The success of a stock portfolio is contingent upon how prudently investors select stocks. A plethora of information available in the market can be of great help to investors but can make the task more arduous sometimes.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Tools offered by TipRanks can be of great help at this juncture. A very popular TipRanks tool is Insider’s Hot Stocks. This tool tracks the activities of corporate insiders, which include the top-level management and executives. Buying and selling of shares by the company’s officials, declared in SEC filings, can be very informative for investors.

A popular saying by one of the greatest American investors, Peter Lynch, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise,” highlights the importance of tracking insiders’ activities.

At the time of writing, more than 60 stocks were featured on TipRanks Insider’s Hot Stocks tool (considering all criteria and strategies). We have narrowed our discussion to three mid-to large-cap stocks (with a market capitalization of more than $7 billion) that have been trending this week.

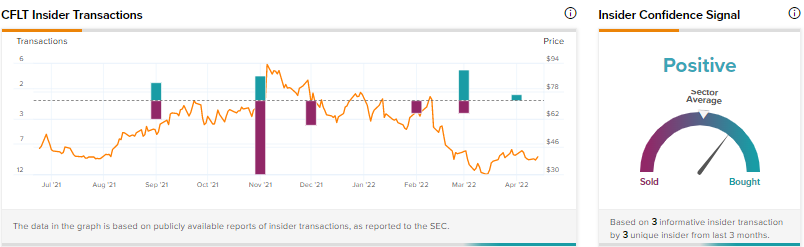

Confluent, Inc. (NASDAQ: CFLT)

Based in Mountain View, CA, the company provides a data streaming platform for customers in the United States and multiple other nations. Over the past month, shares of this $11-billion company have increased 33.4%.

The company anticipates generating revenues within the range of $117-$119 million in the first quarter and $538-$546 million in 2022. In February, the company’s CFO, Steffan Tamlinson, said, “… we remain focused on executing against our plan to drive durable growth and profitability over the long term.”

The momentum around the company’s healthy prospects is supported by a ‘Positive’ Insider Confidence signal. Gerstner Brad, an owner of >10% shares, made an ‘Informative Buy’ of 439.2 thousand shares of Confluent for $17.12 million six days ago. Overall, corporate insiders have bought $30.9 million worth of Confluent shares over the past three months.

Also, last month, Michael Turrin of Wells Fargo maintained a Buy rating on Confluent while decreasing the price target to $55 (37.12% upside potential) from $75.

Overall, the company has a Moderate Buy consensus rating based on five Buys and six Holds. Confluent’s price forecast of $74.55 suggests 85.86% upside potential from current levels. The stock scores a 6 out of 10 on TipRanks’ Smart Score rating system.

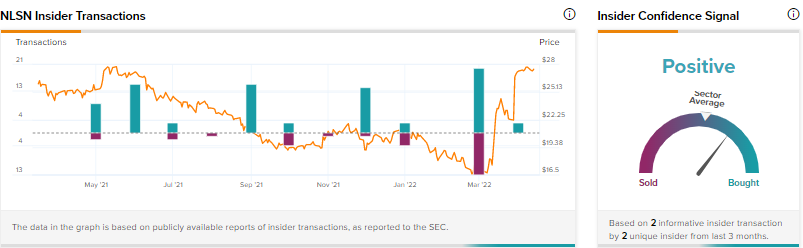

Nielsen Holdings plc (NYSE: NLSN)

The $9.9-billion company provides data collection and analytics services. It is headquartered in New York. Over the past month, shares of Nielsen have grown 20.4%.

In March, the company agreed to a takeover deal, worth $16 billion or $28 per share, by a consortium led by Brookfield and Elliott. This transaction is expected to conclude in the second half of 2022.

The Chairperson of the company’s board of directors, James A. Attwood, said, “After a thorough assessment, the board determined that this transaction represents an attractive outcome for our shareholders by providing a cash takeout at a substantial premium while supporting Nielsen’s commitment to our clients, employees and stakeholders.”

Insider activities on the stock are pointing towards ‘Positive’ confidence. Windacre Partnership LLC, which holds 10% shares in Nielsen, made an ‘Informative Buy’ of 23.09 million shares for $631.1 million on Wednesday and 31.57 million shares for $870.3 million six days ago. Corporate officials have bought shares worth $1.5 billion in the past three months.

Recently, Ashish Sabadra of RBC Capital reiterated a Hold rating on Nielson while increasing the price target to $28 (1.74% upside potential) from $20.

The company has a Hold consensus rating based on one Buy, seven Holds, and one Sell. Nielson’s average price target is $24.75, suggesting 10.07% downside potential from current levels. The company scores a ‘Perfect 10’ on TipRanks.

Nexstar Media Group, Inc. (NASDAQ: NXST)

The Irving, TX-based company provides digital media and television broadcasting services. It presently has a market capitalization of $7.1 billion. Nexstar’s shares have declined 1.7% in the past month.

In February, the company’s Chairman and CEO, Perry A. Sook, said, “We expect 2022 operating results will benefit from strong mid-term election year political advertising.”

Perry believes that renegotiation of distribution contracts will be beneficial for Nexstar in 2023 while “presidential election year political advertising and additional distribution contract renewals” are likely to be advantageous in 2024.

“For the 2022/2023 cycle, we expect to generate pro forma average annual free cash flow of approximately $1.40 billion,” he added.

The Insider Confidence signal is ‘Positive’ for Nexstar. On April 13, the company’s Director, John R. Muse, executed an ‘Informative Buy’ of 21.58 thousand shares for $0.21 million.

Two days ago, multiple Informative Buy and Uninformative Sell transactions were conducted by corporate officials. Over the past three months, corporate insiders have sold shares worth $3.7 million.

Last month, Connor Murphy of Deutsche Bank maintained a Buy rating on Nexstar while increasing the price target to $216 (24.91% upside potential) from $187 in the last month. His bullish outlook is supported by a recovery in core advertising, at least mid-single-digit growth in net retrains, and shareholder-friendly policies of the company.

Overall, the company has a Strong Buy consensus rating based on five Buys. Nexstar’s price forecast of $213.80 suggests 23.64% upside potential from current levels. The company scores an 8 out of 10 on TipRanks.

Conclusion

A proper analysis of the information stemming from insiders’ activities can help investors build a strong portfolio. Understanding them can help investors strengthen their stock selection and the timing of increasing or decreasing exposure to any company.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure