Australia and New Zealand are seeking to rapidly expand their renewable energy capacity in the coming years, in a bid to meet their Paris Agreement commitments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amongst the mix in Australia, solar is the fastest growing renewable energy. Companies with exposure to the solar power industry are set to gain from the push towards renewables.

For investors looking for exposure to the solar energy industry through ASX shares, Origin Energy (ASX:ORG) and Contact Energy (ASX:CEN) are worth considering.

Origin Energy shares have gained 40%, with more room to rise

Origin Energy is an Australian energy provider. It offers solar energy solutions to domestic and business customers. The company’s solar products include solar panels, battery storage systems, and inverters.

In the past 12 months, Origin Energy shares have risen more than 40%. The stock has gained more than 16% year-to-date. According to TipRanks’ analyst rating consensus, ORG stock is a Hold. The average Origin Energy share price target of AU$6.34 implies over 6.7% upside potential.

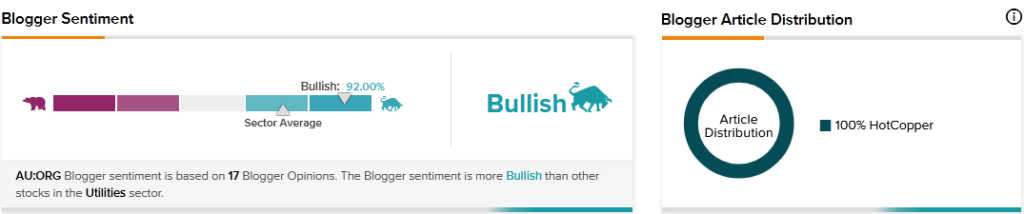

Origin Energy shares are gaining favourable mentions from financial blogs. TipRanks data shows that financial blogger opinions are 92% Bullish on ORG, compared to a sector average of 72%.

Contact Energy shares are bouncing back with substantial upside ahead

Contact Energy is a New Zealand electricity company listed on the ASX. The company currently has a mixed focus of resources, including solar, natural gas, and coal powered-facilities.

Renewable energy has become a major focus for the company. In April 2022, Contact Energy announced a partnership with Lightsource to develop solar projects that would generate enough electricity to power more than 50,000 homes.

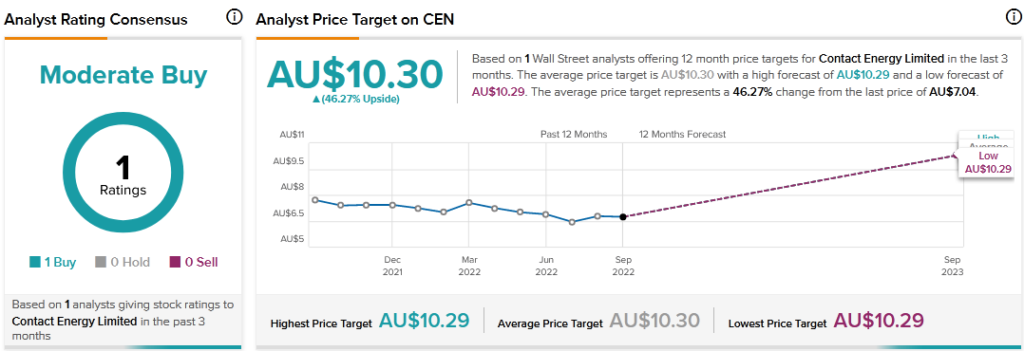

Although Contact Energy shares are still down more than 7% over the past year, they are bouncing back. The shares have gained more than 14% over the past three months and have further growth potential. According to TipRanks’ analyst rating consensus, CEN stock is a Moderate Buy. The average Contact Energy shares price forecast of AU$10.30 implies over 46% upside potential.

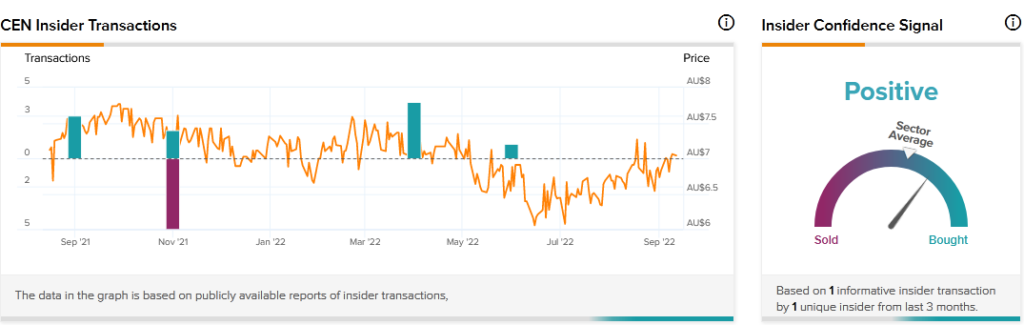

Contact Energy stock is a favourite of insiders. TipRanks’ Insider Trading Activity shows that Insider Confidence Signal is currently Positive on CEN stock, with corporate insiders purchasing AU$19,900 worth of shares in the last quarter.

Final thoughts

The influence of the Paris Agreement is set to drive continued demand for renewable power. Origin Energy and Contact Energy stand to benefit from such demand, considering their expanding role in solar energy production.