Due to severe market turmoil caused by geopolitical crises, recession risk and high uncertainty, Annaly Capital (NLY) shares have not fared well so far, losing more than 15%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I have a bearish sentiment on this stock for the time being.

Since the triggers of such market headwinds do not seem short-lived, they are likely to continue to impact Annaly Capital.

About Annaly Capital

Annaly Capital is a mortgage real estate investment trust (REIT), one of the largest in the U.S. market.

The firm invests in agency mortgage-backed securities, mortgage servicing rights and residential real estate.

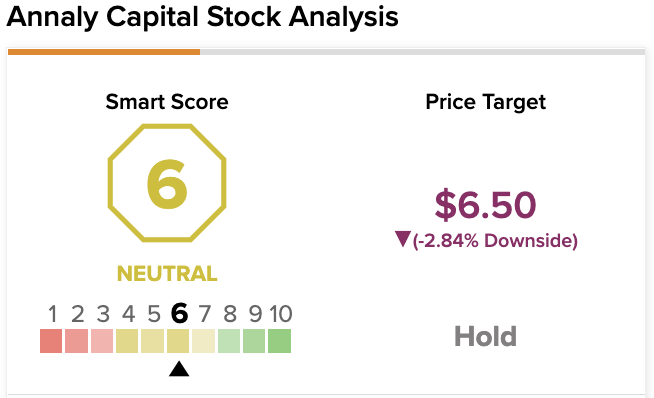

On TipRanks, NLY scores a 6 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

Financial Results From the First Quarter of 2022 Report

Reflecting a deterioration in agency mortgage-backed securities performance due to market turbulence, Annaly Capital Management’s book value per share declined approximately 15% to $6.77 in Q1 2022, compared to $7.97 in the last quarter of 2021.

Commenting on Annaly’s financial results for the first quarter of 2022, David Finkelstein, CEO of Annaly, highlighted the particularly challenging fixed income market environment, characterized by exceptionally high volatility coupled with significant spread widening and interest rate benchmark increases.

Despite this, the portfolio continued to generate returns that were in-line with the previous quarter and beat analysts’ estimates. The company reported distributable earnings per share of $0.28 (vs. the analysts’ average estimate of $0.25), equivalent to 125% coverage of its current quarterly dividend of $0.20.

Amid other relevant metrics the company reported for the quarter, there was a 65.6% annualized rate of return on equity (which is a GAAP measure) and a 14% annualized rate of available for distribution return on equity.

In addition, the leverage ratio (a GAAP measure) increased to 5.3 times in the first quarter of 2022, from 4.7 times in the last quarter of 2021, while the economic leverage ratio increased to 6.4 times from 5.7 times in the previous quarter.

In my opinion, the company hasn’t performed well this quarter. The company has taken on more debt and is also likely to bear higher borrowing costs while funding its assets, which have fallen in value due to adverse market conditions.

Outlook

The war in Ukraine, high inflation and the resurgence of COVID-19 in Asia are serious factors that make it very difficult for economists to predict how the economy will develop.

This kind of inefficiency also affects the U.S. Federal Reserve (Fed) when it comes to making monetary policy decisions.

The U.S. central bank will continue its aggressive stance and aim to bring inflation back to the 2% target, as soon as possible. However, any attempt to predict in advance how much the Fed will raise interest rates or reduce its expenditures in Treasury and Agency Mortgage-Backed Securities (MBS) is futile at this point.

Investors would like more clarity on how the Fed will implement quantitative tightening, but the top U.S. monetary authority cannot grant their wish. As a result, the market may continue to experience high volatility in the coming weeks, the same issue that made the environment challenging for the agency’s MBS in the first quarter.

If so, this will likely continue to affect the value of Annaly’s shares.

Higher Insolvency Risk Perceived

In very uncertain times, banks hold more liquidity than before to better hedge against the risk of default, which they perceive as elevated among borrowers such as families and businesses. Thus, the banking system has the necessary resources to intervene quickly when the economy needs support, as was the case during the COVID-19 crisis.

The point is that debt repayment times tend to shorten while interest rates, on the other hand, tend to rise. Moreover, in such a situation, the interest coupon collected on the outstanding securities representing medium/long-term loans is unlikely to be adequate compared to the risk of default perceived by the banks.

Therefore, the spread between the interest payable on the short-term loan (to finance the investment in securities representing MBS) and the interest received on these securities and other real estate instruments loses attractiveness in the market compared to other income-bearing assets.

In addition, inflation is currently high, reducing the purchasing power of this interest income.

By reducing purchases of government bonds and MBS, the banking sector saves liquidity but results in a lower market price/asset value for Annaly and other diversified asset managers.

For these reasons, and in line with the current situation of great uncertainty, the decision to buy Annaly shares and other similar operators is usually postponed to more favorable times, preferring different investment solutions.

Analysts’ Earnings Growth Estimates

Analysts expect Annaly Capital’s earnings per share (EPS) to fall 17.20% this year and 5.2% next year. In addition, the company’s profits are expected to decline by 4.98% each year for the next 5 years, from 2023 to 2027.

Wall Street’s Take

In the past three months, nine Wall Street analysts have issued a 12-month price target for NLY. The stock has a Hold consensus rating based on two Buys and seven Holds.

The average Annaly Capital (NLY) price target is $6.50, implying a 2.84% downside potential.

Valuation

Shares are changing hands at $6.62 as of the writing of this article for a market cap of $9.67 billion, a price-earnings ratio of 3.8, and a 52-week range of $6.18 to $9.64.

The stock price doesn’t look expensive as it trades below the 50-day moving average of $6.68 and significantly below the 200-day moving average of $7.75. However, a lower price does not lead to a buy approach for this stock, as the market turbulence and the unfavorable outlook for the company could mean that the stock price could continue to lose value in the upcoming weeks.

Currently, the stock pays a quarterly cash dividend of $0.22 per common share, yielding 13.23% at the time of writing.

Conclusion

Annaly Capital was able to make the same profit, but equity was lower.

Meanwhile, the stock price fell significantly as investors deemed market conditions too risky due to high volatility.

Given the current economic situation and its possible evolution, the turbulence responsible for Annaly’s downtrend could continue in the coming weeks.

A 14-day relative strength indicator at 51.90 suggests there is plenty of room for further declines. This ratio ranges from 20 to 80. Anything in between means the stock is neither overbought nor oversold. A reading of 20 means the stock is oversold, while a reading of 80 means the stock is overbought.

Read full Disclosure