Seasoned investors know that a downturn can be turned into an opportunity to strengthen portfolios. However, buying the right stocks that will survive the downturn and emerge stronger is the key to long-term wealth creation. TipRanks’ Analyst Top Stocks tool helps investors build good portfolios by offering a comprehensive view of the stocks that top Wall Street analysts are recommending right now. Granite Point Mortgage (NYSE:GPMT) and Mobileye Global (NASDAQ:MBLY) are two stocks that have been recommended by the best-performing Wall Street analysts over the past two days.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Granite Point Mortgage (GPMT)

Commercial real estate lender Granite Point Mortgage has a diversified portfolio of commercial real estate loans carrying an impressive average loan-to-value ratio of 63%. The company’s investment portfolio is primarily formed of senior first mortgages (about 99%), making it safer.

The company also recently repaid $225 million of debt in full under its higher-cost senior secured term loan facilities. At the end of Q3 2022, the company had $165 million in cash and $3.7 billion in total assets.

Moreover, in the last quarter, hedge funds have increased holdings of Granite’s shares in their portfolios by about 95,600 additional shares, giving the stock a positive hedge fund confidence signal on TipRanks.

Does GPMT Pay a Dividend?

The company’s dividend-paying history makes it a great high-yield dividend stock for investors seeking to build a dividend portfolio. In the first three quarters of the year, Granite paid more than $17 million in dividends. Its current dividend yield stands at 15.08%, which means that the company pays a sizeable percentage of its share price as dividends.

What is the Price Target for GPMT Stock?

Three unanimous Buy ratings have led to GPMT stock getting a Strong Buy consensus rating on Wall Street. Its average price target of $9.67 indicates a 49.8% upside over the next 12 months.

Mobileye (MBLY)

Mobileye builds AI technology like semiconductor chips, software, and cameras for autonomous driving and the advanced driver-assistance system (ADAS).

Is Mobileye Public?

Market followers will be aware that Mobileye was a public company in 2017 before being acquired by Intel (NASDAQ:INTC). This year, it separated from its acquirer and went public again in November. The IPO during the great bear market of 2022 was successful despite coming at a bad time for IPOs, which is a sign of strength.

What is the Price Target for MBLY Stock?

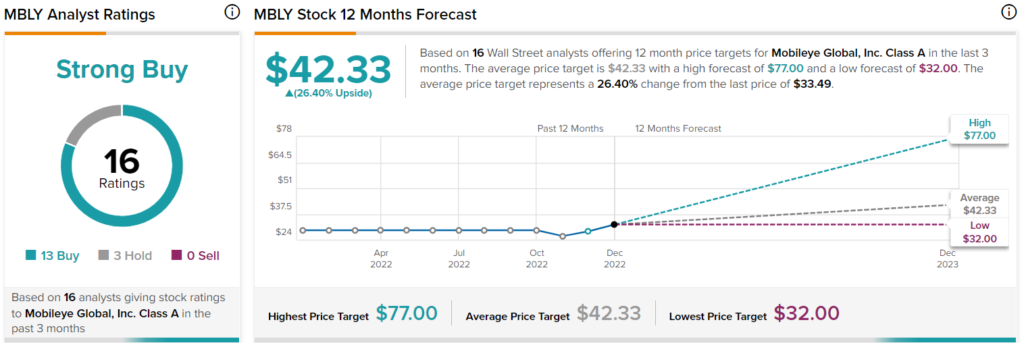

Last week, Baird analyst Luke Junk reiterated a Buy rating and raised his price target to $39 from $36, encouraged by the company’s expectation of strong EyeQ sales growth and Mobileye SuperVision volumes in its guidance. The analyst believes that Mobileye’s premium ADAS offerings are driving the company’s remarkable top-line growth, which is aiding the company’s research and development investments.

Overall, MBLY stock has a Strong Buy consensus rating based on 12 Buys and three Holds. The average price target of $41.79 indicates 23% upside potential from current price levels.

The Takeaway

Granite Point has built a fortress out of a strong balance sheet and a relatively safe investment portfolio that will act as a hedge in the event of a recession. On the other hand, Mobileye’s expertise in a niche technology area that has a sizeable emerging demand makes it a great technology stock to consider, according to analysts.