After the recent seesawing action, it would be nice to know where the market is heading next, but that is anyone’s guess. The conflicting signs make for a difficult terrain to navigate across.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In the search for sound investments in such an environment, it helps to lean on those in the know and one such strategy involves tracking the moves of corporate insiders. After all, no one is better equipped to know the inner workings of companies than those operating from within.

If an insider has been picking up shares, it is usually a buy sign as it indicates confidence in the company’s trajectory. To level the playing field, these insiders are required to make such purchases public, and investors can track these opportunities.

The TipRanks Insiders’ Hot Stocks tool comes in handy here and we have pinpointed two stocks which corporate officers have been snapping up as of late. There are other positive signifiers to follow; both stocks are rated as Strong Buys by the analyst consensus and are projected to pick up steam in the months ahead.

Oscar Health (OSCR)

We’ll kick off with a company which operates in the health insurance industry. Oscar Health prides itself as providing differentiated care, its products and services enabled by a proprietary full stack technology platform, which helps members find their way through a complex health care system. The company claims to be the first health insurance company to boast a tech-enabled offering. Oscar’s various insurance plans cater to individuals, families, small businesses as well as providing Medicare Advantage.

As evident in the company’s latest earnings – for 2Q21- the top-line has seen some serious growth this past year. Revenue rose by 359% year-over-year to $529.28 million, but 60.72 million shy of the consensus estimate. Oscar beat the analysts’ call on the bottom-line, however, with EPS of -$0.35 coming in above the Street’s forecast by $0.13.

The company is relatively new to the public markets and priced its March IPO at $39 per share, above the original target of $32-$34. The stock began trading on the NYSE between that range, at $36 a piece, providing the company with a market cap of roughly $7.1 billion. It has been a challenging start, with shares drifting south by 51% since.

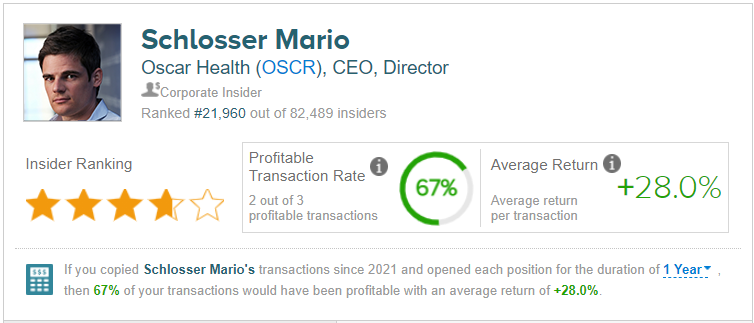

Evidently, CEO and co-founder Mario Schlosser thinks the stock is undervalued now, because he has just picked up 57,300 OSCR shares for $17.53 each, amounting to just over a $1 million outlay.

He is not the only one exuding confidence, so does Wells Fargo’s Stephen Baxter, who thinks the company’s customer care sets it apart.

“The investment case for Oscar centers on the company’s differentiated member engagement and satisfaction, which is enabled by Oscar’s proprietary technology platform and digital tools,” the analyst wrote. “Member satisfaction with Oscar is significantly above industry average, improving growth and retention. We see continued strong growth for Oscar’s standalone and co-branded health plans, as well as an early-stage opportunity for the company to monetize its technology platform by working with other health plans. We see the combination of growth drivers as attractive in the context of Oscar’s current valuation.”

In line with his optimistic take, Baxter rates OSCR an Outperform (i.e. Buy). Baxter’s $30 price target conveys his confidence in OSCR’s ability to climb 78% higher in the next twelve months. (To watch Baxter’s track record, click here)

Looking at the consensus breakdown, with 2 additional Buys vs. 1 Hold, OSCR boasts a Strong Buy consensus rating. Shares are anticipated to gain 44% in the year ahead, given the average price target clocks in at $24.25. (See OSCR stock analysis on TipRanks)

See the top insider buys of the week >>

Agree Realty (ADC)

The next stock we are looking at is Agree Realty, a retail property stalwart. With a focus on companies with a national footprint, the real estate investment trust (REIT) acquires, develops and leases properties to some of the US leading retailers. Its largest tenants include Wal-Mart, Sherwin-Williams, and TJX Companies.

