Needham analyst Quinn Bolton has warned that the SemiCap (semiconductor capital equipment) stocks are overbought due to the rally powered by the hype around AI (Artificial Intelligence). As a result, the analyst downgraded various stocks within the semi-cap sector, including Applied Materials (NASDAQ:AMAT) and Axcelis Technologies (NASDAQ:ACLS).

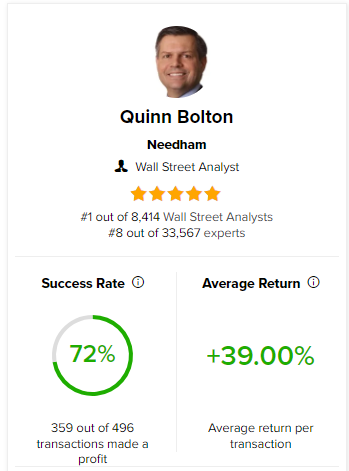

Before digging into the details, investors should note that TipRanks identifies the Top Wall Street analysts per sector, per timeframe, and against different benchmarks. The ranking reflects an analyst’s ability to deliver higher returns through recommendations. Following the ratings, TipRanks’ algorithms calculate the statistical significance of each rating, the analysts’ overall success rate, and the average return.

Quinn Bolton ranks #1 on TipRanks’ top analysts list with a success rate of 72%. Bolton’s best rating has been on ACM Research (NASDAQ:ACMR), a provider of equipment that supports semiconductor IC manufacturing. It’s worth highlighting that his Buy recommendation on ACMR generated 608.4% return from August 19, 2019, to August 19, 2020.

Many SemiCap Stocks Overbought, Says Bolton

A jump in interest in Generative AI resulted in the quick success of OpenAI’s ChatGPT. Further, this led Nvidia’s (NASDAQ:NVDA) stock to reach $1 trillion in market cap. Also, the hype around AI supported the rally in several other stocks, including those from the SemiCap industry.

In a note to investors dated June 14, Bolton said that investors’ enthusiasm for shares of companies with exposure to generative AI and LLMs (large language models) has driven many SemiCap stocks to craft new highs. Due to the rally, the forward price-to-earnings multiples of SemiCap companies are near historical peak levels (valuation looks expensive).

Bolton added that SemiCap stocks are “overbought” as they have increased substantially on AI hype. Further, he believes that AI is unlikely to “drive a significant increase in WFE [Wafer Fab Equipment] spending.”

The analyst finds the risk-reward ratio of many SemiCap stocks unattractive. He downgraded the shares of Applied Materials, Onto Innovation (NYSE:ONTO), Axcelis Technologies, Advanced Energy (NASDAQ:AEIS), KLA Corp. (NASDAQ:KLAC), and Nova (NASDAQ:NVMI) to Hold.

It’s worth highlighting that shares of AEIS, KLAC, NVMI, AMAT, and ONTO are up about 25%, 28%, 43%, 46%, and 55%, respectively, on a year-to-date basis. At the same time, ACLS stock jumped 118%. The recent uptrend has left little room for upside, noted the analyst.

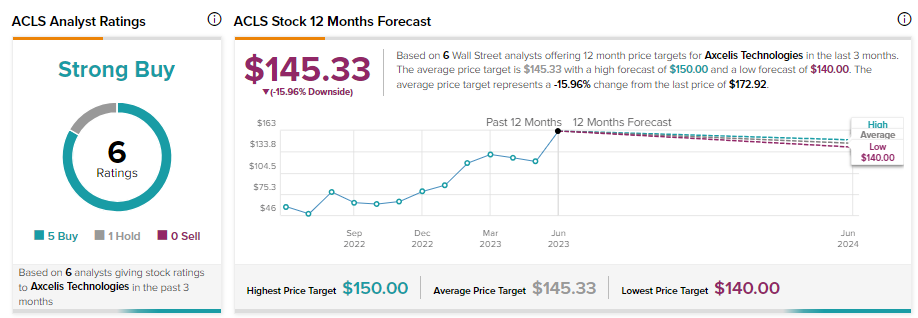

Is ACLS Overvalued?

ACLS stock has more than doubled so far this year, leading to valuation concerns. The company’s growth could take a hit due to tough year-over-year comparisons, highlighted Bolton, implying that ACLS stock looks overvalued.

ACLS stock has five Buy and one Hold recommendations, translating into a Strong Buy consensus rating. Further, analysts’ average price target of $145.33 implies 15.96% downside potential from current levels.

