With inflation rising, investors are looking for a safe place to park their money. According to the Consumer Price Index (CPI) from November, inflation of 6.8% was the highest in 39 years. Fannie Mae, the government-backed mortgage supporter, projects inflation to grow to an average of 7% in the first quarter of 2022, before falling to 3.8% by the end of the year.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Gold has long been considered the gold standard for an inflation-hedging investment. Instead of purchasing physical gold, investors can find the top gold stocks to invest in.

Using TipRanks’ stock screener, I have identified 5 gold stocks with a Strong Buy consensus rating from analysts. While they might not prove to be gold mines for investors, all of these stocks could prove to be a good choice for safe sailing through the inflation ahead.

Kinross Gold (KGC)

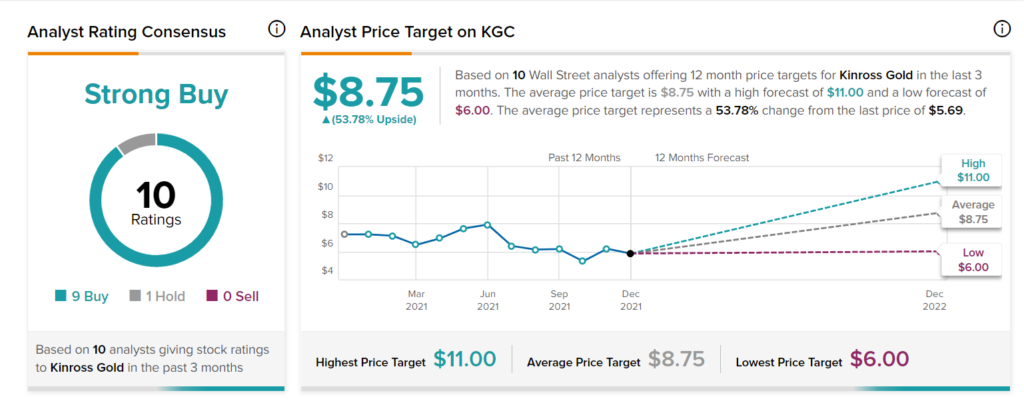

Canadian company Kinross Gold engages in the production, acquisition, exploration and development of gold bearing properties in Canada, the United States, Russia, Africa, and South America. In the past 3 months, nine analysts have given Kinross a Buy rating, and one analyst has given it a Hold. With an average analyst rating of Strong Buy and an average KGC price target of $8.75, the implied upside is 54.6%.

While KGC has dropped 26.9% this year, its earnings beat estimates in the most recently reported quarter. Moreover, it has a “Perfect 10” Smart Score, supported by positive sentiment by bloggers and investors, increased purchases by hedge funds, increased insider activity, and 4.03% asset growth in the trailing twelve months.

In another positive for the company, Kinross Gold reported free cash flows of $182.8 million in Q2 2021, implying an annualized FCF of almost $800 million.

Kirkland Lake Gold (KL)

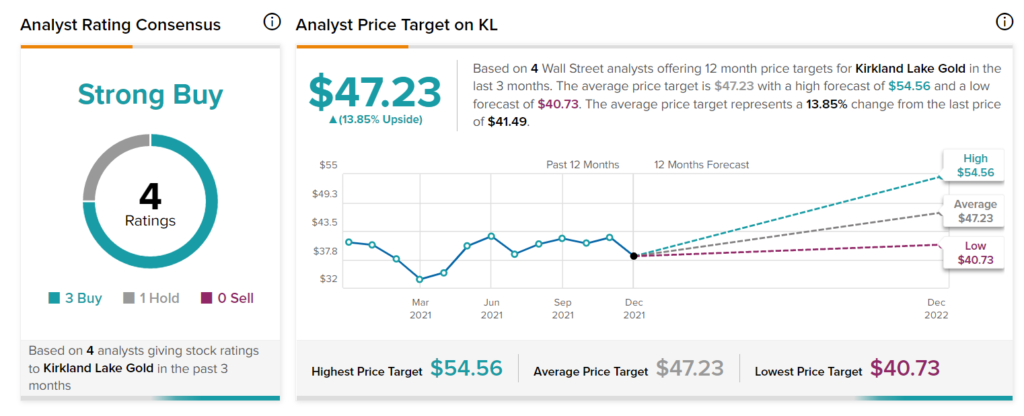

Kirkland Lake Gold Ltd., a Canadian company, engages in the mining, development, and exploration of gold properties. This Strong Buy stock has an average KL price target of $47.23, implying upside of 13.9%. In the past three months, three analysts have given it a Buy rating, and one has given it a Hold.

The stock dropped by 2.7% year-over-year, but it showed an earnings beat in the most recently reported quarter, and its quarterly dividend has held steady since the company increased in in December 2020.

RBC analyst Josh Wolfson gave Kirkland Lake a Buy rating and a $50.00 price target. He commented that the company’s Q321 production and costs were better than estimated, and production is moving along the top end of guidance. He is also heartened by the expected completion of the Macassa shaft project, on track for late 2022.

Wheaton Precious Metals (WPM)

Wheaton Precious Metals Corp. is a Canadian mining company that engages in the sale of precious metals, including gold, and cobalt production. With nine Buy and one Hold rating, this stock is clearly an analyst favorite. The stock has also earned an “Outperform” Smart Score, according to TipRanks’ unique datasets.

The stock has experienced price fluctuations over the year, but the price did not vary by much more than $10.00 throughout the year. The past three months have been good for the stock, with a 10.75% rise in stock price.

Furthermore, the stock offers a steady dividend with a healthy payout ratio of 47.56%. Also heartening is the fact that hedge funds purchased 662 shares of WPM in the past quarter.

Analyst consensus is an average WPM price target of $49.99, implying an upside of 19.8%.

Franco-Nevada (FNV)

Franco-Nevada is a Canadian gold-focused royalty and stream company. The company’s earnings beat estimates during the past eight quarters, and revenue in Q3 was up 13% year-over-year. Moreover, FNV is debt free, and calls claim to $1.6 billion in available capital.

On the other hand, hedge fund owners seem less than enthusiastic about this stock. In the last quarter, hedge funds sold 79.2K shares of Franco-Nevada stock.

In the past three months, six analysts have given FNV a Buy rating, and two have called it a Hold. With a $157.50 average FNV price target, the upside is 15.5%.

Barrick Gold (GOLD)

Barrick Gold is another Strong Buy, with nine Buy and three Hold ratings. The average GOLD price target is $25.41, with an upside of 34.09%. However, the three most recent ratings have been Holds. The stock has also dropped 20.64% in the past year.

This Canadian company is engaged in the production and sale of gold and copper, as well as related activities such as exploration and mine development. For the past six quarters, the company has beaten earnings estimates, but its revenues have fallen year-over-year.

An additional positive for GOLD stock is its dividend, which has increased in 2021, reaching record levels.

Disclosure: At the time of publication, Gilan Miller-Gertz did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >