High stock prices can be a double-edged sword. On one hand, they indicate that a company is strong and profitable enough to attract investors. On the other hand, when shares climb toward $1,000 each, it can turn off investors and slow down the flow of ready capital.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

To solve this paradox, companies often employ a stock split. This tactic reduces the share price while increasing the total number of shares, without impacting the company’s market capitalization. During a split, shareholders receive additional shares relative to their current holdings – for example, a 2-for-1 split doubles a shareholder’s 100 shares to 200, with each new share priced at half the original value. This approach effectively lowers the share price, making it more attractive to new investors and encouraging them to invest in the company.

While splits are usually initiated for the company’s benefit, they also bring opportunities for investors. Companies that split to reduce their share price are usually quality firms, and paring back the cost of entry gives new investors a chance to buy top-end stocks at more comfortable prices. Moreover, statistical reviews of post-split shares have shown that they tend to outperform the broader markets by significant margins in the 12 months following the split.

We can follow this line, using the TipRanks database to pull up the details on two Strong Buy stocks that announced upcoming splits – and see where they stand in relation to the overall markets.

Deckers Brands (DECK)

We’ll start with Deckers Brands, a footwear company based in Southern California where it was founded in 1973. The firm offers a wide range of footwear, including lines of leisure shoes, outdoor shoes and boots, and athletic gear. Deckers markets these under multiple brand names, including such well-known names as HOKA, Teva, and UGG. The company’s brands feature a performance orientation, based on the California lifestyle of freedom and exploration, and Deckers has spent more than 50 years building its brands and reputation around the world, in more than 50 countries. Deckers’ shoes and other products are found online, in company-owned brick-and-mortar stores, and in selected department and specialty stores.

Deckers’ combination of quality and image have brought the company a loyal customer base, and that in turn has led to retail successes. The company has seen consistent year-over-year revenue growth over the past several quarters, and in the last reported period, fiscal 1Q25 (June quarter), brought in $825 million. This was up 22% from the prior-year period and beat the forecast by over $18.8 million. At the bottom line, Deckers had an EPS of $4.52. While this was only a penny better than expected, it compared favorably to the $2.41 reported in fiscal 1Q24. The company’s strongest revenue growth performance came in the Direct-to-Consumer channel, which was up 24% year-over-year, and in the US domestic market, where sales were up 23% from the prior year.

This record of success has been reflected in the stock price – DECK shares are up by 84.5% in the past 12 months, and are now trading near $953 each. This lies behind the company’s July 12 announcement that the Board has approved a 6-to-1 forward stock split with an effective date of September 16 after the market’s closing bell. On the morning of September 17, shareholders who owned DECK shares on September 6 will find their holdings increased by a factor of 6. With a current share price near $953, the new share price will be set at approximately $159.

Writing on Deckers earlier this month, after both the split announcement and the earnings release, TAG analyst Dana Telsey expressed her faith in the company’s business model, writing, “DECK is squarely focused on product and innovation, tightly controlling brand and presentation within the marketplace. The company has left some growth on the table in order to maintain scarcity. This scarcity model helps to support its brands’ premium positioning, particularly in the DTC channel. Slow, controlled expansion with key partners that can uphold a brand’s positioning aims to drive strong growth while preserving brand equity, as opposed to flooding distribution channels.”

Looking ahead, Telsey explains why Deckers has high potential for continued growth, adding to the above, “Despite raising its FY25 EPS guidance last quarter on a stronger FQ1 gross margin performance, the new guide was still below the prior consensus. Nonetheless, we believe the outlook is in keeping with DECK’s typically conservative stance and continue to see the company as well-positioned with its healthy, and more focused, brand portfolio, that can continue to drive growth longer-term.”

The analyst quantifies her stance on this stock with an Outperform (Buy) rating and a price target of $1,100, implying an upside of 15.5% for the next 12 months. (To watch Telsey’s track record, click here)