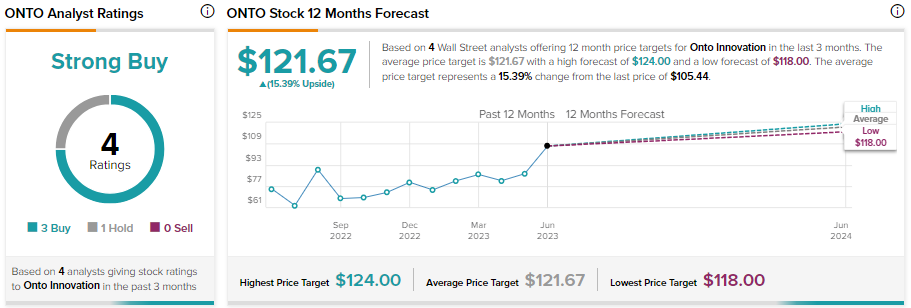

What is the Price Target for ONTO stock?

While the analyst likes ONTO’s exposure to specialty devices and higher growth rate, the recent run in its stock price keeps him sidelined. ONTO stock has received three Buy and one Hold recommendations for a Strong Buy consensus rating on TipRanks.

Meanwhile, analysts’ average price target of $121.67 implies 15.39% upside potential from current levels.

Is Applied Material a Good Buy?

Citing Applied Material’s valuation, Bolton said that investors should show patience and not chase the stock near its current levels. Including Bolton, Applied Material stock has received six Hold recommendations. 11 analysts recommend a Buy, while one suggests a Hold.

Overall, AMAT stock has a Moderate Buy consensus rating. Furthermore, analysts’ average price target of $138.60 implies 1.82% downside potential.

Is Nova a Good Stock to Buy?

The analyst stated that Nova is one of the fastest growing companies in the SemiCap industry and attracts a higher valuation multiple. However, given the recent appreciation in price, Bolton believes that Nova stock “may cool off” and offer a better entry point.

NVMI sports a Strong Buy consensus rating on TipRanks based on three Buy and one Hold recommendations. Analysts’ average price target of $117 is in line with its closing price on June 14.

What is the Future of KLAC Stock?

The analyst believes that KLAC stock deserves a higher valuation multiple than AMAT owing to its increased market leadership in the process control market. However, the recent growth in its share price limits its upside potential.

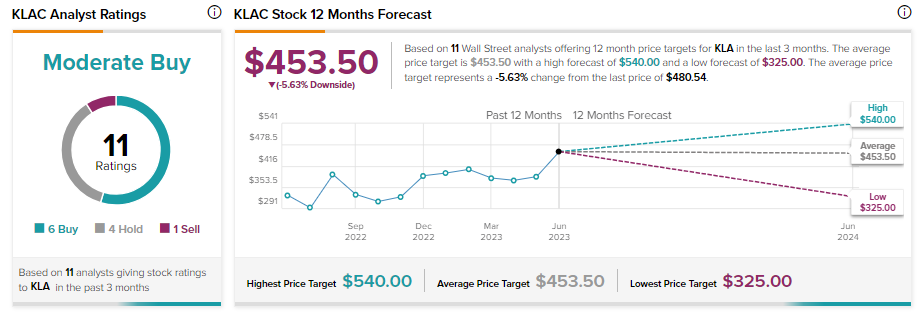

KLAC stock has received six Buy, four Hold, and one Sell recommendations for a Moderate Buy consensus rating. These analysts’ average price target of $453.50 implies 5.63% downside potential.

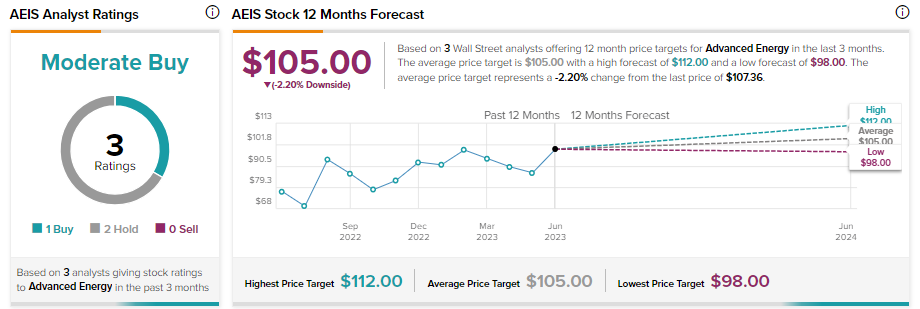

What is the Price Target for AEIS Stock?

Bolton acknowledged that AEIS is diversifying away from semiconductors into other industries, including industrial and medical. Thanks to its efforts to diversify operations, Wall Street analysts are bullish about the stock.

AEIS stock sports a Strong Buy consensus rating, reflecting five Buy and one Hold. Analysts’ average price target of $145.33 indicates 15.96% downside potential.