The cannabis sector is a fascinating topic. It’s new, its legal status is shifting as society pushes the state legislatures, and that combination is creating opportunities for companies and investors alike. Which brings us to the disparate policy potentials of the major heading into the November election.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

To start with, the Republican platform simply does not prioritize cannabis legalization. The substance in illegal now, and Rs are not likely to change that any time soon. But – the Trump Administration has not been taking explicit anti-cannabis actions, and has allowed states which have legalized the drug, whether for medial or recreational use, to enact their own various policies. But it’s clear that Federal-level legalization is not a priority for a Republican Congress or Administration.

The Democrats take a different tack. Their party platform does call for three specific changes to the Federal government stance on cannabis: first, full legalization for medical use; second, remove of the drug from the list of Schedule 1 illegal narcotics; and finally, explicit support for individual states to set their own cannabis policy with Justice Department interference.

As a result of these policy differences, a Democratic election victory should be viewed as bullish for the cannabis industry.

“The formalized documentation of support for federal cannabis decriminalization via the Biden-Sanders Unity Task Force, a more recently pro-cannabis running mate in Sen. Kamala Harris, and the removal of the overall ambiguity and unpredictability of President Trump’s stance on the subject matter,” Canaccord’s industry expert Matt Bottomley noted.

In addition, Bottomley notes that current polling shows the Democrats with a better-than-even chance of retaking control of the Senate – and control of both Congressional Houses will give the Dems greater ability to craft public policy through legislation. In event a of Biden win, such legislation would undoubtedly be signed into law.

In addition to evaluating the industry as a whole, Bottomley is weighing in on three individual cannabis stocks that are poised to benefit if Biden wins election. Using TipRanks’ database, we found out that the analyst consensus has rated all three a Strong Buy, with major upside potential also on tap.

Columbia Care (CCHWF)

We’ll start with Columbia Care, a small-cap player in the medical, pharmaceutical, and health and wellness cannabis sector. The company operates is based in New York and operates in over a quarter of the US states plus the EU. Columbia Care has built up its operations on a state-by-state basis, taking advantage of local legalization regimes. The company boasts 54 facilities and 35 operating licenses, giving it insight into regulation, compliance, cultivation, quality control, and the myriad customer issues required for success in a rapidly growing industry.

Columbia Care’s revenues have been showing strong growth despite the coronavirus pandemic. On the top line, the company recorded $26 million in 1Q20 and $28 million in 2Q20. Share price has moved in-line with the revenues, growing 48% year-to-date. The performance reflects growing demand in the medical marijuana sector and among non-prescription CBD wellness products.

In early September, Columbia Care signed off on a $69 million deal to acquire the smaller California-based company Project Cannabis. The move adds significantly to Columbia’s presence in southern California, including an additional 100 dispensaries to the company’s network.

Canaccord’s Bottomley notes the Project Cannabis move in his review of Columbia’s stock, pointing out the strong gains inherent for Columbia in the acquisition.

“We believe this deal provides CCHW with a solid platform to continue adding to its CA exposure… In addition, we believe the decision to acquire a more modest, but immediately cash-flowing asset is an attractive and risk-mitigated way to build up exposure to the US’ largest cannabis market that is still in a rather disaggregated state,” Bottomley said.

Bottomley’s C$13 (US$9.77) price target on Columbia Care shares suggests a huge upside of 167% for the coming year – and fully supports his Buy rating. (To watch Bottomley’s track record, click here)

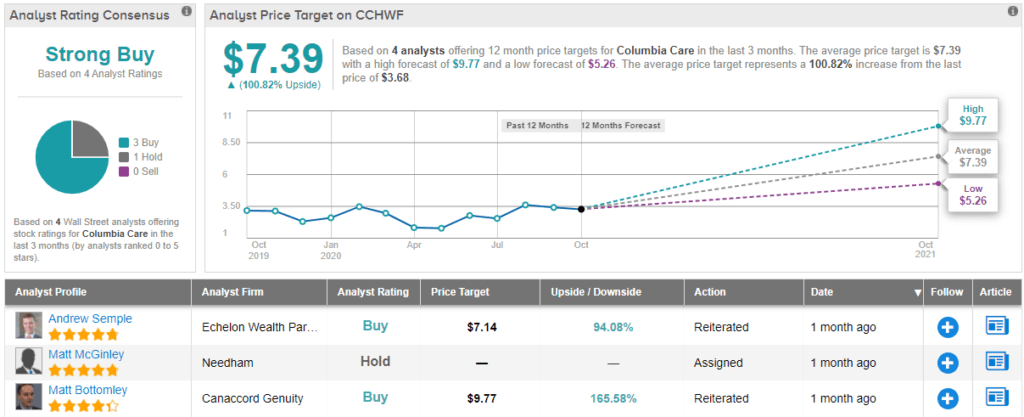

Overall, Wall Street agrees with Bottomley – Columbia has a Strong Buy from the analyst consensus, based on 3 Buys and 1 Hold set in recent weeks. The stock is selling for just $3.68 (C$4.87), and the average price target of US$7.39 suggests a one-year upside of nearly 101%. (See Columbia Care’s stock analysis on TipRanks)

Green Thumb (GTBIF)

The next stock on our list, Green Thumb, has been operating in Canada since that country fully legalized cannabis back in 2018, and has been making inroads into the US market as more and more states and localities legalize or remove criminal penalties. The company offers a range of products in the US and Canadian markets, includes vapes, pre-rolled joints, edibles, and CBD-infused wellness products. The company boasts a $3.36 billion market cap, and its Chicago headquarters are centrally located for a North American business.

