There are few sectors that can offer investors massive returns – but biotech comes to mind as one. These companies are typically involved in the pharmaceutical or medical device industries, and they are famous for their unique combination of high overhead and high product lead times, and even higher profit potential when a new product makes it through the regulatory approval process.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

So biotech stocks can definitely bring the rewards that investors want – but they are not investments for the risk-averse. It can take years for new drugs or devices to reach the market, the companies generally operate at a loss until then, and there is no guarantee that products will be approved. The key here, as it is in all investing, is to do the homework. For biotechs, that means finding companies with important catalysts coming up in the near term.

We’ve gotten a start on this process, finding two biotech stocks that have important FDA decisions on the near horizon. According to the latest data from the TipRanks database, both stocks hold Buy ratings from the Street’s analysts – and both offer solid upside potential, in the triple digits in one case. Let’s take a closer look.

Ascendis Pharma (ASND)

Ascendis, the first stock we’ll look at, is a company that is in the process of building a marketable drug program based on its unique technology-development platform. This platform is dubbed TransCon, a portmanteau shortening of transient conjugation. Using the platform, a flexible technology that makes use of advanced chemistry, Ascendis can design drug candidates that work by linking the therapeutic agent to an inert carrier compound. The platform is capable of designing new drugs, with novel therapeutics and equally novel delivery mechanisms, that can meet unmet needs in multiple diseases.

The company’s work is focused mainly on two conditions – growth hormone deficiency (GHD) in adults and children, and hypoparathyroidism (PTH), also in adults and children – and Ascendis has a GHD medication approved and on the market already. The GHD drug, Skytrofa, received its original approval in 2021, and is currently generating revenues in both the US and Europe. The company plans to submit a supplemental Biologics License Application to the FDA, for use of the drug to treat GHD in adults, during the current 3Q24.

Its hypoparathyroidism drug candidate completed the clinical trial process last year, but is currently facing delays in the approval process. The initial New Drug Application for palopegteriparatide, the TransCon-developed PTH drug, elicited a Complete Response Letter from the FDA in May of last year. The updated NDA was resubmitted in December and given a PDUFA date – May 14 of this year. On that day, Ascendis announced that the FDA had extended the date by three months, to August 14. That day is rapidly approaching, and marks the next major catalyst for Ascendis.

In the meantime, we can look back at the company’s last quarterly report, which covered 1Q24. In that report, Ascendis gave a top line of 95.9 million Euros, for a year-over-year gain of 185%. That total included 65 million Euros in Skytrofa revenue, a figure that was up 106% y/y. The company ran a net loss in the quarter, of 131 million Euros, or 2.30 Euros per share.

This biotech firm has caught the eye of Stifel analyst Alex Thompson, who sees the TransCon PTH drug as the main factor to bring in investors. He writes of Ascendis, “ASND’s TransCon PTH is the key focus of the stock… We remain confident in the prospects for approval in the US despite multiple delays… Hypoparathyroidism represents a multi-billion euro commercial opportunity on the backdrop of a growth hormone base business (Skytrofa) that can continue to grow via broader transition of the daily market to weekly and label expansion – even in the presence of major competitive threats. To that end, we model peak sales for TransCon PTH in Hypoparathyroidism of €3.0B based on conservative penetration assumptions and Skytrofa sales of €1.3B, above and in-line/lower than consensus estimates, respectively.”

These comments back up Thompson’s Buy rating on the stock, and his price target, set at $200, implies an upside of 47% on the one-year horizon. (To watch Thompson’s track record, click here)

