With unemployment rising to 15%, and the grim corporate earnings seasons wrapping up, investors may struggle to keep up the relatively buoyant mood that has boosted markets in recent weeks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Writing from JPMorgan, global market strategist Samantha Azzarello has commented on the apparent performance disconnect between the markets and the economy. “I think the volatility right now is tied to a bunch of different things whether we’re going up or going down — right it’s vaccine news, it’s treatment news, it’s Jay Powell speaking… I still think though there’s a little bit of a disconnect between the real side of the economy and what’s happening with the macro data, in particular the labor market…”

It’s a situation tailor made for defensive stocks. High-yield dividend plays are getting lots of love from Wall Street’s corps of stock analysts, and are showing high upside potential as investors move toward them. These are the stocks that pad a portfolio, providing an income stream capable of compensating for low share appreciation. Using TipRanks database, we’ve found three low-cost dividend plays that are yielding 10% or better. If that’s not enough, all three received enough support from Wall Street analysts to earn a “Strong Buy” consensus rating.

Starwood Property Trust (STWD)

We’ll start with a real estate investment trust, a safe place to look for high-yield dividends. These companies are required by tax codes to return a certain percentage of profits and earnings directly to shareholders, and dividend payments are the common method. Starwood, which both originates and invests in commercial mortgage loans and other commercial real estate debt investments and instruments, is typical of the niche, as shown by the 90% dividend payout ratio.

Starwood posted strong Q1 beat recently. Earnings came in at 53 cents against a 46-cent forecast. The 15% earnings beat came in a quarter when most companies were struggling to cope with the effects of the coronavirus pandemic, and reports of steep misses were common.

The solid earnings have supported a solid dividend. We’ve already noted the high payout ratio – the actual dividend payment is 48 cents per share quarterly, and has been paid out reliably for the past seven years. The yield, at 15.2%, is simply excellent – and it shows the value of a reliable dividend stock. Dividend yields in the financial sector average 2.16%, so simple arithmetic shows that STWD returns more than 7x that rate.

Deutsche Bank’s analyst George Bahamondes gives STWD shares a Buy rating, and his $17 price target suggests an upside potential of 32%. (To watch Bahamondes’ track record, click here)

Justifying his bullish stance, the analyst noted, “We continue to believe STWD’s diversified business model allows the company to allocate capital to strategies that generate the best risk adjusted returns for shareholders… Importantly, the company’s business model has also been central to the STWD’s diversified capital structure, insulating the company from liquidity issues to a better degree than peers. In an environment mired with uncertainty, capital allocation optionality is valuable…”

The group wisdom on Wall Street is in concurrence with Bahamondes; STWD shares have a unanimous Strong Buy consensus rating, based on 5 recent Buy reviews. The average price target of $16.88 is also in line with Bahamondes’, and indicates about 32% upside for the coming year. (See Starwood stock analysis on TipRanks)

Cherry Hill Mortgage (CHMI)

Based in, and operating in, the state of New Jersey, Cherry Hill Mortgage is another REIT. Rather than buying properties directly, the company manages a portfolio of excess mortgage services rights, agency residential mortgage backed securities, and other mortgage assets.

Unlike many companies in recent months, Cherry Hill has flat-out beaten expectations on earnings. In Q4, the company reported 48 cents EPS against a 44-cent forecast; in Q1, despite the coronavirus, CHMI showed 47 cents EPS after a 43-cent forecast. Q1 revenues, at $6.23 million, beat the forecast by an impressive 19%, and also grew 6% year-over-year. Earnings are estimated at 32 cents per share for Q2.

CHMI shares pay out a 40-cent dividend, after a downward adjustment from 49 cents in Q3 2019. The adjustment kept the payment in line with earnings; important, since the payout ratio is a high 85%. The annualized payout, of $1.60, gives a stunning yield of 21.5%. There is simply no point in comparing that to peer companies; that return is head-and-shoulders higher than anything else an investor is likely to find in the financial markets.

In his note on this stock, Piper Sandler analyst Kevin Barker says, “We expect CHMI to remain defensive in the near-term by reducing leverage and holding cash. We also assume prepay speeds will continue to accelerate over the next couple of quarters as mortgage rates push closer to 3.0% or lower. Meanwhile, the bump higher in interest expense to 2.33% should moderate with market volatility settling down.”

Barker gives CHMI a $12 price target, which suggests room for a 52% upside to the stock. (To watch Barker’s track record, click here)

Cherry Hill is another stock, like Starwood above, with a unanimous analyst consensus rating. In this case, the Strong Buy rating is based on 4 recent Buys. Shares are priced low, at $7.85, and the average price target of $11.41 implies a 12-month upside potential of 45%. (See Cherry Hill Mortgage stock analysis on TipRanks)

Solar Capital, Ltd. (SLRC)

Next up is a business development company, focusing on debt and equity investment in leveraged companies, generating income by pumping capital into client companies existing investment-grade loans. Solar Capital is one of the scores of financing companies that makes liquid capital available to mid-market firms.

After a remarkably stable earnings run from Q3 2018 through Q3 2019, SLRC saw a sudden drop-off in EPS in Q4 and Q1. Both quarters missed expectations and saw sequential drops. Q4 EPS came in at 41 cents, against a 44-cent forecast, while Q1, hit by the coronavirus-inspired shutdowns, saw EPS slip again to 38 cents. It’s important to note, however, that SLRC remains in positive earnings territory, in contrast to the well-publicized earnings losses that have made headlines since Q1. Looking ahead, Solar Capital is expected to remain profitable in Q2, with a 35-cent EPS projected.

Solar Capital uses its earnings to fund a generous dividend. The company has been growing the payment very gradually over the past seven years, and the current quarterly payment is 41 cents per share. At $1.64 annualized, this gives a yield of 10.6%. With dividend yields among S&P companies averaging 2%, and Treasury bonds down below 1%, the attraction of SLRC’s yield is obvious. The only bit of cloud is the 107% payout ratio, indicating that earnings do not cover the dividend – but with $60 million cash available, and a further $545 million on a revolving credit facility, the company sees no problem in maintaining the payments.

Covering SLRC for JMP Securities, Christopher York sees SLRC taking a proactive role generating income moving forward. He writes, “[We expect] that the company will be very active in new originations in 4Q20 and 1Q21. We believe Solar continues to be a strategic buyer of niche commercial finance businesses, which could be an immediate use of investment capacity.”

York’s Buy rating is supported by an $18.50 price target, which suggests a one-year upside of 19% for the stock. (To watch York’s track record, click here)

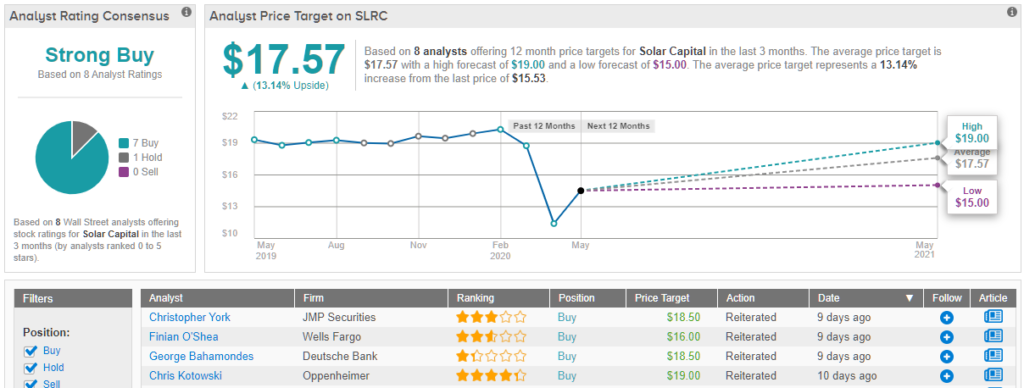

The Wall Street analyst corps is bullish on SLRC, giving the stock 7 Buys against just one Hold. This adds up to an analyst consensus rating of Strong Buy. The average price target is a bit more cautious than York’s, at $17.57, and implies an upside of 13% for the coming year. (See Solar Capital stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.