After weeks of euphoric buying, volatility has made its way back to Wall Street. COVID-19 continues to take a heavy toll on the stock market, with a slew of new infections in the U.S. and China sending the stock market on a downward spiral.

However, some stocks are holding up better than others. Small-caps have been charging forward, with the Russell 2000 outpacing the broader market since hitting a low point on March 23.

Bearing this in mind, we used the TipRanks database to locate three small-cap companies that combine that positive niche position with a low cost of entry. These stocks will cost less than $8 per share to buy into, and offer potential growth of 40% or better.

Ceco Environmental (CECE)

We’ll start with Ceco, an industrial company focused on air purification systems. The company offers equipment and solutions for air scrubbing tech, dampers and diverters, industrial ventilation, and silencers to customers around the world. Ceco’s products are used in the oil and gas, power, battery manufacturing, and wastewater industries, among others.

Ceco finished 2019 on a positive note, with $67.7 million in bookings and a backlog of $216.6 million. These numbers bode well for the company’s future, and have helped it to maintain profitability during the corona pandemic. In Q1, Ceco’s 15-cent EPS beat the forecast by 36% even as revenues missed expectations.

Looking ahead, the company is expected to show continued growth in Q2, with revenue reaching as high as $86 million. The forecast for the full year 2020 is for over $358 million on the top line.

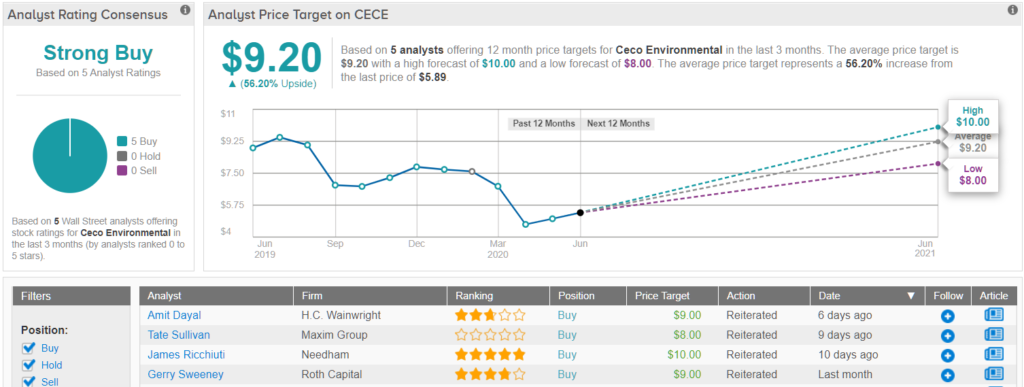

Roth Capital analyst Gerry Sweeney sees CECE’s story as a simple one, about a company that does things right and is poised to benefit from that: “The COVID impact remains tough to gauge, but after several years of operational refinement, a solid balance sheet and mix of short, medium & long cycle businesses, CECE is prepared for the tide to recede.”

To this end, Sweeney says “CECE looks attractive for a small cap industrial platform company.” The analyst rates the stock a Buy along with a $9.00 price target, which implies a healthy 54% upside. (To watch Sweeney’s track record, click here)

Overall, Wall Street agrees with Sweeney on Ceco. The company’s Strong Buy consensus rating based on a unanimous 5 Buys, all set in the past few weeks. The average price target of $9.20 suggests a premium of 56% from the current share price of $6.02. (See Ceco stock analysis on TipRanks)

Aspen Aerogels (ASPN)

Next up on our list is Aspen Aerogels, a leader in the industrial insulation market. Aspen’s products offer high-performance thermal insulation, flexible enough for uses across a range of industries. The company specializes in aerogel insulation, designing, developing, and manufacturing its full line of products.

Aspen was hit hard by corona, as the economic shutdowns strangled the need for insulations. The share price lost over 50% in the initial market fall, and has not truly recovered.

At the same time, with many states moving to reopen their economies, Aspen is preparing for a potential surge in demand. It’s important to note here that the company beat expectations in Q1 even as it lost 13 cents per share; forecast had been for a 23-cent loss. The Q2 outlook is a 20-cent loss; Aspen believes it can clear that bar, too.

Craid-Hallum analyst Eric Stine writes that Aspen is well-positioned for the resumption of economic activity, with a solid balance sheet and pent-up demand offering the prospect of customers lined up through 2H20 into 2021.

“While not surprising that it withdrew its 2020 guidance given the unprecedented level of uncertainty in the market, we continue to believe that ASPN’s value proposition and foundation remains strong and its core maintenance business resilient… Aspen Aerogels should see meaningful multi-year growth given a disruptive product offering with a compelling value proposition, blue-chip customer list, [and] low penetration (~4%) of the massive $3B energy insulation market,” Stine noted.

Stine’s $12 price target is in line with his upbeat outlook, indicating an impressive potential for 65% growth in the coming year and fully supporting his Buy rating. (To watch Stine’s track record, click here)

Once again, the Street’s aggregate view is also bullish. The unanimous analyst consensus of Strong Buy is based on 4 reviews, and the $10.25 average price target implies an upside of 41%. (See Aspen stock analysis on TipRanks)

Kaleyra (KLR)

Last but not least is Kaleyra, a cloud computing company that offers communications platforms and tools on the popular SaaS model. Products include SMS and voice calling, along with communications data insights and global contact numbers.

In the second half of 2019, KLR’s earnings turned positive, but the COVID-19 epidemic brought that to a halt. The European operations are based in Milan, Italy – and northern Italy was particularly hard-hit by the virus. That outweighed the advantages of cloud-based communications systems in a telecommuting environment, and KLR reported a steep net loss in Q1. EPS came in at negative 35 cents.

Kaleyra proved itself relevant in the crisis, however. The company made available a free texting service for Italy’s emergency medical services. The system allowed medical providers to keep in contact with each other and with potential patients while maintaining physical distance.

For investors, however, probably the most important number here is 21%. That is the company’s year-over-year revenue growth. The top line reached $33.6 million in the first quarter, even with the epidemic.

Northland’s 5-star analyst Michael Latimore covers KLR shares, and he was impressed enough by the company to assign a Buy rating. His $17 price target shows the extent of his confidence – it suggests a whopping 193% upside potential. (To watch Latimore’s track record, click here)

In his comments, Latimore acknowledges that Kaleyra suffered disproportionately from COVID-19. Yet, the analyst went on to tick a list of pros: “Posted 21% growth despite CV19 issues in March. Has 0% customer churn among largest accounts, and 80% of revenue comes from customers that have been with KLR for over one year. Volumes improving in Italy over past few weeks. Ecommerce related services are up. Won new customers, such as the Red Cross.”

This ticker, being new to the stock market, only has 3 analyst reviews on record – but all three agree that this is a stock to buy, making the analyst consensus a unanimous Strong Buy rating. Shares are priced at $5.75, and the average target of $12.83 implies an upside of 121%. (See Kaleyra’s stock-price forecast on TipRanks)

To find good ideas for small-cap stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.