Corporate insiders buying and selling stocks isn’t a new phenomenon, and in most cases, it doesn’t impact the price, as these transactions could take place for various reasons.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, paying attention to corporate insiders’ (individuals holding at least a 10% stake in a public company) activities could significantly boost the chances of beating the market, especially if it is an Informative Buy or Sell.

The reason is simple: these transactions have higher predictive ability. For instance, an Informative Buy indicates that the insider is buying shares with their own capital, indicating a greater confidence in the company’s prospects.

TipRanks’ comprehensive Insiders’ Hot Stocks and Top 25 Corporate Insiders tools make it easy to keep up with activities of the corporate insiders. That, in turn, helps investors make investment strategies for a potential gain in the future.

With that backdrop, let’s look at three stocks that have witnessed significant insider trading activity in the recent past.

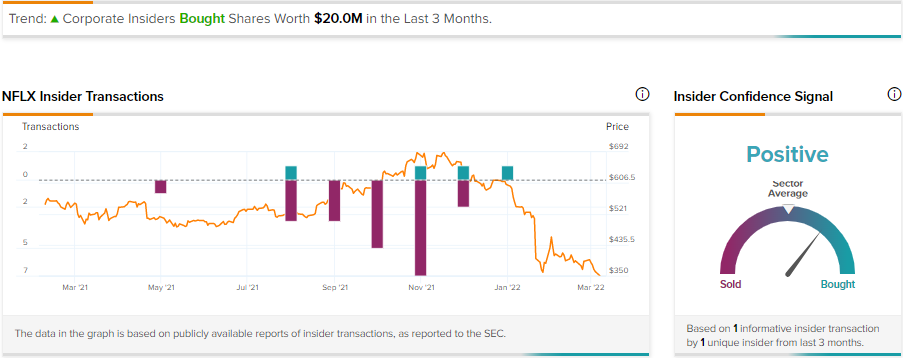

Netflix

A deceleration in paid-user growth, weak guidance, and increased competitive activity weighed on Netflix (NASDAQ:NFLX) stock. Due to the recent selling, Netflix stock has fallen about 42% this year.

For context, Netflix managed to add 8.28 million paid members in Q4, which fell short of management’s guidance of 8.5 million. Moreover, it missed the consensus estimate of 8.32 million. Furthermore, the company now expects its global paid member base to increase 8% year-over-year and reach 224.34 million in Q1, which indicates further moderation in growth.

While NFLX stock has trended lower, the company’s CEO Reed Hastings saw this as a buying opportunity. The move comes in the form of an Informative Buy worth $20 million. Per an SEC (Securities and Exchange Commission) filing, Hastings bought 51,440 NFLX shares on the pullback.

On TipRanks, Hastings is rated as a three-star insider, and his transactions over the past year have netted him an average of 42.5%.

Along with Hastings, hedge fund owner Bill Ackman added 3.1 million NFLX shares. Citing the selloff as an opportunity to buy, Ackman stated that Netflix’s valuation appears attractive, while the company has multiple growth vectors.

Following the news, NFLX stock recovered about 27%. However, broader market selloff and the geo-political crisis limited the upside.

Nevertheless, J.P. Morgan’s Doug Anmuth shows confidence in NFLX stock. Anmuth expects Netflix to benefit from secular tailwinds. Moreover, the analyst highlighted that NFLX’s Q1 paid member additions are tracking ahead of plan and could beat the company’s guidance.

Anmuth has a Buy rating on the NFLX stock with a price target of $605, signifying a 72.7% upside potential.

Kodiak Sciences

Kodiak Sciences (NASDAQ:KOD) is a biopharmaceutical company engaged in developing therapies for retinal disorders. Shares of Kodiak Sciences crashed (declined about 85%) after it announced (on February 23) that its lead product KSI-301 failed to meet the primary efficacy endpoint in the late phase trial for wet age-related macular degeneration.

Kodiak Sciences’ CEO Victor Perlroth stated that “allowing treatment with KSI-301 no more often than every 12 weeks after the loading phase for every patient turned out to be insufficient.”

Following the development, Perlroth sold Kodiak shares. This represents an informative sell worth approximately $12.25 million. Per an SEC filing, Perlroth sold 1,340,000 KOD stock for an average price of between $8.98 and $9.20.

The latest trial data and Perlroth’s stock sale indicate uncertainties over the commercial path of KSI-301.

Meanwhile, Morgan Stanley analyst Matthew Harrison cut his target price to $17 from $77 as the trial data raises concerns over the odds of success of KSI-301. Furthermore, Anupam Rama of J.P. Morgan downgraded KOD stock to Hold and reduced his peak sales estimate and probability of success for KSI-301.

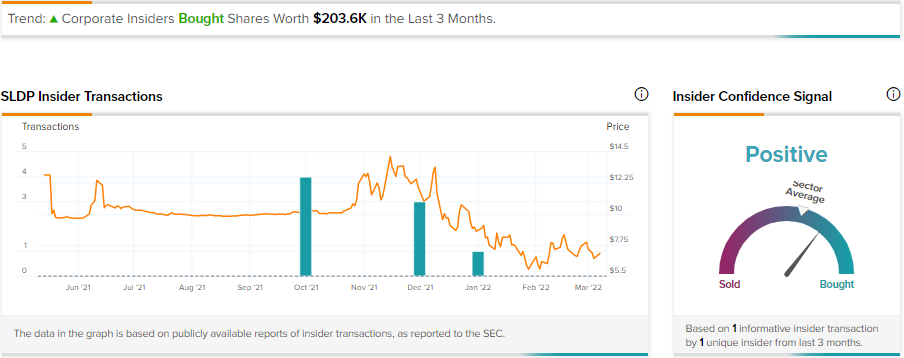

Solid Power

Douglas Campbell, CEO of Solid Power (NASDAQ:SLDP), exercised his option to buy about 5.1 million SLDP stock. The company develops all-solid-state rechargeable battery cells for EVs and mobile power markets.

The CEO’s Informative Buy could be seen as a positive development. Meanwhile, Needham analyst Vikram Bagri initiated coverage on SLDP stock with a Buy rating and price target of $13, implying 75.7% upside potential.

Bagri stated that Solid Power is among the few solid-state battery (SSB) developers globally and has the potential to emerge as the leader. The analyst highlighted multiple catalysts that could drive SLDP stock higher.

Bagri stated that SLDP is “not only working on three different cell designs but also betting on becoming the marquee supplier of sulfide-based electrolytes, a key component of SSBs. We believe that this multi-pronged growth strategy reduces risk, allows for continued growth, and helps capture medium and long term opportunities in the space.”

He further highlighted Solid Power’s partnerships with Ford (F) and BMW (BMWYY), and capex-light business model, to back his bullish view.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.