Oil is up, the Russian ruble is down, and financial markets are showing increased levels of volatility. The rolling boil in the markets comes as Russia’s Vladimir Putin has launched the largest ground war in Europe since the Second World War. It’s no wonder that investors are starting to seek out defensive positions.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The classic defensive position, of course, is the dividend stock. Plenty of companies send out a dividend but only a select group attract the attention of serious dividend investors. These are the stocks that pay out the highest yielding dividends with the most reliable payment histories. In turbulent times like these, the market’s dividend champions are sure to get a second look from investors.

Bearing this in mind, we used the TipRanks’ database to zero-in on two stocks that are showing high dividend yields – on the order of 8%. Each stock also holds a Strong Buy consensus rating; let’s see what makes them so attractive to Wall Street’s analysts.

Brigham Minerals (MNRL)

One of the biggest economic sectors to feel the fallout from the Russia-Ukraine fighting is the energy sector. Russia is a major hydrocarbon exporter, and has not been shy about using its energy clout in foreign policy. In the lead-up to the Ukraine crisis, Russia has been building the Nordstream 2 pipeline, a natural gas pipeline to Germany that bypasses Ukraine. While the ins and outs of the project and its impact on international relations are beyond the scope of this article, it may be of interest to take a look into the US hydrocarbon sector.

And there we’ll find Brigham Minerals. Based in Austin, Texas, Brigham is a mineral and royalty interest acquisition company – that is, it buys up land holdings and the rights to resource exploitation thereon, and collects royalties on the oil and gas extracted from those lands. Brigham’s portfolio includes land holdings some of the richest resource basins in the lower 48, including the Williston of North Dakota, the DJ of Colorado/Wyoming, the Scoop/Stack of Oklahoma, and the Midland and Delaware of Texas and New Mexico.

Brigham’s operating model differentiates it from its peers, focusing as it does on maximizing royalties. The company directs its purchases to just 5 ‘tier one’ regions, with proven hydrocarbon output; leases its holdings to a diverse group of well-capitalized operational firms; and focuses solely on land purchases and royalty acquisitions, avoiding any expenses for lease development or operations.

This strategy has been successful for the company, and in its last quarterly report, for 4Q21, Brigham showed over $47 million at the top line, a company record. It was also the sixth quarter in a row with a sequential revenue gain. In a key metric for dividend investors, Brigham finished the quarter with $27.7 million in discretionary cash flow to fund the dividend.

The dividend was paid out as both a base – of 14 cents per common share – and variable dividend, of 31 cents. The company uses the variable dividend to adjust total payment to make up 80% of discretionary cash flow. The combined dividend marked the sixth consecutive quarter that the payment increased for common shareholders. In Q4, Brigham paid out a total dividend of 45 cents per common share. At that payment, the dividend annualizes to $1.80 and yields 8%.

Even more important for dividend investors, however, is Brigham’s forward guidance. The company anticipates royalty-generating production increasing on its holdings by 25% in the coming year, allowing for an increase in the base dividend of 2 cents per share. With the usual variables added to it, this should create a windfall for dividend investors.

RBC’s 5-star analyst TJ Schultz notes the bullish dividend outlook, and writes, “At ~80% payout levels we see a path to >$2.00/share in dividends in 2022 (implying a ~10% forward dividend yield). This keeps us constructive on the story; we like MNRL for its diversified exposure to core basins amid strong commodity prices, attractive yield, and disciplined acquisition strategy…”

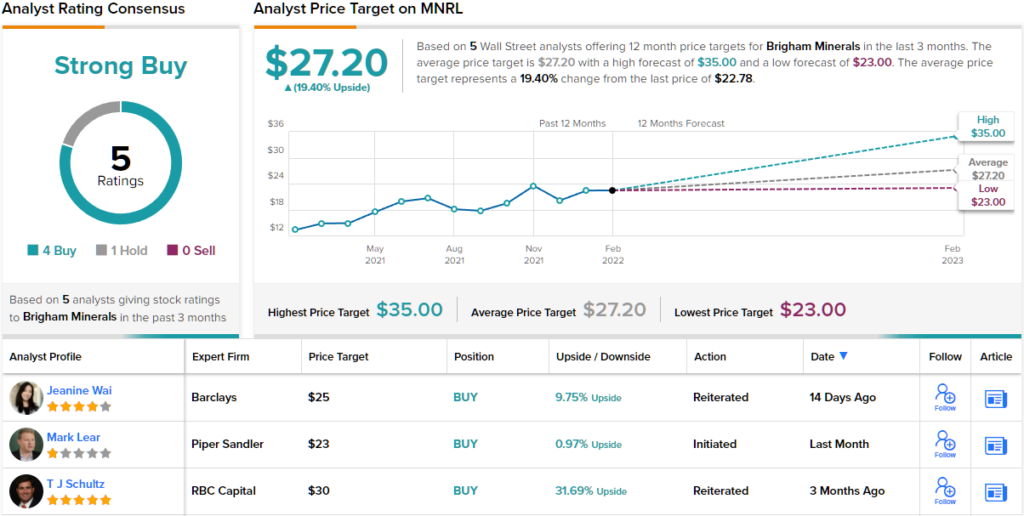

To this end, Schultz rates MNRL an Outperform (i.e. Buy) rating, while his $30 price target implies a one-year upside potential to the stock of ~32%. Based on the current dividend yield and the expected price appreciation, the stock has ~40% potential total return profile. (To watch Schultz’s track record, click here)

