Apple (NASDAQ:AAPL), one of the largest manufacturers of high-tech devices in the world, has faced scrutiny for failing to launch a blockbuster product in recent years. The Apple Vision Pro, the company’s first virtual reality headset, is widely seen as a potential silver lining that could become the biggest product launch since AirPods.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Apple Vision Pro will be available for purchase in the U.S. starting on February 2, and the company is yet to announce an international launch date. Although I am beginning to be optimistic about what’s in store for Apple this year, I am neutral on AAPL stock, nonetheless.

Looking Beyond Encouraging Demand Trends

The Apple Vision Pro has been available for pre-order since January 19, starting at a price of $3,499 for the 256 GB version. For comparison, Oculus Quest 3, the latest AR headset developed and sold by Meta Platforms, Inc. (NASDAQ:META), starts at $499 for the 128 GB version. The hefty price of the Apple Vision Pro raised concerns when the product was unveiled last June, but data from the first weekend of pre-order availability suggests strong initial demand.

According to popular Apple analyst Ming-Chi Kuo, Apple sold between 160,000 and 180,000 Vision Pro units during the first pre-order weekend, which suggests the device was sold out, as expected, within the first weekend itself. As the analyst observed and reported, expected shipping times for all Vision Pro devices extended to five to seven weeks immediately after pre-ordering was enabled – a clear indication that the Vision Pro was sold out.

There is, however, a major difference between blockbuster iPhone models and the Vision Pro. Typically, iPhones see a steady rise in shipping times for at least 48 hours after the availability of pre-ordering, but Vision Pro shipping times remained steady in the first 48 hours after the initial burst. This, according to analyst Ming-Chi Kuo, serves as a warning sign.

Apple has a cult-like follower base that lines up to purchase new devices as and when they are released. A blockbuster product will not only attract this strong follower base but will also appeal to the masses. The waning demand for the Vision Pro after an initial burst suggests the VR headsets are yet to attract mass tech consumers.

The AR/VR Market Has Room for Disruption

Empirical evidence suggests that Apple has been wildly successful in aggressively gaining market share in various consumer tech niches such as smartphones, personal computers, and smart watches despite not enjoying first-mover advantages in any of these markets. Apple’s success stems from the company’s proven ability to develop appealing tech products based on a deep understanding of consumer preferences.

Today, the AR/VR headset market is at an infant stage, with IDC projecting just 8.1 million AR/VR device shipments in 2023. According to Counterpoint Research, Meta dominated this market in the third quarter of 2023, accounting for 49% of all device shipments. Counterpoint data reveals that headset shipments plummeted by 29% year-over-year in Q3 due to a lack of compelling headset launches.

The relatively small size of the AR/VR headset market leaves ample room for disruption, and Apple has a reputation for successfully exploiting similar opportunities in other market segments.

Apple’s Scale Problem

Apple has grown in leaps and bounds since the first-ever iPhone was released in 2007. The massive size and scale of the company, however, has made it difficult for Apple to meet Wall Street’s growth expectations in recent years. For context, in Fiscal 2023, total revenue declined close to 3% year-over-year to $383 billion, while net income also declined by 2.8%.

The problem with Apple’s massive scale is that it takes a wildly successful product to move the needle for the company from a financial performance perspective. In 2024, Apple expects to sell 500,000 Vision Pro units, bringing in revenue of at least $1.75 billion. This may seem like an encouraging figure in isolation, but in comparison to the almost $400 billion in revenue Apple is projected to bring in this year, Vision Pro sales seem trivial.

Even if Apple sells double the projected Vision Pro units for 2024, this segment will still account for less than 1% of total company sales this year. Going by this understanding, it seems fair to conclude that Vision Pro will fail to meaningfully impact Apple’s fundamentals in the foreseeable future.

The highly anticipated VR headset, however, has the potential to improve the market sentiment toward Apple and ascertain the company’s position as a dominant tech innovator if unit sales exceed Wall Street expectations this year.

Is Apple Stock a Buy, According to Wall Street Analysts?

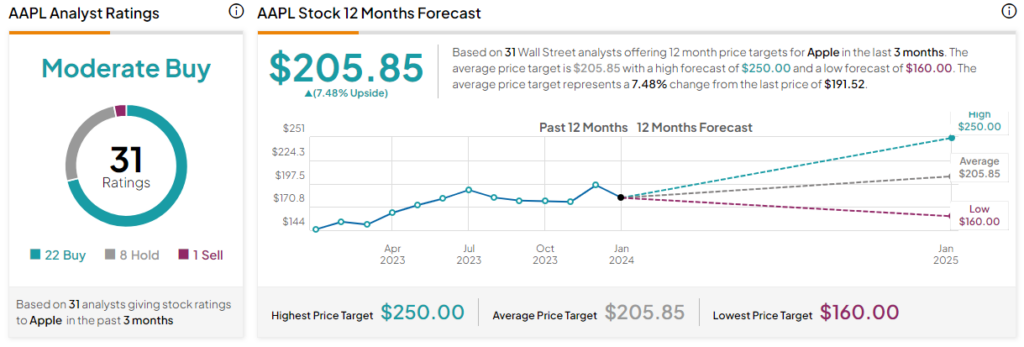

Apple is one of the most followed companies in the market. Not surprisingly, Wall Street analysts are often divided about Apple’s prospects, but they’re currently bullish overall. The stock earns a Moderate Buy consensus rating based on 22 Buys, eight Holds, and one Sell assigned in the past three months. Here’s what some analysts have said about Apple.

On January 18, Bank of America Securities upgraded Apple and raised the stock’s price target from $208 to $225, citing the company’s promising AI product roadmap, among other bullish developments such as the improved outlook for the services segment. BofA also claimed that Vision Pro sales could eventually surpass iPad revenue in the long run, with VR going mainstream.

On January 23, Bank of America (NYSE:BAC) added Apple to its US 1 list, which is a collection of the bank’s best investment ideas.

Morgan Stanley (NYSE:MS), in its Weekly Warm-Up Report, published on January 22, identified Apple as one of the top high-quality growth stocks in the U.S. among 56 other companies that are seemingly well-positioned to deliver alpha returns this year.

Last week, Piper Sandler highlighted Apple as the 3rd most attractive pick out of Magnificent 7 stocks, behind Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL) and Meta Platforms.

Overall, based on the ratings of 31 Wall Street analysts, the average Apple stock price target is $205.85, which implies upside of 7.5% from the current market price.

The Takeaway: Vision Pro is Exciting, Apple’s Valuation Is Not

Apple is heading into exciting days, with the first batch of Vision Pro units expected to be shipped out in the coming weeks. Although the Vision Pro may not have a strong impact on Apple’s earnings this year, the market may reward Apple handsomely if the device attracts tech bulls and positive reviews from tech enthusiasts. Apple, however, looks expensively valued at a forward P/E of 29 compared to its five-year average of 25.