Magna International (TSE: MG) (MGA) is a mobility technology company that supplies to the automotive industry. It operates through the following segments: Body Exteriors and Structures; Power and Vision; Seating Systems; and Complete Vehicles.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Like most companies, Magna’s stock is well off its highs. However, does this mean that the stock is undervalued?

Measuring Efficiency

Magna International needs to hold onto a lot of inventory in order to keep the business running. Therefore, the speed at which a company can move inventory and convert it into cash is very important in predicting its success.

To measure its efficiency, I will use the cash conversion cycle, which shows how many days it takes for the company to convert its inventory into cash. The lower the number, the better. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Magna International’s cash conversion cycle is 39 days, meaning it takes the company 39 days for it to convert its inventory into cash. In the past decade, this number has trended upwards, indicating that the company’s efficiency has deteriorated. In the last 10 years, its low point was 28 days in Fiscal 2012, and its high point is the current 39 days.

Valuation

To value Magna International, I will use a single-stage DCF model because its free cash flows are volatile and difficult to predict.

For the terminal growth rate (the rate at which the company can be expected to grow at forever), I will use the 30-year U.S. Treasury yield as a proxy for expected long-term GDP growth. The 30-year yield is currently sitting around 2.96%, meaning the below valuation uses that number as the company’s expected long-term growth rate.

For Magna International, my calculation is as follows:

Fair Value = Average FCF per share / (Discount Rate – Terminal Growth) US$90.27 = US$6.17 / (0.098 – 0.0296)

As a result, I estimate that the fair value of Magna International is approximately US$90.27 under current market conditions, which translates to about C$115.55.

Risks

The main risk to the share price at the moment is recession fears, which are caused by high inflation. Investors are worried that the Federal Reserve may raise interest rates too high and slow the economy too much.

Although Magna would be impacted by a recession, the business will survive as it has done so in the past during other recessions. In addition, the current valuation provides a margin of safety for investors who may be thinking about adding Magna to their portfolios.

Wall Street’s Take

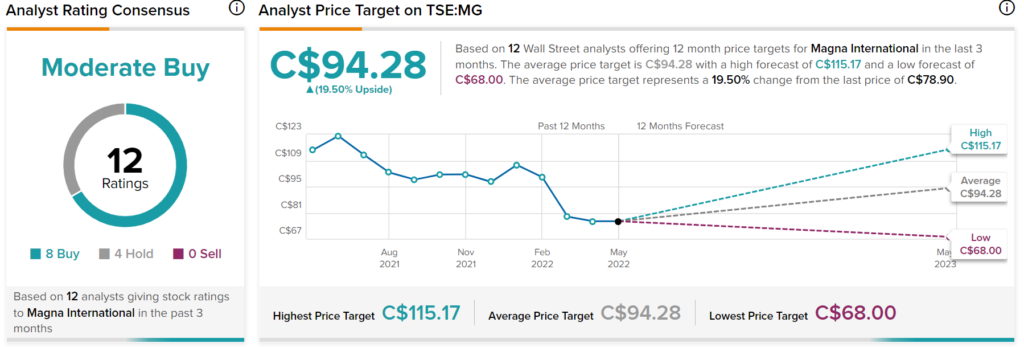

Turning to Wall Street, Magna has a Moderate Buy consensus rating based on eight Buys, four Holds, and zero Sells assigned in the past three months. The average Magna International price target of C$94.28 implies 19.5% upside potential.

Analyst price targets range from a low of C$68 per share to a high of C$115.17 per share.

Final Thoughts

Magna International has declined about 36% from its high in 2021. As a result, the company is now in undervalued territory based on a discounted cash flow valuation. In addition, Magna also has the backing of Wall Street analysts who see almost 20% upside potential.

However, investors should be aware that the stock could still go lower, especially if companies continue to miss on earnings and forward guidance.

Read full Disclosure