The cannabis sector appeared in a dire position heading into the coronavirus outbreak. The sector was generally unprofitable and needed additional capital to grow so an extended shutdown of retail stores would have crushed the stocks.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ultimately, most states considered cannabis stores as essential during the shutdown of most retail stores. The inclusion of medical cannabis in most recreational stores ensured consumers had access to these stores whether just for delivery or curbside pick-up. Only a few states such as Massachusetts and Nevada closed stores during the virus outbreak.

The large multi-state operators (MSOs) with access to cash and open stores generally thrived during the time when most retail struggled. After coming through the worse possible period and surviving a recession, the proof of concept is even further boosted.

Most MSOs are now poised to benefit from the optionality of states approving recreational cannabis in key states such as Arizona, Florida, New Jersey or Pennsylvania. The New York governor recently reinforced the plans to approve recreational cannabis due in a large part to the reduction in tax revenues this year due to the economic shutdown from the virus.

The ultimate gift for shareholders could exist from the Safe Banking Act getting approved via current legislature in the House as part of another round of stimulus. Over 34 state Attorney Generals approve the passage of the bill to eliminate the handling of cash, amongst other reasons.

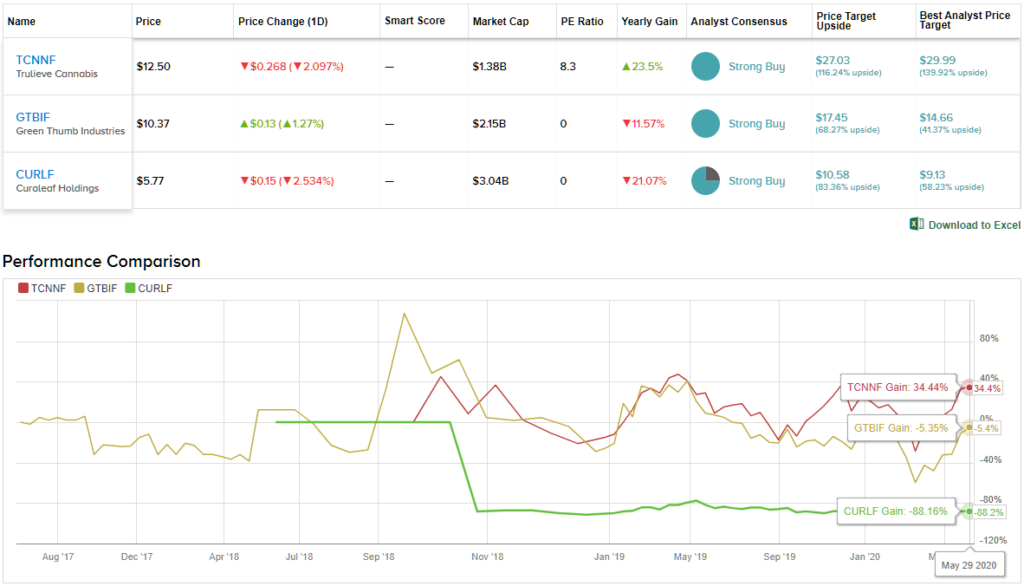

With this in mind, we’ve delved into three MSO stocks to consider along the economic reopening after thriving during the virus shutdown. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these MSO players.

Trulieve Cannabis (TCNNF)

Trulieve Cannabis remains the MSO with the best business metrics in the cannabis retail space. The company generated Q1 revenues of $96.1 million, up 21% sequentially.

The most important metric in the sector as the massive adjusted EBITDA of $48.4 million for 51% margins. The company even obtains 70% gross margins in a space where most competitors are happy with 50% margins.

During the quarter, Trulieve Cannabis opened three new stores in Florida to reach 47 stores. The majority of stores are in Florida with a few stores in California, Massachusetts and Connecticut offering some future growth potential after Florida becomes saturated, but this won’t happen for years and not until after the sunshine state approves recreational cannabis down the road.

Despite the coronavirus outbreak causing most corporations and especially retailers to pull 2020 guidance, Trulieve Cannabis maintained previous revenue estimates of $380 million to $400 million and EBITDA of $140 million to $150 million. The cannabis company forecasts EBITDA margins to normalize below 40%.

Even with the stock trading near the $14 high for the year, Trulieve Cannabis only has a market cap of $1.4 billion placing the stock below 10x EBITDA estimates. Growth stocks normally don’t trade at this low of a multiple when the financial metric is growing at a 50% clip.

The stock has consistently faced resistance around $14 since going public back in 2019. A breakout of this range would be a positive indicator for the sector.