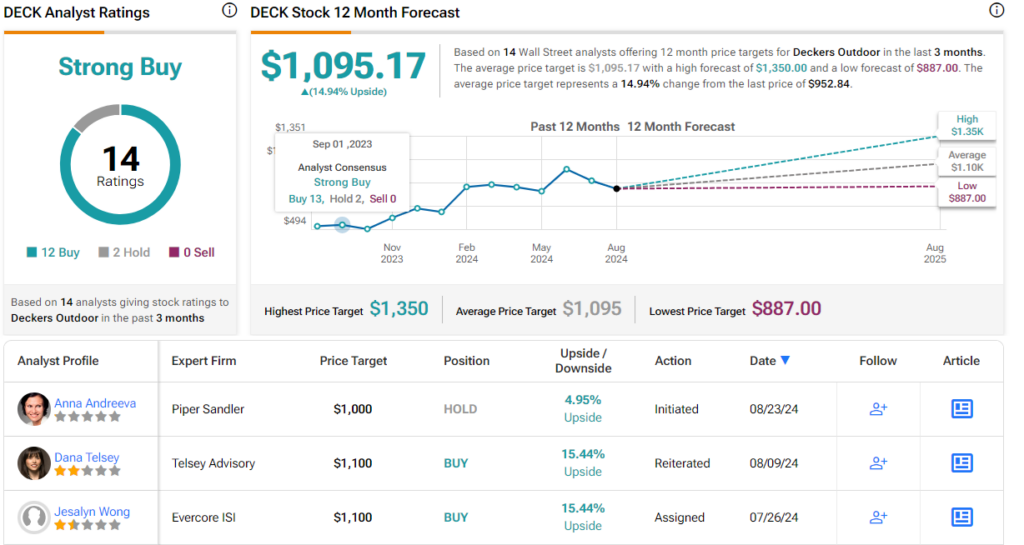

There are 16 recent analyst reviews of DECK shares, breaking down to 12 Buys and 4 Holds for a Strong Buy consensus rating. The stock’s $952.84 current trading price and $1,095.17 average price target together suggest a one-year upside potential of 15%. (See Deckers stock forecast)

Tetra Tech (TTEK)

The next stock we’ll look at, Tetra Tech, is a science and engineering firm specializing in a range of environmental-related services, including strengthening safe water supplies; accelerating the economic transition to clean and renewable energy sources; and advancing biodiversity and conservation efforts around the world. Tetra Tech is based in Pasadena, California, and operates through 550 offices around the world. The company employs some 28,000 people worldwide and has its hands on 100,000 projects per year. This is a lucrative business, and in the last four fiscal quarters, Tetra Tech brought in over $5 billion in total revenues.

Among the services that Tetra Tech offers are consulting and program management, engineering and construction management, in fields such as infrastructure, energy, resource and water management, and international development. The company brings its expertise to bear in areas such as applied science, information technology, construction design, and maintenance and operations.

In its last earnings release, covering fiscal 3Q24, Tetra Tech reported total top-line revenues of $1.34 billion, for an 11% year-over-year gain – and beating the estimates by $260 million. The company’s bottom line, reported as a GAAP EPS of $1.59, was 3 cents per share better than the forecast. Both the top and bottom lines were described by the company as record-level results.

With the fiscal earnings report, Tetra Tech also announced that the Board of Directors had approved a 5-to-1 stock split of the common shares outstanding. The split will be made effective after the market closes on Friday, September 6. The split will be reflected when the markets open after the weekend, on September 9, with each common stockholder’s stake increasing by a factor of 5. Based on the stock’s current value, the split will bring the price down to around $47 per share.

For Maxim analyst Tate Sullivan, this stock already offers investors a solid set of attributes. He writes, “We reiterate our Buy rating based on TTEK’s differentiated focus on creating solutions for environmental and water infrastructure problems, a consistent acquisition strategy to acquire companies with government contracts in other countries and advanced analytics companies, and a history of dividend growth.”

That aforementioned Buy rating is backed by a $268 price target that points toward a gain of 13% on the one-year time horizon. (To watch Sullivan’s track record, click here)

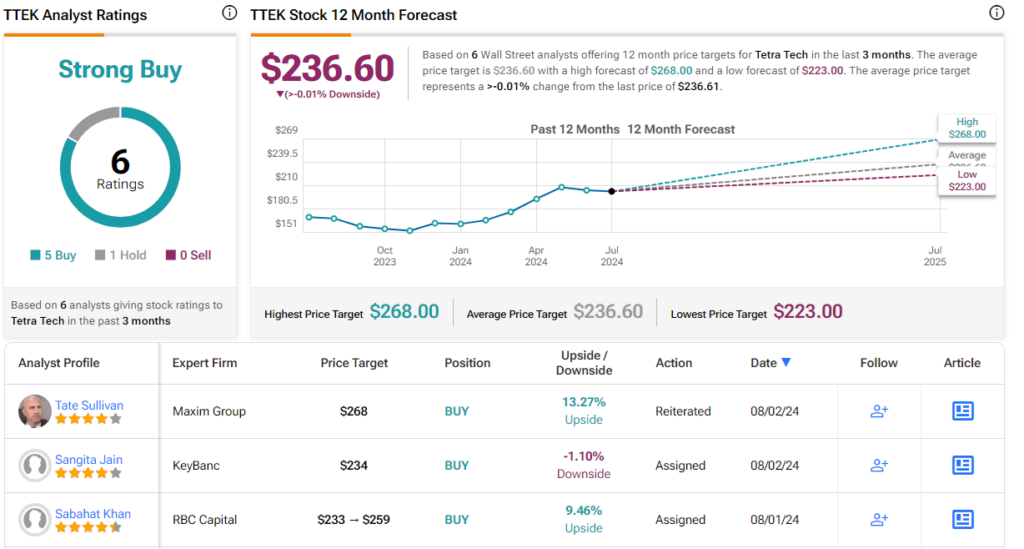

TTEK shares have a Strong Buy consensus rating, based on 6 reviews that include 5 Buys and 1 Hold. However, the $236.60 average price target implies shares will stay rangebound for the time being. (See TTEK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.