In this piece, I evaluated two aerospace stocks, Boeing (BA) and Lockheed Martin (LMT), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a bearish view of Boeing and a neutral view of Lockheed Martin.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Boeing is the largest aerospace company in the world, and it sells airplanes, rockets and missile systems, satellites, and more. Lockheed Martin designs, develops, and manufactures jets, missiles, space systems, and more, mostly for the U.S. Department of Defense and other federal agencies.

Shares of Boeing have plunged 37% year-to-date and are down 31% over the last year. On the other hand, Lockheed Martin stock has surged 23% year-to-date, accounting for almost all of its one-year gain of 25%.

Despite such a dramatic difference in their share-price performances, the two companies’ valuations (on a sales basis) are not that far off.

Since Boeing is not profitable, we’ll compare the companies’ price-to-sales (P/S) ratios to gauge their valuations against each other and that of their industry. We’ll also consider Lockheed Martin’s price-to-earnings (P/E) ratio for additional information.

For comparison, the aerospace and defense industry is trading at a P/S of 2.2x versus its three-year average of 1.9x. It’s also trading at a price-to-earnings (P/E) ratio of 36.6x, higher than its three-year average of 27.1x.

Boeing (NYSE:BA)

At a P/S of 1.4x, Boeing is trading at a discount to its industry and to Lockheed Martin. However, that discount is absolutely warranted due to the many problems the company faces, so a bearish view seems appropriate.

For one thing, Boeing faces increased scrutiny as the National Transportation Safety Board (NTSB) holds two days of hearings on a mid-air emergency involving the company’s 737-9 MAX plane. In the January incident, a door plug blew out. The NTSB rebuked Boeing earlier this summer for overstepping in sharing details about the agency’s investigation during a media briefing.

Aside from the problems with the Boeing MAX aircraft, the company also faces problems with the astronaut crew it sent up on its Starliner spacecraft. They were supposed to be home on June 14, but issues with the Starliner have kept them stranded on the International Space Station (ISS).

The issues lie with the thrusters, which experienced significant strain during the ascent. Some of those thrusters even failed, and there was an issue with a helium leak. NASA is now considering “all options” to get that crew home, and reports now suggest a greater than 50/50 chance that the Starliner crew won’t be going home on Boeing’s spacecraft.

Boeing is also running out of time to move the Starliner from the dock at the International Space Station. The ISS needs that dock for another upcoming mission.

Additionally, Boeing faces problems with its aerial refueling and transport aircraft, the KC-46. Additionally, the Federal Aviation Administration is investigating a new directive around Boeing’s 787 Dreamliner, which would require record maintenance checks on the aircraft due to a missed test for a landing gear.

Due to all these issues, it just seems like a good idea to avoid Boeing stock at this point.

What Is the Price Target for BA Stock?

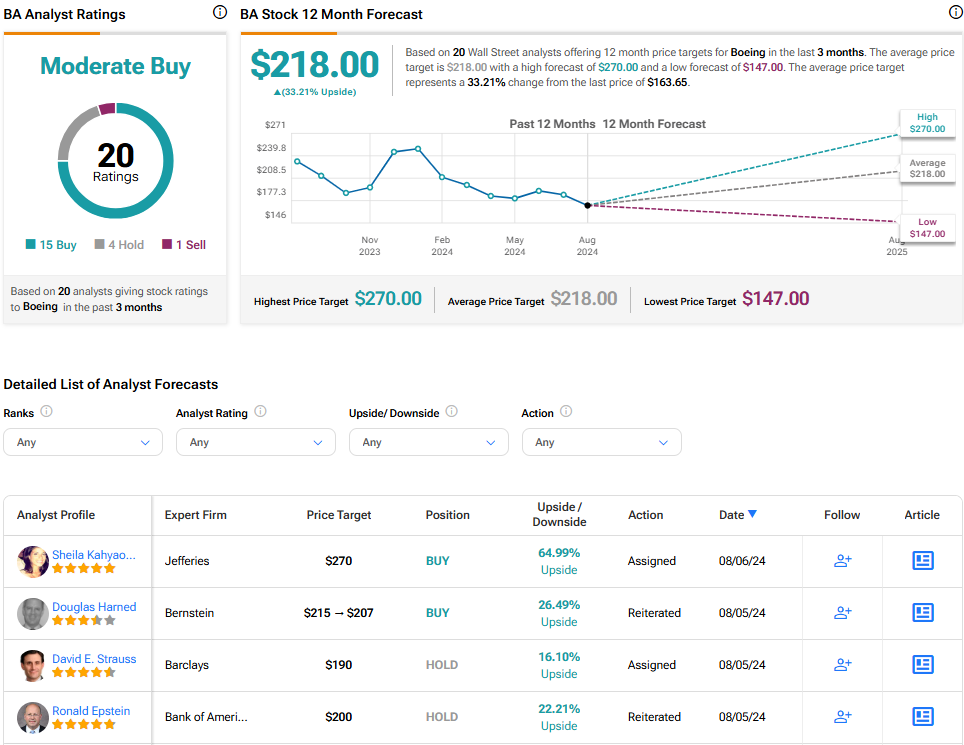

Boeing has a Moderate buy consensus rating based on 15 Buys, four Holds, and one Sell rating assigned over the last three months. At $218.00, the average Boeing stock price target implies upside potential of 33.2%.

Lockheed Martin (NYSE:LMT)

At a P/S of 1.8x, Lockheed Martin is trading roughly in line with the industry’s three-year average, but on a P/E basis, it’s trading at a significant discount at 19.8x. However, its Relative Strength Index (RSI) of 83.8 suggests the stock could be overdue for a correction, calling for a neutral rating until that comes back down.

I’d really like to assign a bullish view to Lockheed Martin, but that extremely high RSI gives me pause. An RSI over 70 suggests that a stock is in overbought territory and signals a possible correction around the corner — despite the discounted valuation.

Tensions in the Middle East are ratcheting up, which is one reason for the latest rise in the shares. As such, Lockheed Martin’s greater focus on defense over commercial aircraft is another reason to prefer its stock over Boeing’s.

Thus, I would monitor Lockheed Martin stock for the correction that appears to be coming and buy on any dip that occurs.

What Is the Price Target for LMT Stock?

Lockheed Martin has a Moderate Buy consensus rating based on seven Buys, six Holds, and one Sell rating assigned over the last three months. At $554.46, the average Lockheed Martin stock price target implies upside potential of 0.9%.

Conclusion: Bearish on BA, Neutral on LMT

Lockheed Martin looks like a stock worth buying and holding for the long term, but with a correction looking likely in the near term, a buy-the-dip opportunity may present itself. The company’s valuation looks quite attractive, even after the recent run-up in the shares, which is why it gets a neutral valuation — pending an exit from overbought territory.

On the other hand, Boeing has so many problems that its stock looks too risky to buy and hold for the long term. Thus, I would avoid BA stock at all costs. There are plenty of other aerospace plays that are better.