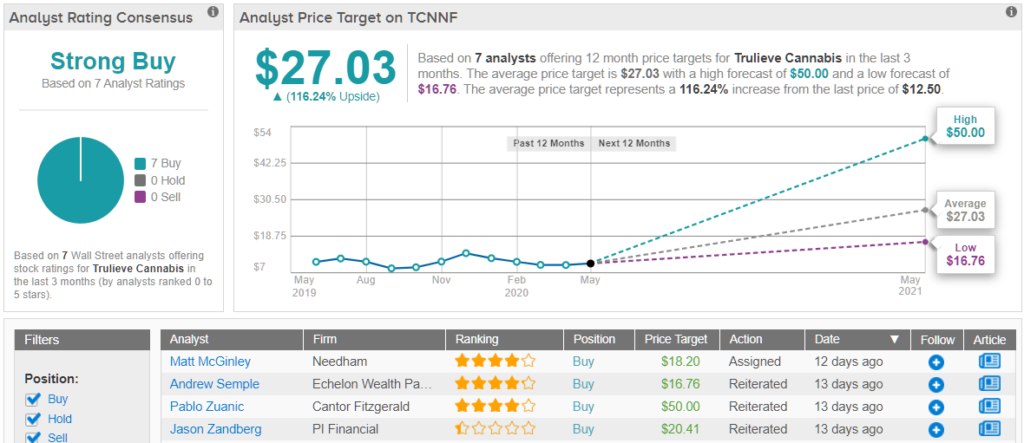

Based on the 7 Buy ratings vs no Holds or Sells assigned in the last three months, Wall Street analysts agree that this ‘Strong Buy’ is a solid bet. It also doesn’t hurt that its $27.03 average price target implies 116% upside potential. (See Trulieve stock analysis on TipRanks)

Green Thumb Industries (GTBIF)

Another MSO heading towards its yearly highs is Green Thumb Industries.

The MSO reported Q1 revenues topped $100 million due to 268% growth from last year. The company benefitted from the launch of recreational cannabis in Illinois on January 1 along with Curaleaf.

Green Thumb saw revenues surge 35% sequentially to $102.6 million with gross margins of 51.6%. Similar to these other MSOs, Green Thumb saw adjusted EBITDA surge to $25.5 million for a huge increase over the levels of last year.

With 208 million shares outstanding, Green Thumb is worth $2.16 billion here. The company is positioned in several states with future recreational optionality such as Florida, New Jersey and Pennsylvania and current recreational boosts from Illinois and Massachusetts recently opening up.

Analysts have the MSO generating $680 million in 2021 revenues with the stock only trading at 3x sales estimates. With the recent $10 million revenue beat in Q1, investors can expect those out year estimates to be exceeded as states look to accelerate recreational cannabis sales after the coronavirus crushed taxes in most states.

It’s not often that the analysts all agree on a stock, so when it does happen, take note. Green Thumb’s Strong Buy consensus rating is based on a unanimous 7 Buys. The stock’s $17.45 average price target suggests nearly 70% upside from the current share price of $10.37. (See Green Thumb stock analysis on TipRanks)

Curaleaf (CURLF)

Quarter by quarter, Curaleaf continues to separate the company as the global leader in the cannabis space. The company reported Q1 managed revenue of $105.0 million and pro-forma revenue of $147.4 million.

As an example, Canopy Growth that gets all the hype in the Canadian cannabis space, yet analyst forecasts are for Q1 revenues below $100 million. Curaleaf forecasts Q2 pro-forma revenues jumping to $165.0 million due to strong sales at Grassroots despite taking an estimated revenue hit of $29.0 million from store closings in Massachusetts and Nevada.

These new stores in those two states were generally opened or acquired in the last quarter so investors aren’t noticing the huge uptick in sales that could’ve occurred. Even despite these issues, Curaleaf saw EBITDA jump 45% sequentially to $20.0 million.

As the company is set to benefit from the Grassroots acquisition due to the start of recreational cannabis in Illinois, other states such as Florida, Pennsylvania and Arizona offer optionality for further sales boosts for Curaleaf without needing additional capital to build new stores.

The approval of the Safe Banking Act would most definitely allow Curaleaf to obtain far better funding options than the recent debt offering at 13%. The ability to obtain better funding will reduce cost of capital and allow for additional growth opportunities.

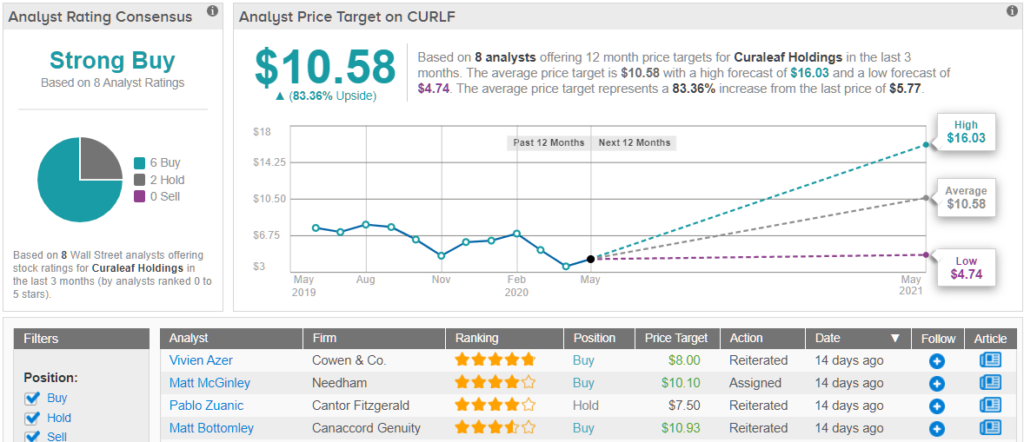

Based on all the above factors, Wall Street analysts are thoroughly impressed with Curaleaf. Based on 8 analysts polled by TipRanks in the last 3 months, 6 rate the stock a Buy, while 2 maintain a Hold. The 12-month average price target stands at $10.58, marking a nearly 83% upside from where the stock is currently trading. (See Curaleaf stock analysis on TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclosure: No position.