The third-quarter earnings season is here, and on October 31, 2024, Amazon (AMZN) is set to report its financial results. As a long-term bull on AMZN, I believe Q3 could be another strong quarter, with more realistic market expectations compared to Q2. The focus will likely be on Amazon’s shift toward higher-margin services and its crown jewel, Amazon Web Services (AWS). I expect the success of the quarter will depend significantly on the company’s ability to sustain sales growth and stabilize its high margins.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In this article, I will focus on the expectations for the September quarter and explore whether Amazon stock is a good investment ahead of its earnings report. I’ll also review where investors are likely to focus their attention.

A Quick Amazon’s Q2 Recap

Before diving into why I have a slightly bullish outlook for Q3, let’s first review what happened in Q2. Amazon, along with other Big Tech companies like Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL), reported solid results but failed to meet the market’s lofty expectations following a consistent period of strong growth fueled by AI. This growth had led to a significant rally in tech stocks during the first half of the year. After reporting earnings, Amazon’s stock dropped 8% to $167 per share but has since rebounded to over $190.

For Q2, the Seattle-based giant posted mixed results. It beat EPS estimates but fell short of revenue projections, reporting $148 billion in revenue, slightly below the forecasted $148.8 billion. Despite this, it wasn’t a bad quarter for Amazon. Operating income surged to $14.7 billion, nearly doubling the $7.7 billion reported in the same quarter last year. A major contributor was AWS, which accounted for $9.3 billion of that figure. The cloud segment grew by 19% year-over-year, surpassing Wall Street’s 17.5% growth estimate.

However, with the market expecting a nearly flawless quarter for Amazon (and AI leading stocks in general), a few weak spots emerged. For instance, advertising revenue came in at $12.8 billion, reflecting 20% annual growth but falling short of the 24% growth reported in the previous quarter. In my view, the biggest downside came from Amazon’s guidance for Q3, where it projected revenues between $154 billion and $158 billion, translating to 9.5% growth at the midpoint. That was shy of the double-digit growth analysts had expected.

Additionally, concerns about capital expenditures (CapEx) were raised. Amazon’s spending on property and equipment jumped to $17.6 billion, up from $11.5 billion in the same quarter last year—a 54% increase, primarily driven by AI investments. This raised concerns that these investment flows could put pressure on margins.

A Cautiously Optimistic Outlook for Amazon’s Q3 Earnings

I hold an cautiously optimistic view on Amazon’s Q3 earnings, largely because market expectations have become more realistic compared to Q2. Over the last three months, 21 out of 33 analysts have revised their Q3 EPS estimates downward, and 30 out of 38 analysts have lowered their revenue forecasts. As a result, the consensus EPS estimate for Amazon’s Q3 is $1.14, representing 21% annual growth, while analysts are expecting to see $157.24 billion in revenue, approximately 10% higher than last year.

AWS Growth and Margins Are Likely to Be the Key Focal Points

A key focal point for Q3 will likely be AWS, which is Amazon’s high-margin business. AWS accounts for two-thirds of the company’s profitability. AWS sales growth has been accelerating, rising from 12% to 19% over the last four quarters, and the company maintained its leadership in the cloud market with a 32% share. The key question is how long this growth can be sustained.

I expect Q3 to be another quarter of accelerating growth, driven by three macro trends noted by CEO Andy Jassy in the latest earnings call. These three macro trends are: (1) companies have largely completed their cost optimization efforts; (2) businesses are refocusing on modernizing infrastructure and transitioning to the cloud; and (3) companies of all sizes are eager to leverage AI.

On the flip side, concerns remain about how much AWS margins will continue to decline after being unsustainably high earlier in the year. Although AWS operating margins were around 37.6% in Q1, they dropped to 35.5% in Q2. The market now seems to accept that margins will continue to soften. However, even with this probable continued decline, I believe Amazon’s operating income will remain strong. The company has provided guidance for Q3 operating income in a range between $11.5 billion and $15.0 billion. If the mid-range estimate of $13.25 billion is achieved, it would represent an 18.3% annual increase—a strong result for a company of Amazon’s scale.

With AWS growth and margins under scrutiny, I believe that a demonstration of continued sales growth in Q3 and operating income guidance that exceeds (or at least meets) guidance could potentially lift Amazon’s stock price. This would support the notion that, even with decelerating AWS margins, Amazon’s management could offset this challenge through cost discipline and operational improvements in other areas, such as advertising and the consumer business.

Is AMZN a Buy, According to Wall Street?

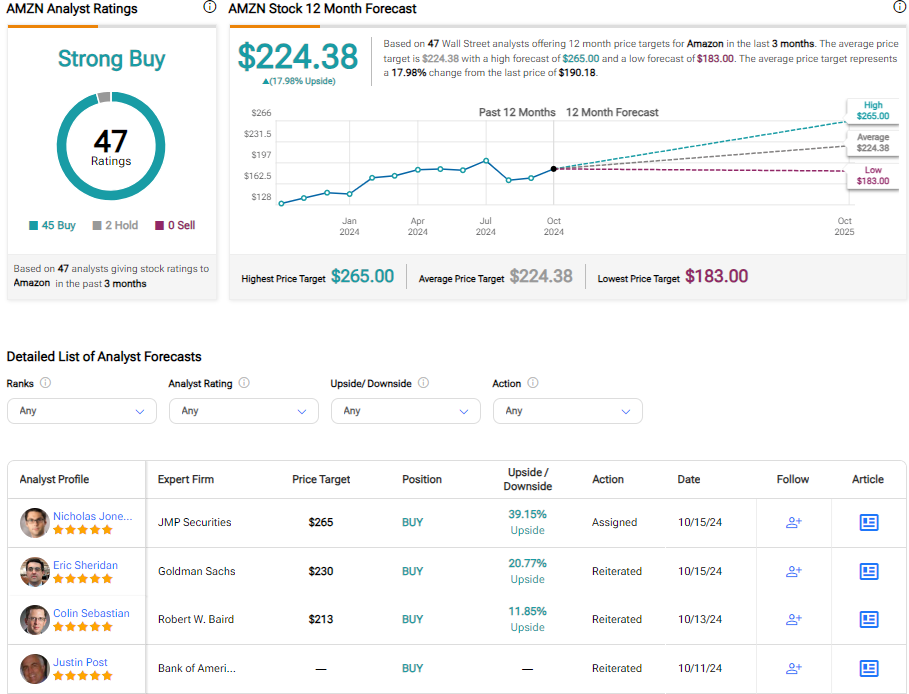

At TipRanks, the Wall Street consensus for Amazon is a Strong Buy, based on 47 analysts. Of these, 45 have a Buy rating, while two analysts rate Amazon stock as a Hold. The average AMZN price target is $224.38, implying potential upside of about 18%.

Conclusion

Amazon looks poised for another strong Q3. Investors look sure to recognize Q2 progress and have been adjusting to Q3 guidance, while the stock price has maintained strong bullish momentum. AWS will be key to the quarter’s performance—if sales growth holds and margin declines exhibit signs of stabilizing, that could ease investor concerns. While AWS margins are clearly softening, Amazon’s advertising and consumer businesses offer the opportunity for cost reduction and efficiency. Given this, I still view Amazon bullishly heading into Q3, though some caution is warranted.