The mining sector is based on volatile commodity prices and faces numerous economic headwinds. Base Resources (GB:BSE) and Kenmare Resources (GB:KMR) are two small players in the mining industry. According to Richard Hatch, both stocks have huge upside potential. Plus, they have good dividend yields. What’s not to like?

Richard Hatch of Berenberg Bank rates the stocks of the metals and mining industries from the UK, the U.S., Canada, and Australia. Hatch has been an equity analyst at the bank for the last four years. Before this, he worked with RBC Capital Markets and covered oil, gas and mining companies stocks.

Hatch is four star rated analyst on TipRanks and is ranked 1,254 out of 7,949 analysts. He has generated an average return of 5.7% per rating. His success rate is 53% with 155 out of 295 ratings achieving success.

Let’s discuss the stocks in detail.

Kenmare Resources – Some headwinds expected, but dividends look good

Kenmare is an Ireland-based mining company, and it deals in titanium mineral sand products.

Recently, the company announced its Q2 2022 and H1 2022 trading updates. The company’s Q2 production was weaker than expected, mainly due to higher slime recirculation. Overall, total shipments of finished products saw a decline of 23% as compared to last year.

As a result, the company expects its production of finished products to be on the lower side of its 2022 guidance range.

On the contrary, increased prices of the company’s products made up for the lower level of production and supported the revenues.

The company will face some headwinds in 2022 because of the Russia-Ukraine conflict. It could lead to some uncertainties in the global trade routes as Ukraine is a major supplier of titanium feedstocks.

In July, Berenberg remained positive for Kenmare and increased its price target from 670p to 750p. The bank said it was “upbeat on the mineral sands sector, and believed the meaningful free cash flow that Kenmare would generate in the medium term would help its valuation.”

Another feather in the cap is the company’s dividend policy. Kenmare’s dividend yield is around 6%, much higher than the industry average of 1.9%. The company’s balance sheet remains strong as its net debt was reduced to $65.5 Million in H1 2022, from $82.8 Million in December 2021. It aims at a dividend payout ratio of 25% profit after tax in 2022.

Base Resources – Numbers on track

Australia-based Base Resources deals in the production and development of mineral sands.

Last month, in June 2022, the company provided an update on its quarterly activities. Despite an eight-day disruption caused by flash flooding at its Kwale mineral sands mine in Kenya, the company’s production was consistent. Base Resources generates the majority of its revenue from this mine.

The company’s sales revenue was $91.3 Million for Q3 2022. The FY 22 guidance numbers were in the range as forecasted earlier. The strong performance was mainly driven by rising prices of rutile and zircon.

However, FY 23 guidance numbers for production are lower than the previous year. This is because mining in the lower HM grade Kwale North Dune orebody will begin in March 2023, and some uncertainty is expected.

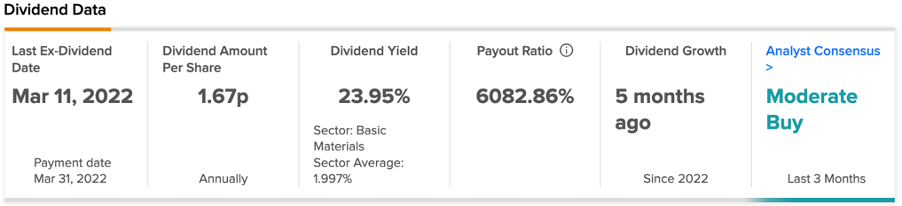

The stock is a gem for income-based investors. Base Resources has a dividend yield of 23.95%, much higher than the sector average of 1.99%.

View from the city

According to TipRanks’ analyst rating consensus, both Base Resources and Kenmare Resources have a Moderate Buy rating from Richard Hatch.

The average price target for Base Resources is 34p, which represents a huge growth of 103% on the current price. Hatch recently raised the price target from 33p to 34p.

The average price target for Kenmare Resources is 790p, which implies upside potential of 80.99% on the current price.

Conclusion

Despite being small players in the industry, both companies are generating good value for investors. Also, looking at Hatch’s optimism about stock price appreciation makes them a win-win option.