Green Thumb has shown the same pattern recently as Columbia above, with growing revenues that have simply shrugged off the COVID-19 difficulties. In fact, Green Thumb’s top line has been growing even faster than Columbia, with $102 million reported in Q1 and $119 million in Q2. Share growth has also been impressive – Green Thumb’s stock has appreciated 61% year-to-date.

Covering the stock for Canaccord, Matt Bottomley noted, “We believe GTI’s exposure in Illinois is the most material value driver for the company at this time. We estimate that GTI is competing for the #1 spot in the market with a current share of >20% and 100% wholesale penetration. In a market that we believe has the potential to reach annual sales of US$3.5B, we believe GTI’s ability to maintain its leading presence in IL provides the most immediate upside potential to the story at this time…”

Bottomley puts a Buy rating on the stock, along with a C$27 (US$20.30) price target, suggesting a 12-month upside potential of 29%.

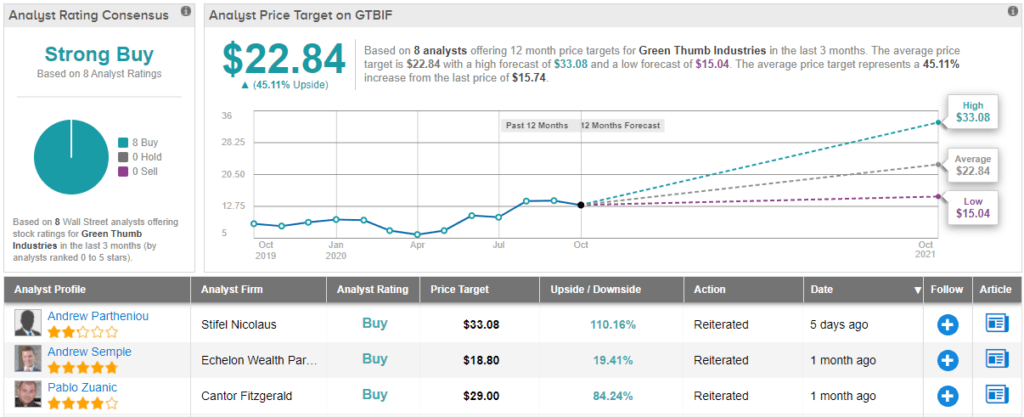

Overall, the analyst consensus rating on Green Thumb is a Strong Buy, based on a unanimous 8 Buy reviews. This stock is selling for US$15.74 (C$20.85), and its US$22.84 (C$30.38) average price target implies room for 45% growth in the coming year. (See Green Thumb stock analysis on TipRanks)

Curaleaf (CURLF)

The last cannabis stock for review today is Curaleaf, which, with a $5.05 billion market cap, is also the largest company on this list. The company has become the world’s largest cannabis producer and distributor, measured by revenues, and operates in 23 states. Curaleaf’s operations include 22 cultivations facilities totaling some 1.6 million square feet of growing space, along with 30 processing facilities and 88 dispensary locations. The company also possesses 135 dispensary licenses.

This is another cannabis company that has produced strong top-line results. Revenues came in at $75 million in Q4 last year, and grew 28% to $96 million in 1Q20. The second quarter saw an additional 21% growth to $117 million. Curaleaf has fueled the revue expansion through a combination of network growth and acquisitions. The most recent acquisition, of competitor Grassroots, was finalized this past summer in a deal worth $700 million.

Canaccord’s Bottomley points out Curaleaf’s proven ability to expand its operations, writing, “Growth was supported both organically and through the first full quarter of contribution from Select and the closing acquisitions in Connecticut and Maine. As a result, Curaleaf saw its retail and wholesale revenues increase QoQ by an impressive 17% and 63%, respectively.”

The analyst gives Curaleaf a C$16 (US $12.03) price target, indicating his confidence in 28% upside growth, along with a Buy rating.

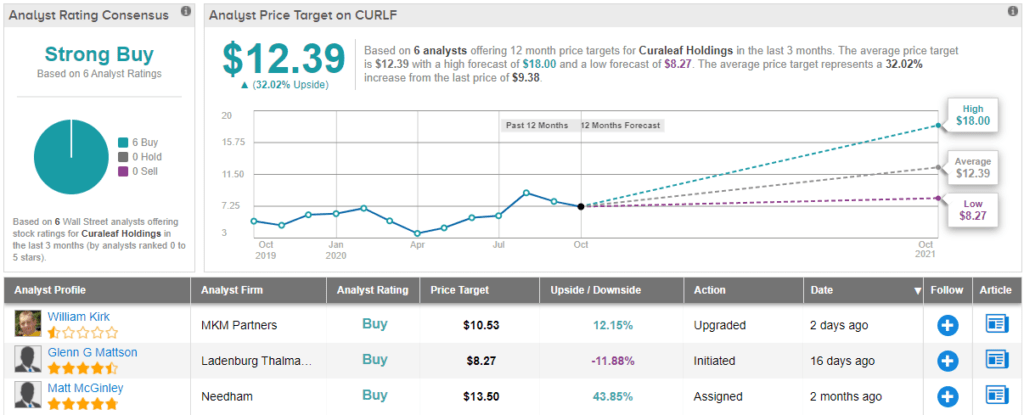

All in all, Curaleaf holds a Strong Buy rating from the analyst consensus, based on 6 positive reviews set in recent months. Shares are priced at US$9.38 (C$12.49); the average price target, at US$12.39 (C$16.48), suggests an upside of 32% on the one-year horizon. (See Curaleaf’s stock analysis at TipRanks)

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.