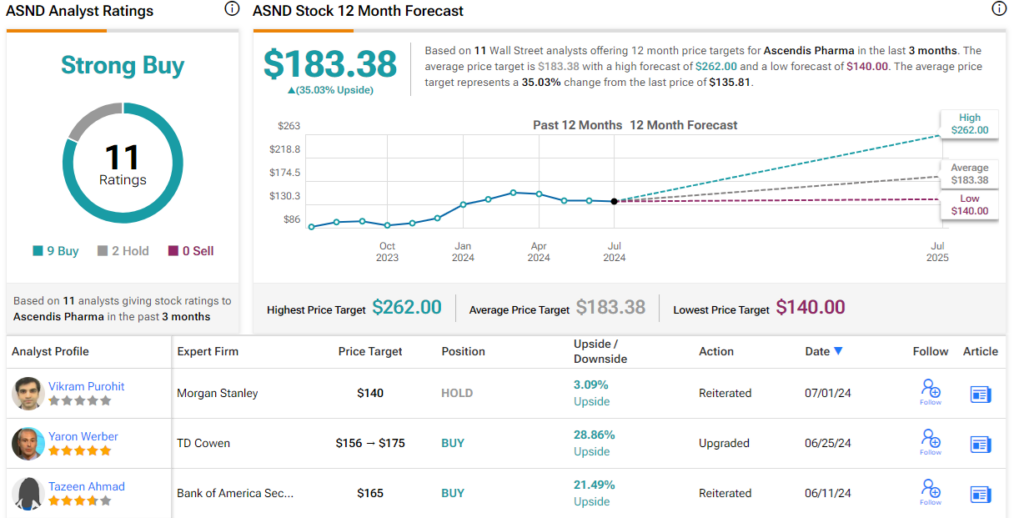

Overall, these shares have earned 11 recent analyst reviews, including 9 Buys and 2 Holds for a Strong Buy consensus rating. The stock is selling for $135.81 and its $183.38 average target price suggests that it will gain 35% over the coming year. (See ASND stock forecast)

Citius Pharmaceuticals (CTXR)

Next on our list is Citius, another biopharma company. Citius is devoted to the creation of new treatments for critical care conditions, in both infectious disease and oncology. The company has two drug candidates at late stages of the trial and regulatory processes; these candidates include Lymphir, a new reformulation of denileukin diftitox, and Mino-Lok, an antibiotic lock solution designed to treat bloodstream infections related to catheter use.

Both of these drugs have high potential in the oncology field. Lymphir is billed as an improvement on an existing drug for the treatment of cutaneous T-cell lymphoma (CTCL), a form of non-Hodgkin lymphoma usually localized on the skin, and catheter-related blood infections are serious – and frequently life-threatening – secondary infections to which cancer patients are dangerously susceptible.

Of these two pipeline candidates, Lymphir is the farthest along. Citius submitted the BLA last year, and in July received a Complete Response Letter. The company responded, addressing the FDA’s concerns, and in March of this year received notice that the application had been accepted for review with a PDUFA date of August 13.

While that was going on, Citius was also proceeding with the late-stage trials on Mino-Lok, and in May of this year released positive data from the Phase 3 trial of the antibiotic lock. The data release showed that Mino-Lok has achieved both the primary and secondary endpoints in the trial.

Maxim analyst Michael Okunewitch covers this stock, and bases his upbeat take on the progress of Lymphir through the FDA regulatory process, writing, “We maintain a positive outlook on the [BLA] filing. Recall that the original CRL was based on manufacturing controls and product testing, rather than safety and efficacy. The company has taken steps to address these concerns…”

Okunewitch goes on to outline the potential of Lymphir as a revenue generator, adding of the drug candidate, “One of the key considerations for assessing the value of Lymphir is to look at the commercial opportunity within cutaneous T-cell lymphoma (CTCL). There are an estimated 30k-40k patients in the US living with CTCL and ~3k new cases per year. When Ontak was originally on the market in the early 2000s, it generated sales in the range of $30M-$40M per year. However, the market has changed significantly in the years since, and we believe these changes to the treatment landscape have increased the potential market opportunity for Lymphir – management estimates the opportunity as high as $400M.”

For the Maxim analyst, this adds up to a Buy rating, while his $4 price target indicates room for a huge one-year upside of 666%. (To watch Okunewitch’s track record, click here)

There are only 2 recent analyst reviews here, but they both agree that this is a stock to Buy, making the Moderate Buy consensus unanimous. The stock is priced at 53 cents per share and its average target price of $4 matches the Maxim view. (See CTXR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.