Seeing out Q2, the company’s portfolio showed ownership of 1,262 properties, spread across 46 states with gross leasable space of 26 million square feet. In the quarter, the company invested around $366 million in 59 retail net lease properties.

Q2 also saw the company delivering a set of results which slightly beat Street expectations. Quarterly revenue has been steadily rising for the past couple of years, and rose by 43.5% year-over-year to $82.55 million, beating the Street’s call by $0.84 million. FFO (funds from operations) managed a 1 cent beat – coming in at $0.89.

Agree stock, however, has underperformed the broader market in 2021, with shares trading at roughly the same price as at the year’s onset, and corporate members have been making their moves.

The insider buying activity shows a flurry of recent purchases. Some of the company’s top brass including President and CEO Joey Agree, Executive Chairman Richard Agree and Director John Rakolta have over the past week collectively bought shares worth $2,023,417, all purchased in the $67-$68 price range.

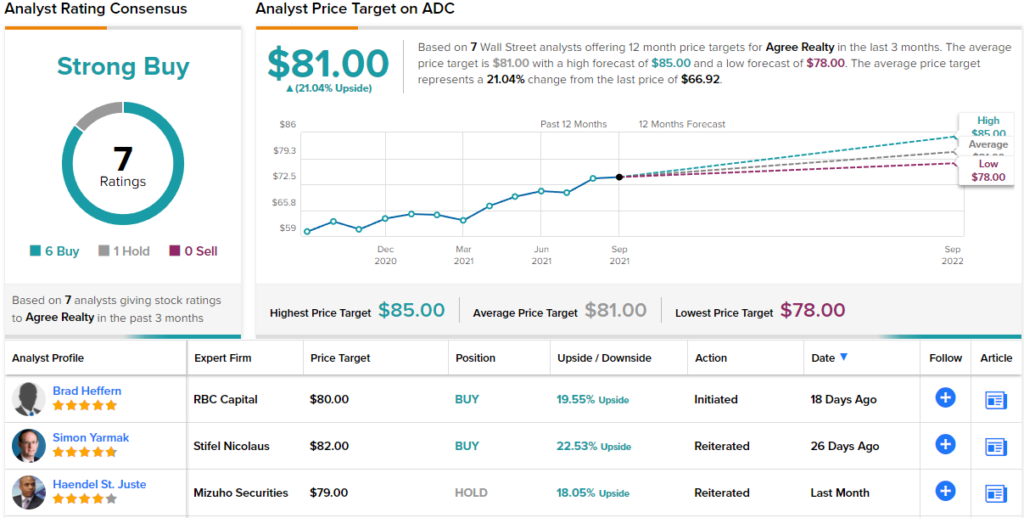

These actions will not be surprising to RBC’s Brad Heffern, who highlights several reasons to back the stock.

“We see ADC’s portfolio of net lease assets as one of the highest quality in the space, with top tier investment grade tenants who are largely public and leaders in their respective industries,” the 5-star analyst wrote. “When combined with a peer-leading acquisition pace and low cost of capital, we think ADC is well positioned for mid-to-high single digit annual AFFO/sh growth for years to come.”

As such, Heffern rates Agree an Outperform (i.e. Buy) backed by an $80 price target. The figure implies ~20% upside potential from current levels. (To watch Heffern’s track record, click here)

Most on the Street agree on Agree. Of the 7 reviews posted during the past 3 months, 1 says Hold while all the rest say Buy, naturally culminating in a Strong Buy consensus rating. The average target is just above Heffern’s; at $81, the figure suggests investors will be sitting on returns of 21% over the one-year timeframe. (See Agree stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.