDAQ:BIDU), the Chinese Internet giant, remains a hidden AI giant in plain sight, with many investors overlooking the appeal of the company as a true leader in the AI space. Amid aggressive investments in AI, Baidu remains attractively valued because of a notable deterioration in investor sentiment toward Chinese companies.

Thus, I am bullish on Baidu, as I believe the company is significantly undervalued.

Baidu’s AI Progress Deserves Recognition

On a global scale, Baidu was one of the very first companies to focus on AI technology. According to data compiled by CB Insights, Baidu first discussed AI technology in 2010, five years before Alphabet Inc. (NASDAQ:GOOGL) first discussed the technology during an earnings call in 2015. In China, Baidu was by far the first company to focus on AI technology, with Alibaba Group Holding Limited (NYSE:BABA) and Tencent Holdings Limited (OTC:TCEHY) first discussing AI in 2017 and 2016, respectively.

Since 2010, Baidu has aggressively invested in developing Baidu Brain, the core AI technology the company is currently using to power many of its innovative products, such as autonomous driving and Ernie, the company’s generative AI chatbot that competes with OpenAI’s ChatGPT. Today, in China, Baidu is benefiting from first-mover advantages in the AI sector, which is evident from Ernie chatbot’s rise to the top of the generative AI ladder.

Earlier this week, Baidu launched Ernie 4.0, its latest generative AI model that is expected to directly compete with OpenAI’s GPT-4, according to company CEO Robin Li. The new AI model is packed with new features and capabilities, such as the ability to answer disorganized questions, create videos based on minimal prompts, and solve complex geometry problems. Based on these new capabilities, it seems reasonable to conclude that Ernie 4.0 is on par with GPT-4 from many different aspects.

Based on the successful launch of Ernie 4.0, the company is now planning to upgrade all of its core products, including Baidu Search, Baidu Maps, and Baidu GBI, in an AI-native approach. This should help the company establish itself as the dominant player in the generative AI sector in China, which is home to the world’s largest online population — more than a billion active Internet users.

So far, the market has failed to recognize Baidu as an AI leader. The most likely reason behind this lack of recognition is the negative investor sentiment toward Chinese companies at a time when tensions between the U.S. and China are rising.

Baidu’s Diversification Efforts are Commendable

Baidu generates the bulk of its revenue from advertising. In 2022, Online Advertising accounted for more than 70% of total revenue. To maintain the growth momentum in its core Advertising business, Baidu is focused on providing a premium search experience to its users, enabled by AI technology. As revealed in the second-quarter earnings call, Baidu is keeping its eyes open for an opening to charge a subscription fee from users in exchange for providing them with AI-enabled search functions in the future.

The Advertising business segment, however, has come under pressure in recent times with the rise of new-age social media platforms such as TikTok, owned by ByteDance. The company is commendably shifting its focus to the cloud business and AI technology, and these diversification efforts are likely to be rewarded handsomely in the long term.

Baidu’s AI Cloud business, which accounts for around 20% of core revenue, has gained momentum in recent quarters, with the company empowering cloud customers to build their high-tech products using the Ernie bot. This has resulted in an increasing number of cloud customers connecting to Ernie, which is a big win for the company. In the second quarter, AI Cloud revenue increased by 5% to RMB 4.5 billion, and even more importantly, the company reported positive operating profits from this segment.

Baidu’s intelligent driving platform, Apollo, continues to gain traction as well, with the rights provided by Apollo Goal increasing 150% year-over-year to 714,000 in the second quarter. The accumulated total rights now sit at RMB 3.3 billion, which makes Baidu the leading autonomous driving technology developer in China.

BIDU’s Valuation is Attractive, but There are Risks

Baidu is currently valued at a forward price-to-earnings ratio of 11.4, which makes the company very attractive compared to many of its American big tech counterparts. For instance, Microsoft (NASDAQ:MSFT), which is the frontrunner in generative AI technology in the Western world, is valued at a forward P/E of 30 today. Baidu is currently valued in line with its Chinese peers, such as Alibaba and Tencent, but I believe the company’s AI advantages deserve a premium in the market.

Still, although Baidu is attractively priced, investors will have to keep a close eye on several risks.

First, tensions between the U.S. and China might impact Baidu’s ability to source key semiconductor components that are required to power AI-enabled products. The U.S. government recently unveiled new restrictions on exports, and these tensions need to be monitored closely.

Second, the policy environment for AI technology is uncertain in China, and the government may end up enacting new policies that harm the continued growth of this sector.

Third, Baidu faces a challenge in its Cloud, AI, and Autonomous Driving segments. That’s because if they don’t generate sufficient revenue to offset the anticipated decline in Advertising revenue from competitive pressures, the company’s profitability could be at risk.

Is Baidu Stock a Buy, According to Analysts?

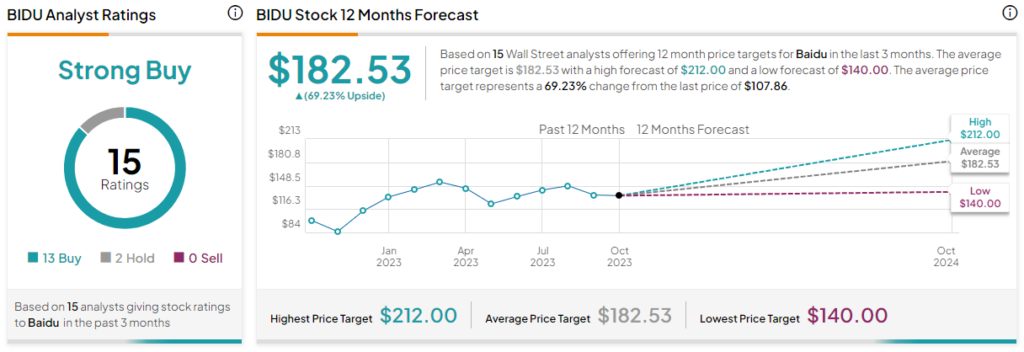

Based on the ratings of 15 Wall Street analysts, BIDU earns a Strong Buy rating, and the average Baidu stock price target of $182.53 implies upside potential of 69.2%.

The Takeaway: Baidu is Attractive amid the Growing Prevalence of AI

Baidu is the generative AI leader in China. The company is transforming many of its key products with the use of AI and is well-positioned to benefit from the integration of AI into cloud computing. Baidu is also cheaply valued compared to its American counterparts, but this valuation mismatch may not last long once geopolitical tensions subside.