UBS Group (UBS) recently released a list of top-conviction plays, as it believes the broader economic state calls for investors to divert from a broad-based equities portfolio. Being the third-largest bank in Europe, UBS’ insights are important to investors. Conviction investing is a tactical approach, which means that investors overweight a small number of stocks in the short run. It can be profitable if done correctly. Here are three high-conviction plays – CRWD, MSFT, and V, – from UBS’ list that I’m bullish on.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CrowdStrike (CRWD)

CrowdStrike is a phenomenal secular growth play, which could cause it to leapfrog many other technology names. The company’s front-end offerings are attractively priced and highly effective, considering CrowdStrike’s 64% year-over-year increase in subscription revenue.

According to UBS’ equity analysis team notes: “Within security, CrowdStrike is the market share leader in endpoint security and is expanding into growing markets including cloud security and security analytics.”

CrowdStrike’s dominant market share is conveyed by its three-year CAGR (compound annual growth rate) of 76.3%, which exceeds the broader cybersecurity market’s growth rate by approximately 5.85x. Moreover, with a gross margin of 73.6%, CrowdStrike has achieved economies of scale, allowing it to reap the benefits of pricing power.

Furthermore, CrowdStrike is on an acquisition spree, which could add tremendous “sum of the parts” value to its business. According to reports, CrowdStrike’s in a bid to acquire an anonymous Israeli data center company for $2 billion. If successful, this acquisition would add vertical integration to CrowdStrike’s business model, in turn proliferating shareholder value.

Turning to Wall Street, CrowdStrike earns a Strong Buy consensus rating based on 21 Buys. CRWD stock’s average price target of $228.33 implies 24.3% upside potential.

Microsoft (MSFT)

UBS believes Microsoft’s Azure is increasing the company’s holistic embedded growth.

Azure holds down more than 20% of the cloud infrastructure space and is growing at nearly 50% per year, meaning that it adds significant secular growth prospects to Microsoft stock. Moreover, approximately 35% of Microsoft’s revenue mix derives from Azure and related offerings; therefore, it could attract many cloud-driven investors in the coming years.

Another factor that could play into Microsoft’s hands is that it’s considered a high-quality stock by many. For instance, BlackRock (BLK) allocates Microsoft to its iShares MSCI USA Quality Factor ETF (QUAL).

Microsoft’s high-quality status could benefit its stock in the current market climate due to risk aversion from investors. High-quality stocks exhibit robust return metrics and solid market share, deeming them favorable whenever the stock market’s in an uncertain state.

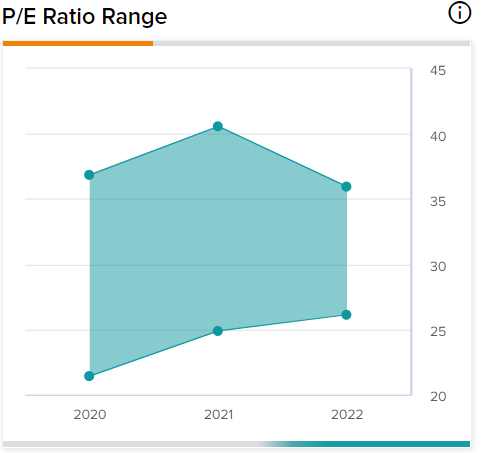

Furthermore, the stock’s price-to-earnings ratio is at a 15.6% discount from its five-year average, implying that MSFT stock is relatively undervalued. TipRanks’ P/E ratio range tool also suggests that Microsoft’s relative valuation metrics have receded.

Turning to Wall Street, Microsoft earns a Strong Buy consensus rating based on 29 Buys. MSFT stock’s average price target of $331.00 implies 19% upside potential.

Visa (V)

Visa released its third-quarter financial report last week, revealing a triumphant quarter as it beat its revenue target by $206.6 million. Additionally, Visa tightened up its income statement to achieve an earnings beat of $0.23 per share.

UBS believes Visa is a value play, which could prompt many investors to buy into weakness after the stock shed almost 15% of its value in the past year.

Visa’s growth rates have picked up lately, as global reopenings and the emergence of seasonal travel has coalesced to benefit the company. In its third quarter, Visa’s year-over-year Payments Volume increased by 12%, Cross-Border Volume increased a staggering 40%, and Processed Transactions increased 16%.

Many see Visa as a mature company that’s facing rising competition. However, with the economy facing significant challenges, the smaller players in the payments & merchant space might fizzle out while Visa sustains its growth. Moreover, the firm exhibits consistency with a 10-year CAGR (compound annual growth rate) of 10.1%.

Even though Visa’s dividend payouts remain stale, there are signs that the firm is gradually starting to increase its shareholder compensation. For instance, Visa stock exhibits 13 straight years of dividend growth, which, if sustained, could add up to a lucrative total return profile for its stockholders.

Turning to Wall Street, Visa earns a Strong Buy consensus rating based on 20 Buys and two Holds. The average Visa price target of $257.18 implies 21.25% upside potential.

Conclusion: CrowdStrike, Microsoft, and Visa Could Outperform

Three stocks stand out in UBS’ high-conviction stock list. According to qualitative theory and bullish analyst ratings, CrowdStrike, Microsoft, and Visa could reign supreme in this challenging economy.