E-commerce giant Amazon (NASDAQ:AMZN) has made quite a name for itself in the online retail industry. It is a global online marketplace with a diverse range of products and services. Aside from online sales, the company has expanded into cloud computing and entertainment. Despite macroeconomic conditions, growth across its segments has the potential to propel its business to great heights in the long run.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

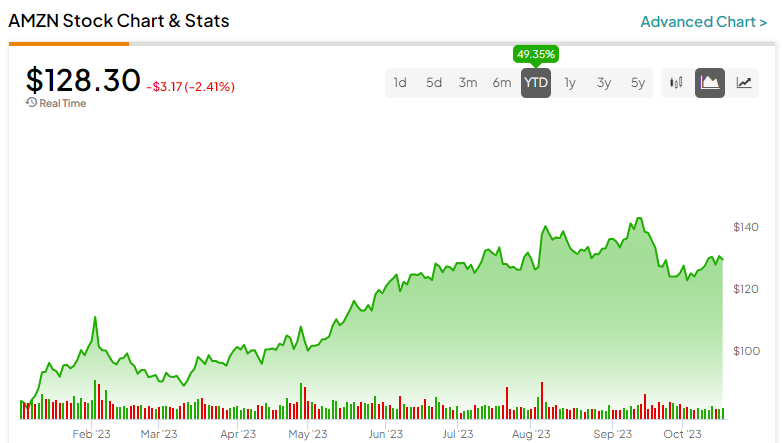

Amazon’s stock has gained 49.4% year-to-date compared to 14% for the S&P 500 (SPX). Also, Wall Street appears to be optimistic about AMZN stock amid the company’s efforts to integrate AI (artificial intelligence) and innovate across all its segments. Hence, I am bullish on AMZN stock as well.

AWS Segment Could Maintain Its Dominant Position

Amazon is a leading player in the cloud computing market with its Amazon Web Services (AWS). What’s more, AWS controls 32% of the global cloud infrastructure market, according to Statista. Meanwhile, the next big players are Microsoft’s (NASDAQ:MSFT) Azure and Alphabet’s (NASDAQ:GOOGL) Google Cloud.

In Q2 2023, the AWS segment generated sales of $22.1 billion, up from $19.7 billion in the year-ago quarter. Net sales for the quarter totaled $134.4 billion, an increase from $121.2 billion in Q2 2022.

Amazon also intends to invest up to $4 billion in AI start-up Anthropic to integrate AI into its products and services to cater to the ever-expanding generative AI niche. In fact, in Q2, it introduced various AWS technologies that use generative AI that it believes will help customers “improve productivity and enhance their security posture.”

The global cloud computing market, valued at $546 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 17.9% through 2027, according to MarketsandMarkets Research. Amazon, with its dominant position, could capitalize on this massive growth.

Additionally, Amazon is currently evolving its voice assistant Alexa, which will be generative AI-powered by early next year. Management claims the upgraded Alexa will be “more intuitive, intelligent, and useful.”

Amazon Prime’s Benefits Lead to Customer Loyalty, Recurring Revenue

Amazon’s success can be credited to its emphasis on convenience, competitive pricing, and providing a diverse range of products to its customers. Its subscription-based streaming service, Amazon Prime, offers a variety of video content. It enables Amazon to generate recurring revenue from loyal customers. As a marketing strategy to attract more Prime subscribers, Amazon even offers free or early shipping, exclusive Amazon deals, and other benefits.

Recently, Amazon announced that its Prime subscribers “saved more than $1 billion across millions of deals during Prime Big Deal Days on October 10 and 11.” The company said this holiday-exclusive shopping event outperformed last year’s event, with U.S. customers purchasing more than 25 million items.

BofA predicts the Big Deal sales could lead to $9.1 billion gross merchandise value (GMV) for Amazon, reflecting a strong start to Q4. Currently, BofA has a Buy rating for AMZN stock with a target price of $174.

Prime Video Ads Could be a Growth Driver

Amazon intends to include a few advertisements in its Prime content next year, which could drive revenue growth. U.S. subscribers will be able to choose a non-ads version for an additional $2.99 per month. Plus, advertising sales could skyrocket in the coming years as the ad market rebounds. Amazon’s advertising sales came in at nearly $38 billion in 2022, and this figure is expected to rise to $71 billion by 2027.

UBS analyst Lloyd Walmsley stated that video ads “will unlock substantial revs (revenues) at high incremental margins, bolstering the margin bull case.” The analyst raised the target price for AMZN to $180 from $175, with a Buy rating.

Overall, analysts predict Q3 revenue to be around $141.5 billion and earnings per share (EPS) to be $0.58. The company has beaten earnings expectations for the past two consecutive quarters, and its next earnings release will be on October 26.

Also, for 2023, analysts expect a net profit of $2.15 per share compared to a loss of $0.27 per share in 2022. Revenue for the year could see a jump to $570.1 billion from $514 billion in 2022.

Is AMZN Stock a Buy, According to Analysts?

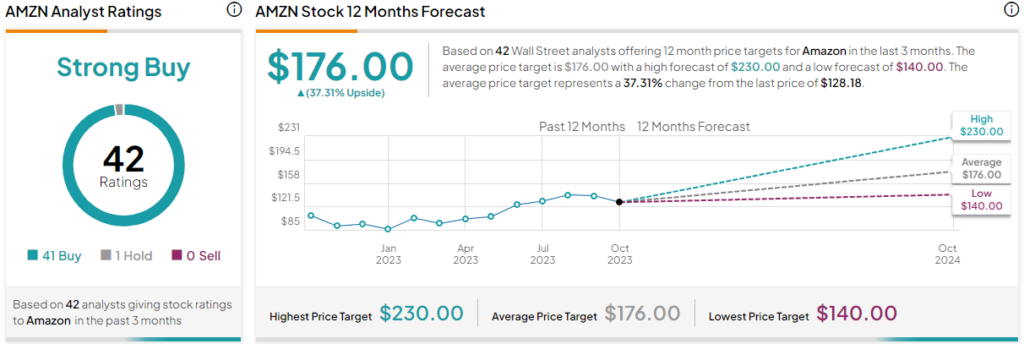

Turning to Wall Street, out of the 41 analysts covering Amazon stock over the past three months, 40 recommend a Buy, and one recommends a Hold. The average Amazon stock price target is $176, implying upside potential of 37.3% over the next 12 months. The highest price target for AMZN stock stands at $230, while the lowest target price is $140.

Further, analysts predict that Amazon’s revenue will increase by 11.6% year-over-year to $636.3 billion in 2024, and EPS could jump to $3.09 from $2.15 estimated for 2023.

Amazon trades at 61 times forward earnings, which looks quite steep. However, its earnings estimates reflect that analysts are highly optimistic about its growth potential.

The Bottom Line on Amazon

Over the next few years, by incorporating AI, Amazon has outstanding growth prospects in e-commerce, cloud computing, and digital advertising. It’s no surprise why Wall Street loves this growth stock, expecting over 37% in upside for the next year.