Advanced Micro Devices (AMD) has been around for a long time. In fact, this company was launched back in 1969 as a semiconductor company, growing into a global behemoth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Currently, this chip maker stands high on the list of top Fortune 500 companies. Its visualizing technology has revolutionized the server market, and continues to provide large-scale customers such as Alphabet, Twitter, Tesla, and HP with much-needed chips.

We’ve seen the headlines around chip shortages shake the valuations of many of the companies on this list. For AMD, such shortages could be good and bad.

On the one hand, surging demand is the key driver of these shortages. On the other, not being able to supply what the market is demanding has led to some sort of deadweight loss for the company.

The past few months have been rocky for AMD stock. This stock currently remains approximately 20% off its all-time high. However, longer-term investors who have held this stock for years will have seen their investment skyrocket, as this token is up nearly 10-fold over the past five years alone.

I’m bullish on AMD’s ability to continue growing from this current level.

AMD’s Long-Term Prospects

AMD’s recent surges and dips appear to be a result of quickly shifting investor sentiment among chip makers.

Driven by various macro headwinds such as supply and demand challenges, rising interest rates, and the performance of its peers, AMD stock has both benefited and suffered as investor sentiment remains all over the map.

Indeed, competition within the chip-making space is fierce. Whether its Nvidia or Intel, other chip manufacturers are vying for market share, offering new products and aiming to differentiate themselves in some way. AMD’s status as one of the “old guard” stocks in this space has some investors thinking of AMD more as an Intel than an Nvidia.

There are many who dispute such a view. AMD’s top-line growth of around 20% for most quarters last year was often eclipsed by the company’s bottom-line growth.

In Q2 of last year, for example, AMD managed to double its earnings on a year-over-year basis. This sort of earnings growth has enticed investors to consider this chip maker, bidding up its valuation.

Currently, AMD stock trades at a valuation multiple of around 51-times earnings. For most stocks, that’s expensive. Compared to Intel, for example, that multiple is rather large. However, AMD’s valuation currently sits right between Intel and Nvidia, a valuation that many seem to think makes sense.

There’s reason to like AMD’s growth profile, and liken this stock more to an Nvidia than an Intel. However, the company’s legacy businesses do provide millennial investors with some pause.

Long-Term Winner

AMD certainly has been a more volatile stock than usual over the past two years. The pandemic has brought to light the benefit of holding high-growth stocks in times of record-low interest rates. Right now, that value is eroding to some degree.

However, the view that AMD stock could be a near-term winner isn’t one I think many investors in this chip manufacturer are taking.

As Lisa Su took over as the CEO of this company in 2014, she came with a vision that has enhanced AMD’s position in the stock market. Over the past five years, AMD’s stock price has surged, alongside this vision.

AMD has done an incredible job in gaining market share, growing in sectors where its competition has had difficulty. For example, the company’s CPU market share went from 3.7% to 9.5% this past year.

In the CPU market, AMD has been going head to head with Intel. Thus far, AMD has been winning that battle. The company’s Ryzen 5000 series CPU processors have revolutionized the market.

Many see AMD’s product innovation as a reason to hold this stock long term. That’s an investment thesis that’s hard to disagree with. The chip manufacturing space is a fast-moving one, and AMD has done a fantastic job of continuing to move forward in a positive way in this space.

Wall Street’s Take

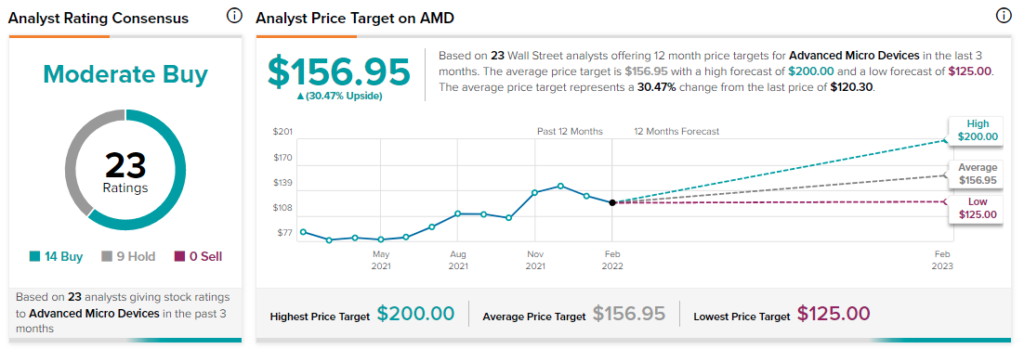

As per the TipRanks’ analysts rating consensus, Advanced Micro Devices is a Moderate Buy. Out of 23 analyst ratings, there are 14 Buy recommendations and nine Hold recommendations.

The average AMD price target is $156.95. Analyst price targets range from a high of $200 per share to a low of $125 per share.

Bottom Line

AMD stock is certainly an intriguing option for investors looking for a stable, long-term growth stock, with innovative upside and an impressive growth trajectory.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure