Apple (AAPL) designs, manufactures, and sells smartphones, personal computers, tablets, wearables, and accessories.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It also offers a range of related services. Its products include the iPhone, Mac, iPad, Apple TV, Apple Watch, Beats products, HomePod and AirPods.

The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak on April 1, 1976, and is headquartered in Cupertino, California.

I am bullish on AAPL stock. Q1 2022 results were very strong, and profitability remains very high, while the company’s debt is well covered by operating cash flows.

Apple Business News

The war in Ukraine has forced many companies to withdraw their operations in Russia, or stop their exports of products taking a clear stand against the invasion of Ukraine.

Apple has stopped its sales in Russia but has also limited the functionality of some of its services and removed Russian news apps. It has even disabled some functions of Apple Maps in Ukraine to avoid the tracking of Ukrainian military and citizen movements. This move should harm the sales in Russia but there is the latest good news that may severely limit this negative impact.

Apple also revealed its latest products, including an affordable iPhone SE with 5G capability, a new desktop flagship computer, and a new iPad Air with M1 chip.

The technology company seems to have found a way to address supply chain constraints and the ongoing global chip shortage very effectively, as this has been reflected in the latest stellar earnings report.

Q1 2022 Earnings

APPL stock earnings have been getting stronger as of Q4 2020 and have a remarkable track record of beating estimates.

In Q1 2022, GAAP EPS of $2.10 was a beat by $0.21, and revenue of $123.95 billion was a beat by $5.41 billion. This was an all-time revenue record up 11% year-over-year.

Diluted EPS increased 25% year-over-year from $1.68 in Q1 2021 and all categories showed a year-over-year increase except for iPad sales.

Net income grew to $34.63 billion an increase of nearly 20.5% compared to net income of $28.8 billion in the same quarter a year ago.

Fundamentals – Risks

The main concern for Apple is its high level of debt. As per the latest quarter, it has a D/E ratio of 1.48.

Other than that profitability is very strong, as gross margin, operating margin, and net margin have all expanded on a TTM basis. There is also a very strong and consistent positive free cash flow trend, as in 2021 Apple generated $92.95 billion of free cash flow; an increase of 26.7% compared to 2020.

Long-term growth is also consistent and positive for the tech giant, as the 10-year average growth for revenue and net income is 12.95% and 13.83%, respectively.

Apple returned nearly $27 billion to shareholders during the latest quarter.

Valuation

AAPL is relatively overvalued based on its P/E Ratio (25.7x) compared to the U.S. Tech industry average (13.9x) and based on its PEG Ratio (6.6x).

The expected 3–5-year EPS growth of 12.5% is very positive for such a large and mature technology company.

Wall Street’s Take

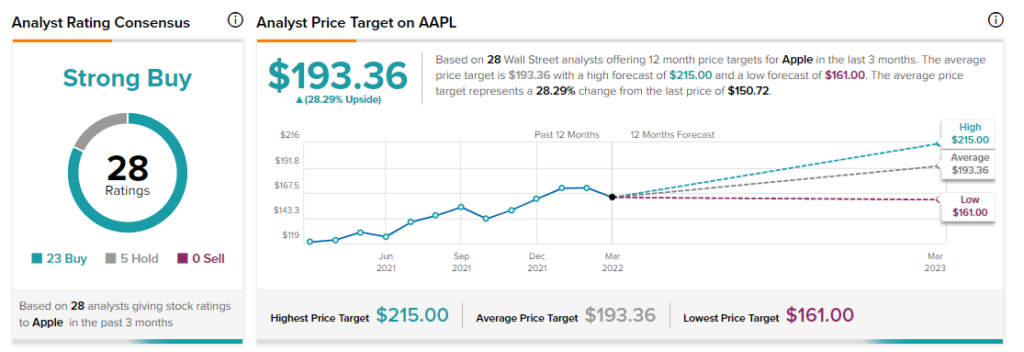

Apple has a Strong Buy consensus based on 23 Buys and five Holds. The average Apple price target of $193.36 represents 28.3% upside potential.

Conclusion

Apple has recently announced a series of new products that should continue to have a positive impact on its revenue growth. Profitability is excellent, the return of cash to shareholders is supportive and growth continues to be very strong.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.