Brigham’s Strong Buy consensus rating is based on a 4 to 1 split favoring the Buys over the Holds, while the average price target of $27.20 indicates room for ~19% upside from the share price of $22.78. (See MNRL stock forecast on TipRanks)

Trinity Capital (TRIN)

With the next up, Trinity Capital, we’ll shift our focus. Trinity works with venture debt, making new capital available to start-up companies. While risky, this activity is essential for the economy, as it’s the funding engine for the ‘tip of the spear,’ the innovative companies that will define the economic future. Trinity, which went public in February of last year, has provided more than $1.5 billion in funding for over 175 companies in its lifetime.

In the year since it entered the public markets, Trinity has shown rising revenues and steadily increasing share price. At the top line, the company reported $22.5 million in 3Q21, the last reported, and the stock is up 29% since the IPO. Trinity will report its 4Q and full year 2021 results on March 3.

In a bit of preview of the Q4 results, Trinity has already reported new fundings for the last quarter. The company originated some $248 million in ‘gross debt and equity commitments’ during the quarter, making its total funding commitments for 2021 an impressive $757 million. The Q4 originations included $121 million to 11 new companies in the portfolio, along with $76.5 million to 14 existing portfolio companies.

Trinity generates income through the return on its investments, specifically, the loan repayments and interest, and the company in its own turn returns these profits to its shareholders through a common share dividend payment. The upshot is, Trinity has increased its dividend in each of the last four quarters, with the last declaration, in December 2021, being 36 cents per share, or 9% higher than the 3Q21 payment. At the current payment, the dividend annualizes to $1.44 and gives an 8% yield.

All of this has caught the attention of B. Riley analyst Sarkis Sherbetchyan, who writes: “We raise our NII per share estimates across the board to reflect robust net originations and meaningfully higher earning assets compared to our previous model… We reason TRIN’s NII growth and recent proceeds from the monetization of equity investments provide the board with ample room to continue raising distributions to shareholders… We appreciate TRIN’s internally managed structure, growth potential for NII and dividends, as well as its valuation relative to the closest venture debt lending peers, which have historically traded at premiums compared to the broader BDC universe.”

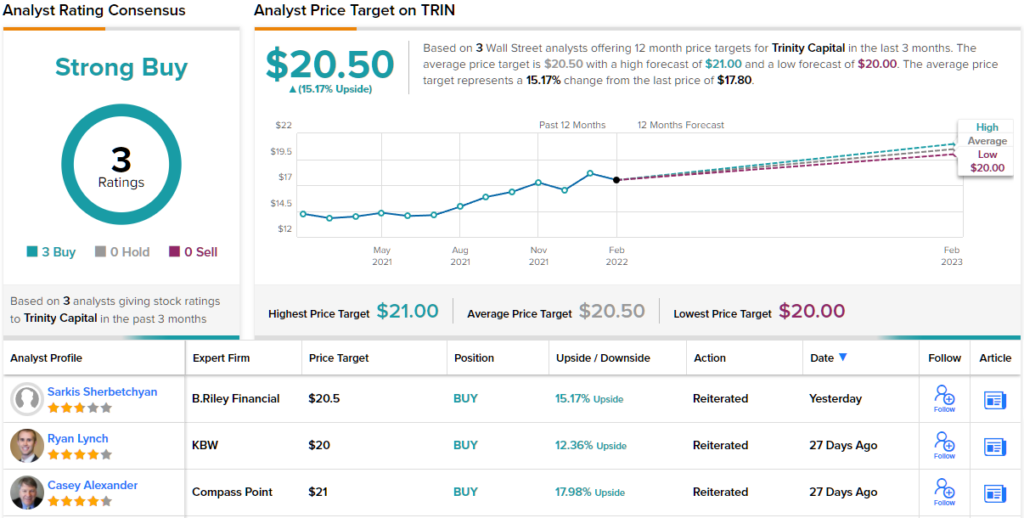

In line with this upbeat outlook, Sherbetchyan sets a Buy rating on TRIN shares, and bumps his price target up to $20.50, suggesting a 12-month upside of 15%. (To watch Sherbetchyan’s track record, click here)

Overall, there are 3 recent analyst reviews of this stock, and they all agree that it’s a Buying proposition, making the Strong Buy consensus rating unanimous. The shares are selling for $17.80 and their $20.50 average price target matches Sherbetchyan’s objective. (See TRIN stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.