I am bullish on Amazon (AMZN) as it has strong growth potential, a wide moat, a discounted valuation, unanimous Wall Street bullishness, and substantial upside relative to its one-year price target.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amazon is one of the largest companies in the world and has a storied history of rising from being a humble online bookstore to arguably the most powerful e-commerce company in the world that now also boasts a thriving cloud technology business, among other ventures.

Its iconic founder Jeff Bezos has created a relentless growth and innovative culture at the company and now has a highly-talented team in place to drive future success for the company while he increasingly turns his attention towards his space exploration company.

Strengths

AMZN benefits from enormous economies of scale, a world-class army of employees, increasing technical prowess, a vaunted army of logistics assets and networks, a massive network effect on its online marketplace that includes leading e-commerce and retail merchants, and an army of Amazon Prime subscribers that now numbers in the hundreds of millions.

Moving forward, the company is increasingly leveraging this massive subscriber membership network alongside its enormous treasure trove of consumer and retailer data.

These factors will help AMZN build artificial intelligence models to maximize the monetization and retention of its member network, which, in turn, results in increasingly loyal customers and drives pricing power for Amazon Prime. Over time, this should create a very lucrative and stable earnings stream for the company.

Recent Results

AMZN reported strong Q4 results recently. Net sales increased by 9% to a whopping $137.4 billion during the quarter. They increased 10% year-over-year on a constant-currency basis. However, operating income fell by nearly 50% to $3.5 billion from $6.9 billion in the same period last year. That said, net income nearly doubled year-over-year to $14.3 billion ($27.75 per diluted share) from $7.2 billion, or $14.09 per diluted share, in the year-ago quarter.

A big driver of the company’s Q4 success was its biggest-ever Black Friday to Cyber Monday holiday shopping weekend, as its apparel, beauty, home, and toys categories led the charge. The company now boasts an army of over 200 million Prime subscribers across the globe.

Valuation Metrics

AMZN stock looks attractively valued at the moment. It currently trades at a 17.2x forward EV/EBITDA ratio, which looks quite reasonable compared to its historical average of ~23x. Furthermore, its forward price-to-normalized-earnings ratio of 56x is well below its historical average of 99x.

Wall Street’s Take

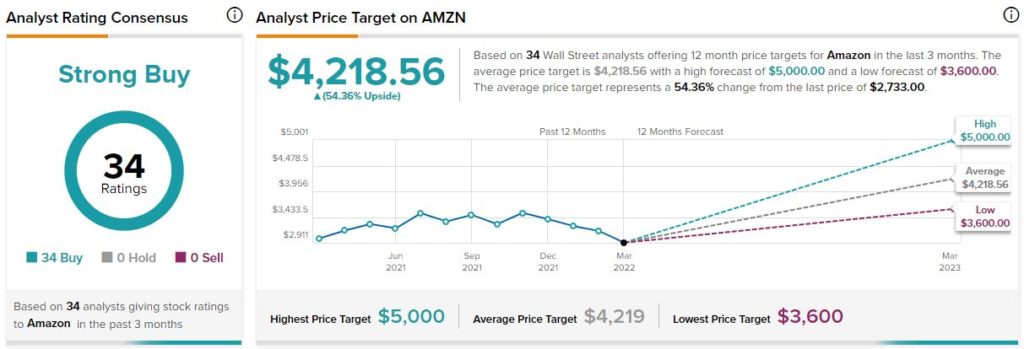

According to Wall Street analysts, AMZN earns a Strong Buy consensus rating based on 34 unanimous Buy ratings assigned in the past three months. Additionally, the average Amazon price target of $4,218.56 puts the upside potential at 54.4%.

Summary and Conclusions

Amazon is a leading global company with a powerful moat and a storied track record of generating massive growth. Wall Street analysts are unanimously bullish on the stock here, and its average price target implies substantial upside potential over the next 12 months.

On top of that, its valuation multiples look discounted relative to its historical averages while its growth potential remains good.

When considering the relatively low risks involved here, it looks like it might be a good time to add shares here. That said, no bet is risk-free, so investors should probably not over-allocate to AMZN stock here.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure